Bitcoin’s Dormancy Flow Reaches Key Threshold, Hodlers Not Ready To Sell

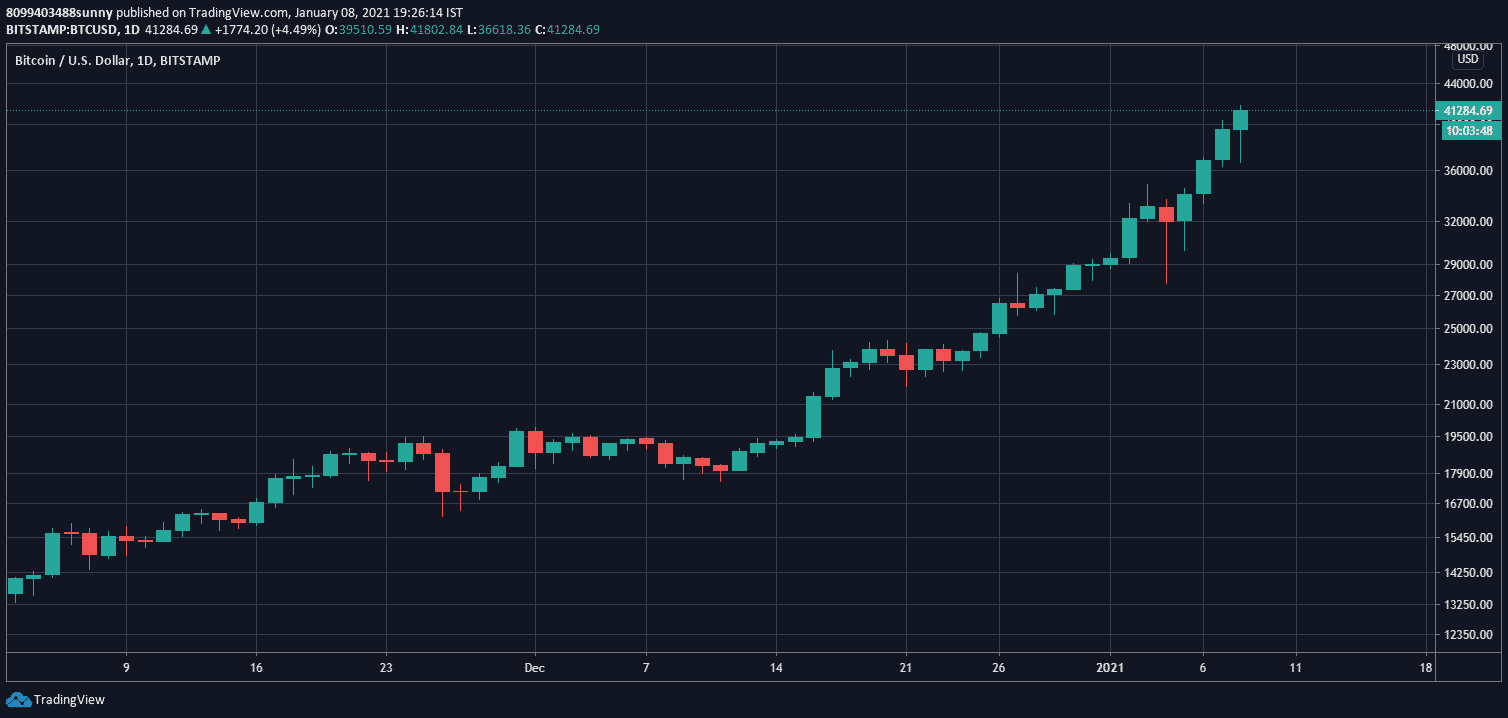

Bitcoin today created another new all-time-high by breaching $41,000 early today after seeing a minor rejection at $40,000 yesterday and the equity adjusted dormancy flow for Bitcoin has reached a very key threshold.

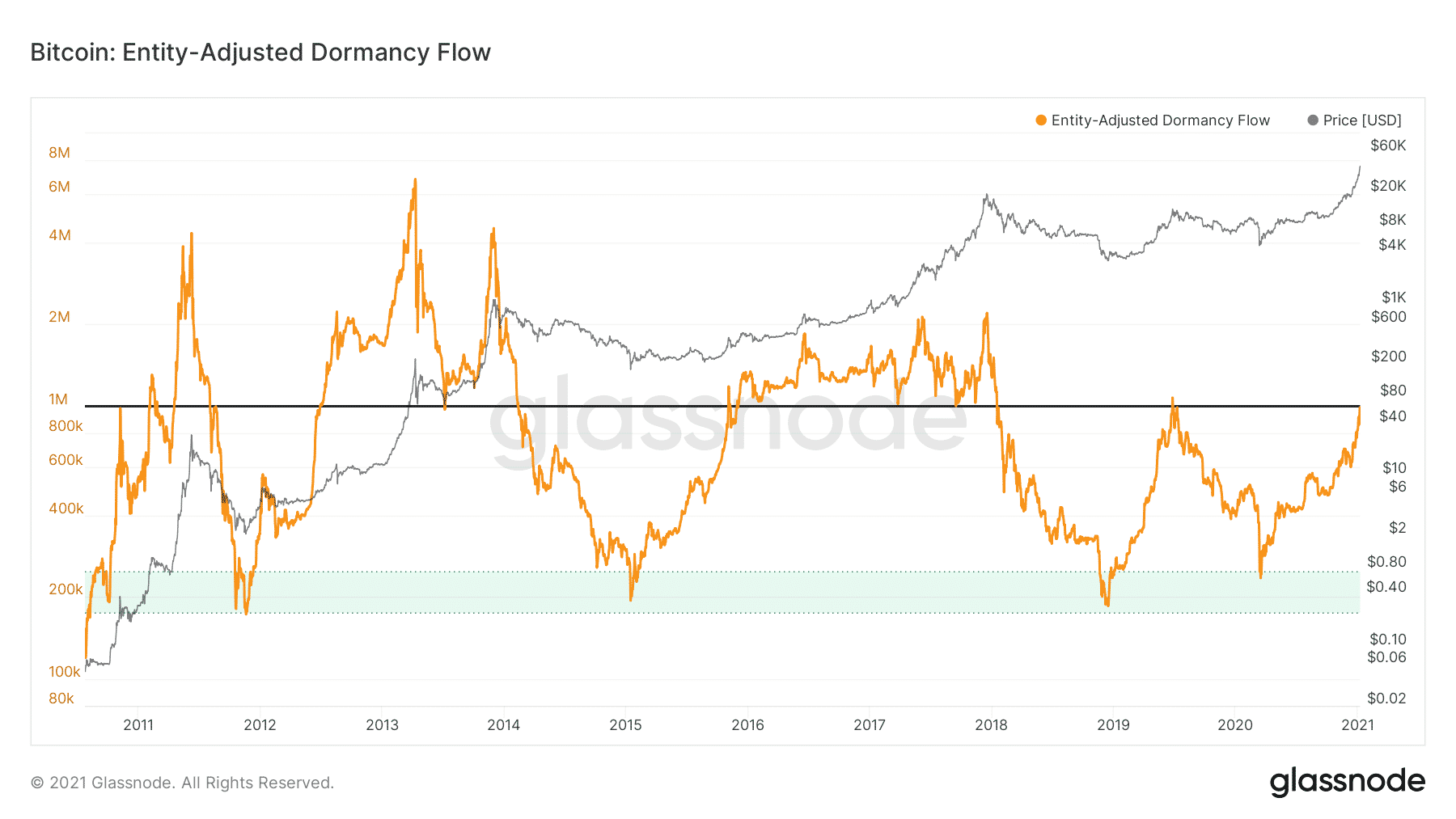

Glassnode, a blockchain analytics firm which offers on-chain metrics for different cryptocurrency recently revealed that the top cryptocurrency’s Dormany Flow has reached the threshold a strong bullish indicator.

Glassnode: Bitcoin adjusted dormancy

Bitcoin Hodlers are Barely Selling

Prior to the 2020 bull market which began in late October, 2020 many believed bitcoin would definitely breach its precious all-time-high but would register a dip as more players would start selling, however, that has not happened yet and been when BTC has more than doubled its previous ATH, they don’t want to sell it at this price suggesting we are far from the top.

Dormancy Flow is seen as the,

The average number of days each coin transacted remained dormant, unmoved. The higher the dormancy, the older the coins transacted are on average, and the more old hands are releasing their bitcoins into circulation. Dormancy flow going up means coins are being traded.

If one has to understand how Dormancy Flow works it can be understood,

1. Coming out of the accumulation phase in the late bear cycle, dormancy is low

2. Entering the early bull market, long-term holders start liquidating their old coins and new traders/investors pick it up, thus high dormancy.

Thus the current threshold suggests Hodlers are not ready to sell their bitcoin even at a price point above $40,000.

The top cryptocurrency’s bullish momentum has overshadowed most of the technical hurdles with ease and looks well set to reach $42,000 by end of the day. The top cryptocurrency has managed to gain back most of the market pullbacks and price rejection within 12 hours of the loss showing the strength of bullish momentum of the bitcoin.

Bitcoin is showing no signs of fatigue or any price crash fears despite rallying more than $21,000 in the past 21 days and it looks like the 2017 high of near $20,000 would just be a blip on the chart just like 2013 high. While institutional FOMO for sure is a major reason behind the ongoing bull run, but over the past couple of weeks, retail whales were seen quite active and bullish with numerous buy orders of over $1 million on different exchanges.

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown