UPDATE: BitMEX User Claims Exchange Didn’t Refund 30 BTC, Exchange Responds

(The article has been updated including statements from BitMEX exchange spokesperson explaining the refund process)

It is 17 days since the BitMEX experienced a “downtime” on their servers liquidating millions of trades on the platform as the price of Bitcoin (BTC) futures dropped to the $3,800 region. Traders across the board have complained that their trades were liquidated abnormally and no refunds have been offered yet.

One trader claims to have lost 30 BTC in a short trade with the exchange only refunding a fraction of the trade (margin), totaling to 0.9242 BTC.

Trader loses over $150,000 in March 12th BitMEX fiasco

In an exclusive email sent to our Coingape team, one trader claims that the BitMEX “downtime”, which was earlier reported as a DDoS attack, wrongly liquidated close to 30 BTC (approx. $150,000 at time of liquidation). While BitMEX gave a long, but slightly stuffed explanation to what happened on their platform on March 12 &13, there remains a bitter taste for traders like this who lost their investment and received no refund.

The email reads,

“I entered my short position at 4900 with the liquidation price set at $5,100. Before the [BitMEX] downtime, price hovered around $3605,” wrote the Korean based trader. “At around 11.55 when the downtime occurred my account was kicked out.”

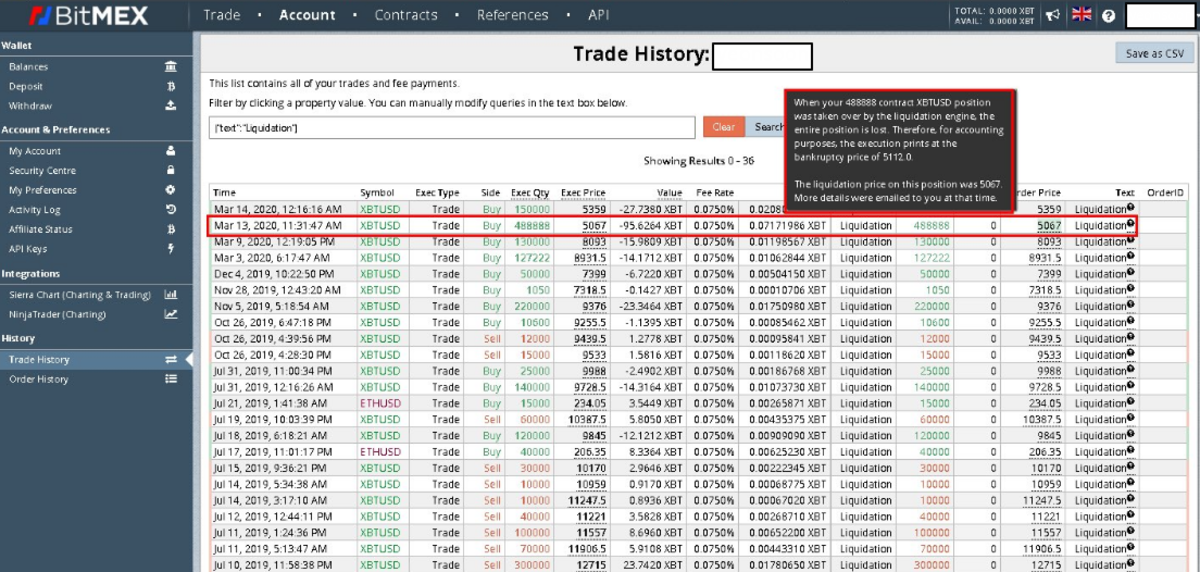

Once the system became operational in less than an hour, the trader found the whole position was liquidated, with only the margin position remaining – 0.9242 BTC (~$4,700). This is a huge difference from the 10 BTC (at least) that should have remained in his account if the stop loss took effect.

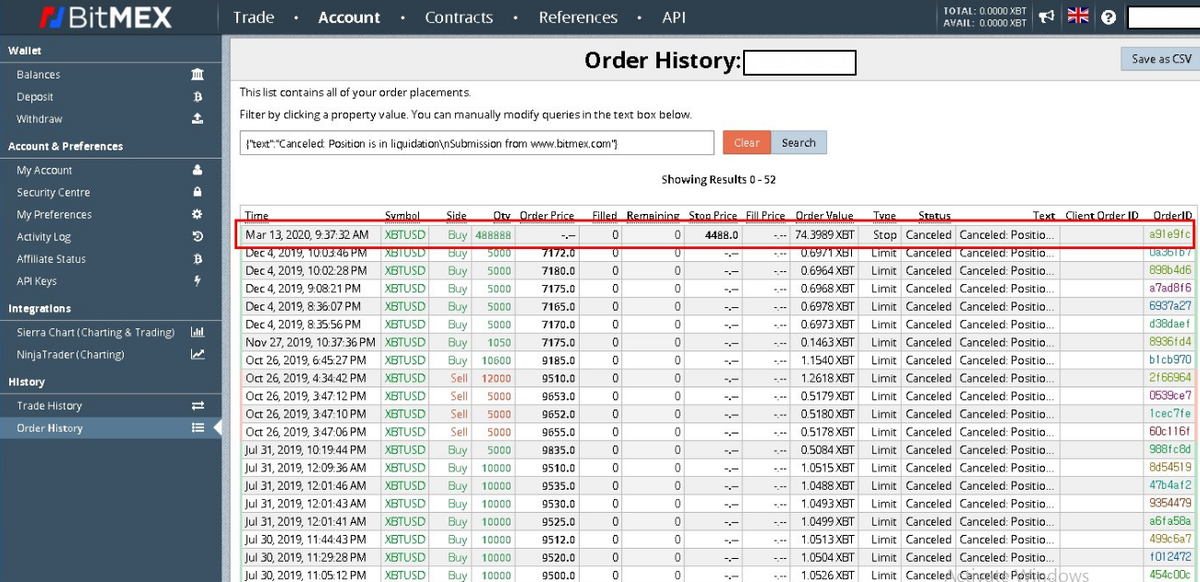

Despite setting a stop loss at $4,488 (as seen in the image above), the traders position was liquidated at $5,100, raising questions on why BitMEX did not stop the trade or at least refund the trader for their own mistake.

“I found record and charts, my position was liquidated by mark price ($5100), at that time, index price only reached $4100.”

And after sending a ton of tickets and complaints to the exchange in a bid for them to investigate the trade a short and disheartening reply was sent out on March 21:

“We know some users can’t control during downtime, but no refund”

The trader continued pestering the exchange for an explanation and a refund but none was offered with the only response from BitMEX team sent out on Mar. 30 reading:

“We investigated all of your [claims], but Sorry, no reason for a refund.”

BitMEX: “We’re reviewing all users who were liquidated”

The exchange has responded to the claims offered by BitMEX stating the exchange in line with the rest of the market faced a “volume hit” on Mar.12 & 13 leading to the unfortunate events but are following closely with traders – including this specific user.

A statement from BitMEX reads,

“We have bee engaging directly with any BitMEX user who found themselves liquidated during the downtime on March 13, including providing timely refunds where applicable. We are also reviewing all our interactions with this specific user. Markets in general – both traditional and cryptocurrency – have seen volumes hit as traders figure their way through the unchartered waters of recent weeks. Open interest on the BitMEX XBTUSD market, which remains the most liquid globally, has been impacted in line with what we have seen in the market.”

Is users’ confidence in BitMEX plummeting?

This was not the only complaint that BitMEX received on their liquidations. A number of traders have kept complaining such as the one below.

The situation with #Bitmex is coming to a close. I’m not going to do a longer write up. I’m exhausted with their mental gymnastics. This will be my last tweet on this account. Find me at @SimpelAlpha. https://t.co/D2KFa02oIq

— Sim (@_simpelyfe) March 26, 2020

To be fair, BitMEX did actually refund some of the traders but the confidence in the platform has taken a hit as the once number one BTC Futures platform, currently is behind Binance, Huobi and OKEx.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs