Bitcoin’s Exchange Supply Hits Three-Year Low, BTC Crowd Sentiment Turns Positive

Earlier this week, the world’s largest cryptocurrency Bitcoin (BTC) made a brief move above $45,000. However, ever since the Federal Reserve announced the inflation numbers on Thursday, it has been moving sideways.

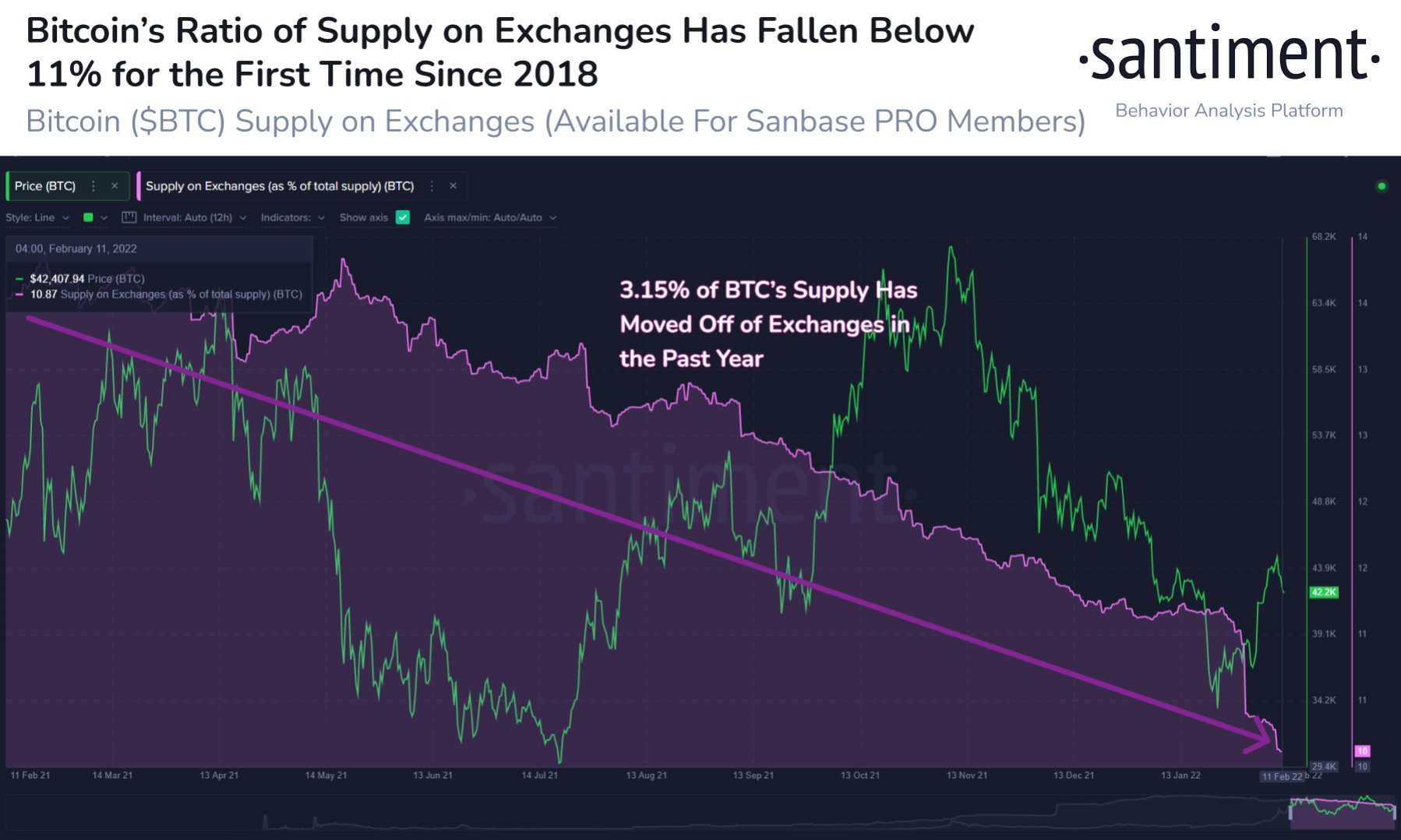

Bitcoin has corrected over 7% from its weekly highs and is currently trading at $42,268 with a market cap of $801 billion. However, one of the biggest positive indicators is that the Bitcoin exchange supply has touched a three-year low since December 2018. On-chain data provider Santiment reported:

With another series of dramatic drops, #Bitcoin’s supply on exchanges is now down to just 10.87%, the lowest percentage seen since December 2018. Generally, this continued trend of coins moving off of exchanges limits the risk of major sell-offs.

A look Into the Bitcoin Crowd Sentiment

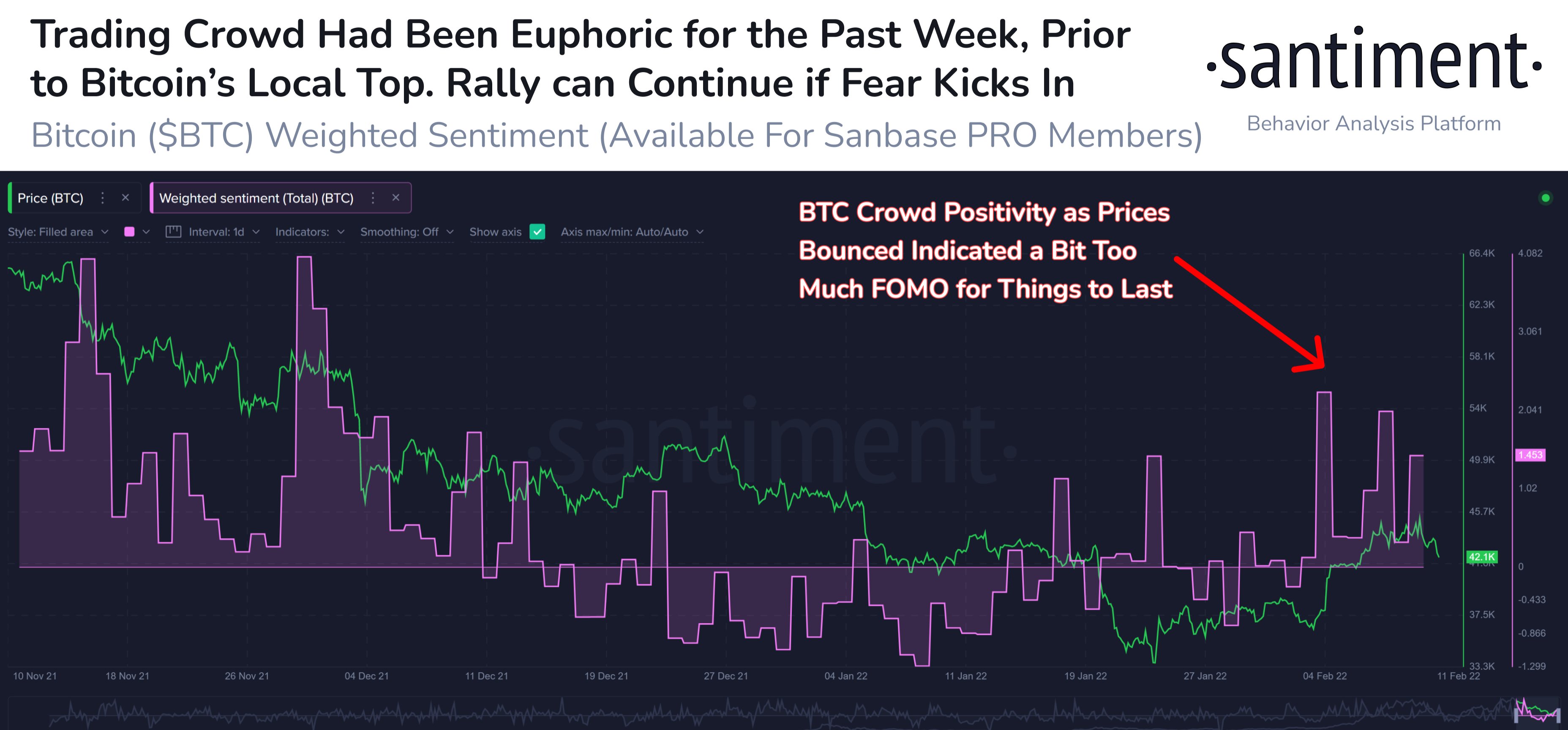

Bitcoin has been somewhat volatile over the last week. However, data provider Santiment reports that the positive sentiment lead to a FOMO-like event which caused the price to drop later. It further added:

Bitcoin’s crowd sentiment has remained positive this week, and this is likely contributing to the decline it & #altcoins have seen to end the week. We will be looking for a bit of crowd #FUD as a signal that bounces will happen heading into next week.

The world’s largest cryptocurrency has been under pressure over the last three days and it has also pulled down altcoins along with it. Along with the inflation data, some analysts believe that geopolitical factors such as the Ukraine crisis are weighing up on the market.

However, Bitcoin proponents believe that it is still less risky to hold Bitcoin against other asset classes. MicroStrategy CEO Michale Saylor said:

Given the uncertainties that investors currently face, it feels less risky to be holding #bitcoin than any mix of currencies, credit, equity, commodities, or property.

As per the Bloomberg report, Bitcoin miners have been selling their holdings recently. The net Bitcoin miners’ holdings have turned negative since February 5. The report stated:

The turn in the metric, or the net change of miner balances over a trailing 30-day window, shows that miners have sold their coins in a possible sign a shakeout of less-efficient operators is coming.

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?