Bitcoin’s Active Address Count Nears ATH; Here’s What It Means

Why Trust CoinGape

CoinGape has covered the cryptocurrency industry since 2017,

aiming to provide informative insights to our readers. Our journal analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our Editorial Policy,

our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes and media correctly. We also follow a

rigorous Review Methodology when evaluating exchanges and tools. From emerging

blockchain projects and coin launches to industry events and technical developments, we cover

all facets of the digital asset space with unwavering commitment to timely, relevant information.

Bulls appeared to be favouring Bitcoin (BTC)’s price movement as it continued to ride high on the charts. The largest cryptocurrency by market cap breached a crucial resistance climbing all the way up to $10,869 after surging by more than 7% over the last two days.

Onchain Switches Bullish: Surging Active Addresses

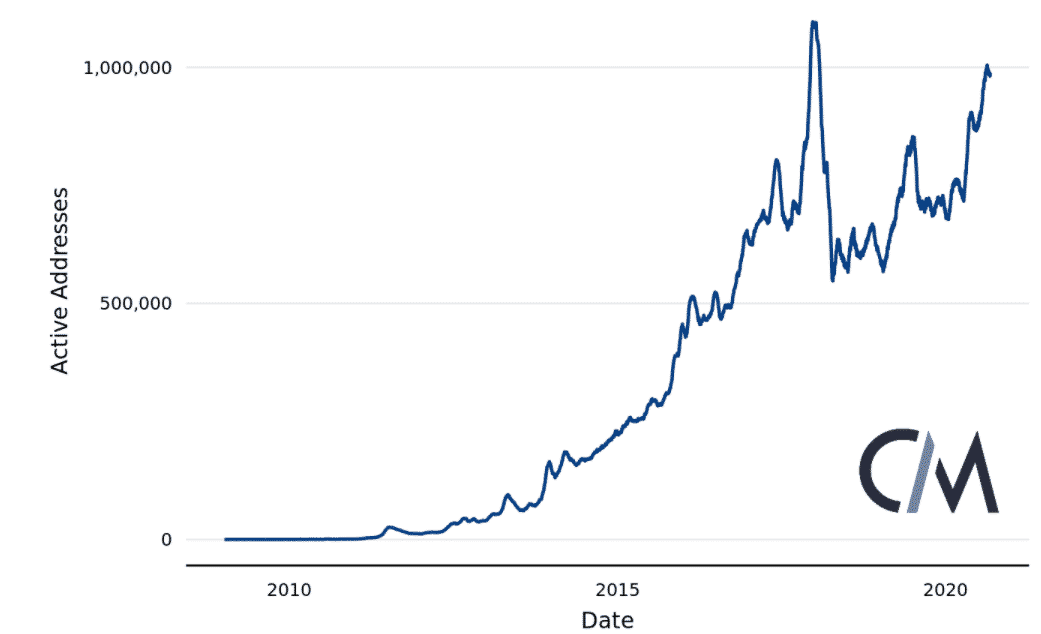

The uptrend seems to have gained momentum as evidenced by various key technicals. For one, Bitcoin’s active address count was hovering close to its previous all-time high seen in December 2017.

This was revealed by CoinMetrics in its latest report, which also noted that the rise of the number of unique active addresses hinted at a rising usage by a “broader set of network participants”. While rising active addresses does not necessitate rising participants as a single user can have multiple addresses, according to the crypto-analytic platform’s report, it is generally considered to be correlated.

Increasing hash power securing the network

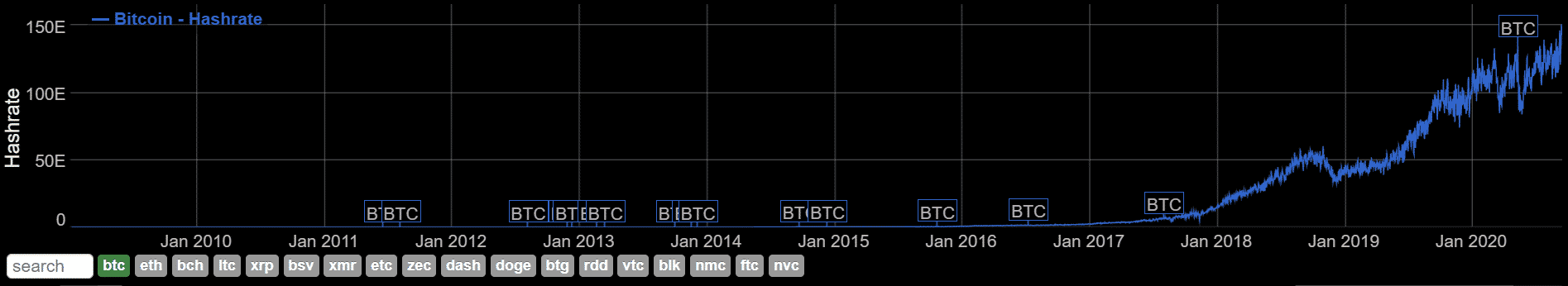

According to BitInfoCharts, Bitcoin’s hash rate also reached a fresh ATH with a staunching 150.93 Exahash per second of Hashpower on the 13th of September. The higher the hash power, the more secure the Bitcoin blockchain is, which is yet another crucial indicator of its network health.

Additionally, Willy Woo in a series of tweets, explained that the next directional move over the coming weeks is likely upwards and a “catastrophic dump” in price from is probably not on the cards in the near future. His tweet further read,

“Overall, I’m not expecting any mega dump, some chance of smaller whipsaws in the short timeframes, resistance is teetering. Not a bad time to get in if you’re a spot investor, given the longer-range macro. There’s plenty of buy support below 10k, this is a buy the dip scenario.”

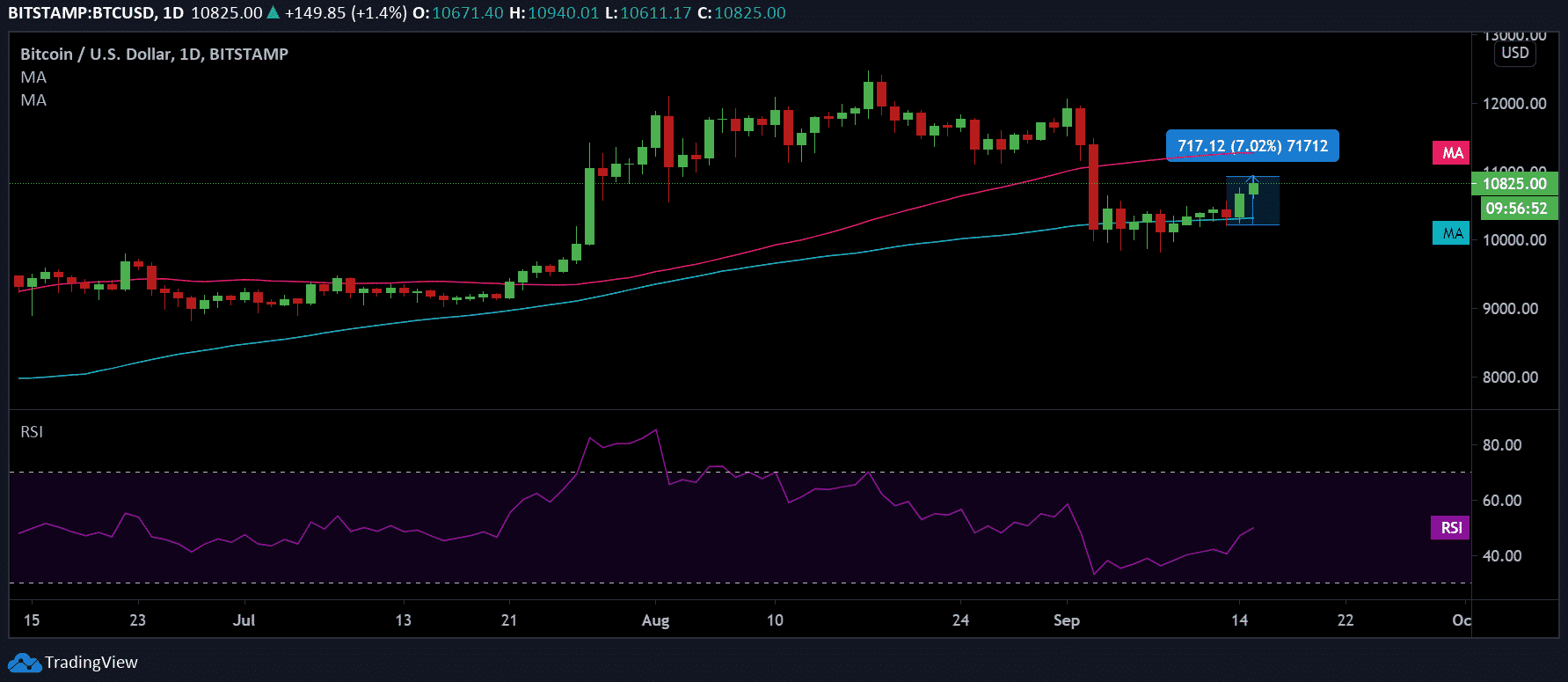

Bitcoin Daily Chart

The above daily chart exhibited an increase of 7.02%. The 50 DMA [Pink] appeared to be resisting an upward price movement to $11,280. However, the 100 DMA [Blue] formed a support price of $10,344. This essentially indicated that despite the persistent bearish pressure, BTC’s attempt to the coveted $11,000-level has not been overturned.

Additionally, the spike in RSI, in tandem with BTC’s price, above the 50 median line depicted a sentiment of rising buy pressure among the traders which could further propel the prices higher. If this materializes, BTC manages to surge beyond $11,000, it could target another key level of resistance at $11,803.

Advertisement

/

- How Low Can Bitcoin Dip- Peter Brandt Predicts Possible BTC Bottom

- Strategy’s Michael Saylor, CEO Phong Le Assure More Bitcoin Buy, No Liquidations Until $8K

- Crypto Market Braces for Deeper Losses as BOJ Board Pushes for More Rate Hikes

- Crypto Prices Drop as U.S. Urges Citizens To Leave Iran

- Japan’s Metaplanet Pledges to Buy More Bitcoin Even as BTC Price Crashes to $60k

- Will Cardano Price Rise After CME ADA Futures Launch on Feb 9?

- Dogecoin, Shiba Inu, and Pepe Coin Price Prediction as Bitcoin Crashes Below $70K.

- BTC and XRP Price Prediction As Treasury Secretary Bessent Warns “US Won’t Bail Out Bitcoin”

- Ethereum Price Prediction As Vitalik Continues to Dump More ETH Amid Crypto Crash

- Why XRP Price Struggles With Recovery?

- Dogecoin Price Prediction After SpaceX Dogecoin-Funded Mission Launch in 2027

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.