Just-In: BitMEX’s Arthur Hayes Predicts Bitcoin (BTC) Price Dump Below $40,000

BitMEX co-founder Arthur Hayes in a new Bitcoin price prediction on Monday said “I think we break $40k”. The change in sentiment comes following a long-term bearish prediction of $5000 for Ethereum (ETH) and $200 for Solana (SOL), as well as in response to the upcoming US Treasury quarterly refunding announcement.

Arthur Hayes’ Bitcoin Price Prediction

Billionaire Arthur Hayes, co-founder of crypto exchange BitMEX shares his bearish sentiment on Bitcoin in a post on January 22.

Hayes said “BTC looks mad heavy. I think we break $40k. I went long some 29Mar $35k strike puts.” He added that BTC price will continue to dump until the U.S. Treasury quarterly refunding announcement on January 31. US Secretary of the Treasury Janet Yellen can bring BTC price further down with her bearish remarks, but the community is awaiting a paradigm shift in momentum.

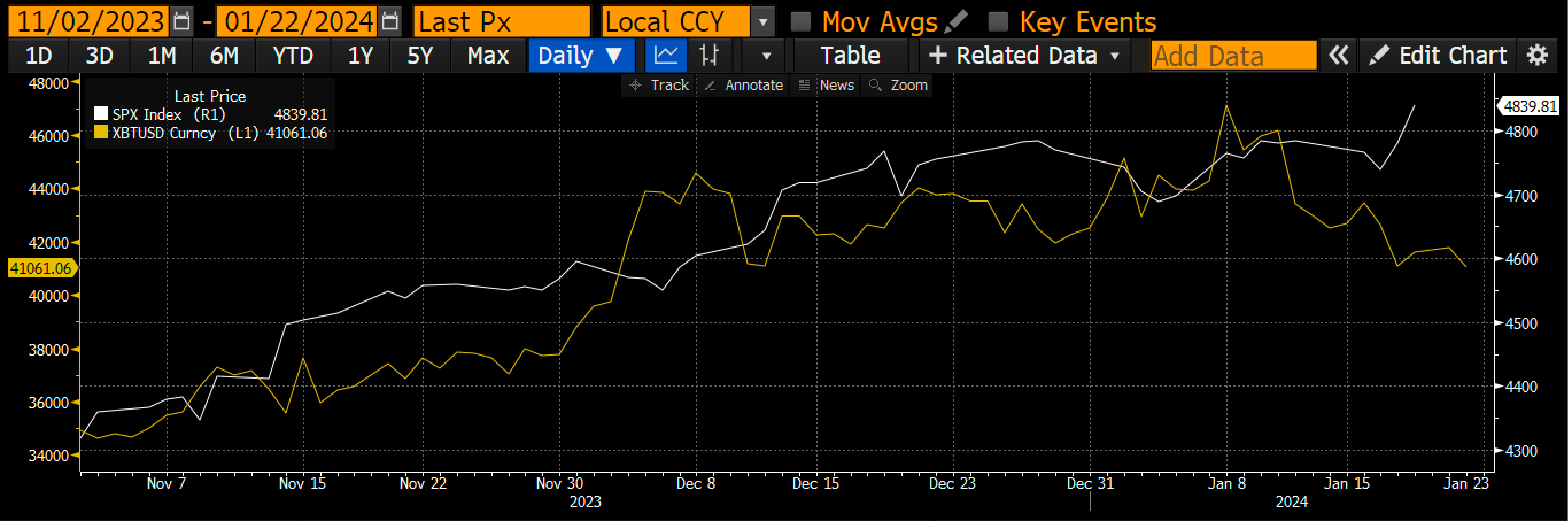

In a previous post today, Arthur Hayes said SPX and BTC both “stopped moving up together post US BTC ETF”. He signals liquidity troubles in the markets as traders await key macro announcements.

Coinglass data indicate liquidation of $140 million in the last 24 hours. Over 63K traders were liquidated in the last 24 hours, with the largest single liquidation order on OKX’s ETH-USD-SWAP worth $3.20 million. Almost $40 million were liquidated after Arthur Hayes’ post on X.

BTC price extended decline after Arthur Hayes’ post, falling to $40,027. The price is currently trading at $40,822. The 24-hour low and high are $40,364 and $41,855, respectively. Furthermore, the trading volume has increased by 72% in the last 24 hours, indicating interest among traders.

On the macro front, the strong US dollar and rising U.S. 10-year treasury yields are causing selling pressure on Bitcoin. The US dollar index (DXY) reversed back to 103.50 from 101 in early January.

Also Read:

- Terra Luna Classic (LUNC) Delisting Confirmed By CryptoCom

- Crypto Market Selloff: Bitcoin, ETH, SOL, ADA, XRP Retreat With 100$ Mln Liquidation

- Terraform Labs (TFL) Files For Bankruptcy Protection, LUNA & LUNC Price Slip 7%

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand