BitMine Buys $29 Million in Ethereum as Kalshi Traders Cut $5,000 Price Odds to 34%

Highlights

- Bitmine makes a purchase of $29 million in Ethereum, signaling strong institutional confidence.

- Kalshi traders cut the odds of ETH hitting $5,000 by this year end to 34%.

- Analysts predict Ethereum’s ecosystem strength could drive a $5,000 comeback soon.

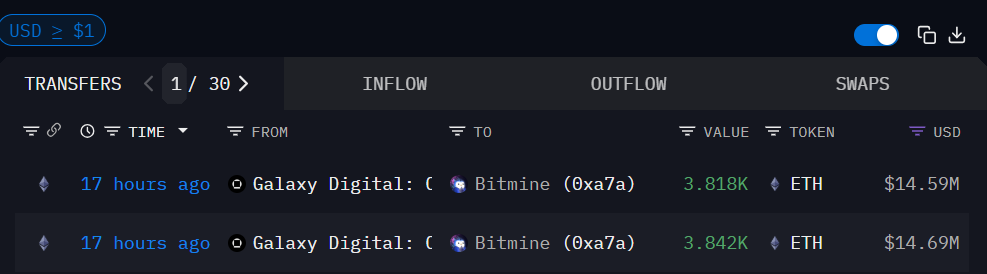

BitMine has made a fresh bet on Ethereum, acquiring 7,660 ETH worth about $29 million from Galaxy Digital. The large inflow into BitMine’s wallet highlights renewed institutional appetite for the world’s second-largest cryptocurrency despite growing caution in retail markets.

Institutions Accumulate Ethereum While Retail Traders Turn Bearish

According to Arkham data, the transactions occurred with Galaxy Digital sending two separate batches of 3,818 ETH and 3,842 ETH to BitMine’s primary address (0xa7a). Based on the accumulation move, institutions are still targeting medium-term profits in Ethereum. The firm’s inflow is the latest in BitMine’s history of large-scale ETH acquisitions, including over $820 million worth of the token in a recent purchase.

However, retail bias is weakening. Continual Ethereum purchases by BitMine and other similar purchases often prelude a shortage of the token on crypto exchanges.

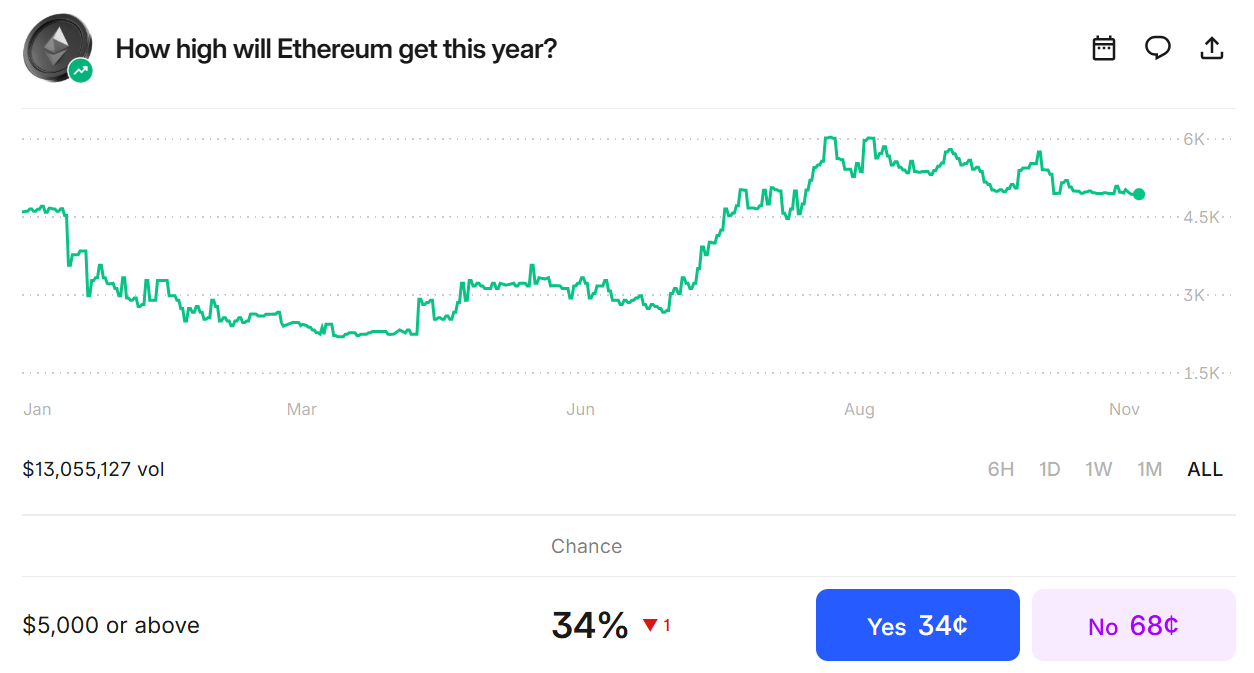

Kalshi’s latest prediction-market data paints a very different mood. Traders on the platform now assign only a 34% chance that Ethereum will reach $5,000 by the end of the year. It is down sharply from more than 40% just a month ago.

The drop indicates continued uncertainties in macroeconomic conditions, Federal Reserve policy on rate cuts, and broader on-chain activity. Recently, Federal Reserve Chair Jerome Powell revealed that there’s an unlikely chance that there would be further Fed rate cuts this year again.

It is clear that there is a divergence between the flows of prediction-market and on-chain flows. During retail pullbacks, whales usually accumulate before the upward momentum starts again. Hence, the acquisition by BitMine may be an indication of the initial phase of wider institutional ETH purchases.

Analysts Predict ETH Price Rally

Meanwhile, market analyst Ted Pillows noted that the company has been purchasing $200 million to $300 million in Ethereum every week. According to Pillows, “a few more buyers like that, and an ETH reversal could happen.” His observation aligns with a growing belief among analysts that consistent institutional buying may soon offset weak retail sentiment.

Adding to the optimism, popular crypto analyst Michaël van de Poppe shared his outlook on Ethereum. He said the network’s broader ecosystem remains one of the strongest investment themes heading into 2026.

The analyst predicted ETH could soon reach a new all-time high “north of $5,000” once momentum builds across its layer-2 networks. Also, analysts are projecting a $5,000 price zone for ETH following the Fusaka upgrade plan.

Van de Poppe’s analysis contrasts with Kalshi’s bearish crowd view. This suggests that major traders still expect Ethereum’s ecosystem to outperform once risk sentiment improves. At the time of writing, ETH price is around $3,780, down about 1.2% in the past 24 hours.

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Will Bitcoin Crash To $58k or Rally to $75k After Hot PCE Inflation Data?

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Crypto Market Weekly Recap: BTC Waver on Macro & Quantum Jitters, CLARITY Act Deadline Fuels Hope, Sui ETFs Go Live Feb 16-20

- Robert Kiyosaki Adds To Bitcoin Position Despite Market Decline

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral