Bitwise CEO Comments On BTC Selling Pressure Amid Bitcoin ETFs Milestone

Highlights

- Bitwise CEO Hunter Horsley said that the Bitcoin ETFs aren't the ones selling BTC and causing its price to remain lower.

- Bloomberg analyst Eric Balchunas indicated that its crypto natives are to blame for the Bitcoin selling pressure.

- The Bitcoin ETFs are closing on Satoshi Nakamoto's 1.1 million BTC stash.

Bitwise CEO Hunter Horsley has defended the Spot Bitcoin ETFs following criticism that these funds are responsible for the BTC selling pressure that has caused the flagship crypto to stay below its current all-time high (ATH). This comes amid the Bitcoin ETFs closing in on Satoshi Nakamoto’s 1.1 million BTC holdings after witnessing three consecutive weeks of inflows.

Bitwise CEO Says Spot Bitcoin ETFs Aren’t Selling

Hunter Horsley remarked in an X post that these funds aren’t the ones selling despite criticisms from the crypto community that they might be responsible for why the flagship crypto hasn’t reached a new ATH despite other assets like the stock markets and Gold reaching new highs.

The Bitwise CEO’s statement came as he highlighted that the Bitcoin ETFs are close to holding a million BTC in assets under management (AuM). He claimed that the fact that the price isn’t higher despite that shows that there is a “pocket of existing holder selling.”

Horsley added that no one wants to raise their hands about the Bitcoin selling pressure but it’s not the ETFs. Bloomberg analyst Eric Balchunas also echoed a similar sentiment to the Bitwise CEO as he suggested that the Bitcoin ETFs aren’t responsible for the selling pressure that is keeping the Bitcoin price down.

In an X post, he stated that the “HODLers” are selling despite the amount of inflows that are coming into the Bitcoin ETFs. He added,

I personally don’t get it but hey it’s a free market.

However, crypto natives can easily rebut this criticism that the “HODLers” are the ones selling. CoinGape recently reported that Bitcoin has the longest HODL period among crypto investors, with an average period of four years and four months.

Bitcoin ETFs Are Closing In On Satoshi Nakamoto

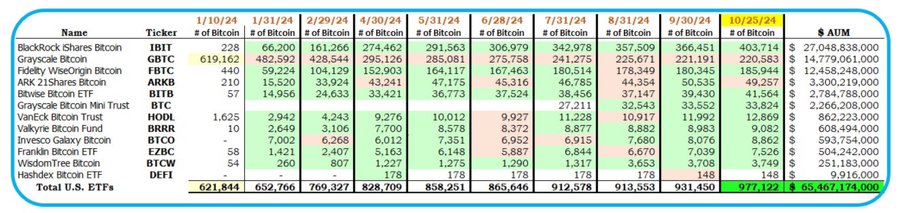

As highlighted by the Bitwise CEO, these Bitcoin ETFs hold almost a million BTC and are now closing in on Satoshi Nakamoto’s net worth of 1.1 million BTC. Specifically, HODL15Capital data shows that these ETFs hold $65.25 billion worth of Bitcoin (977,122 BTC), which amounts to 4.93% of the flagship crypto’s circulating supply.

BlackRock remains the issuer with the largest BTC holdings with $26.98 billion in assets under management for its IBIT Bitcoin ETF. The world’s largest asset manager is followed by Grayscale, Fidelity, and Ark Invest in that order. Meanwhile, Bitwise comes in fifth with net assets of $2.78 billion for its BITB ETF.

These Bitcoin ETFs are currently enjoying massive demand having witnessed three consecutive weeks of inflow. Their biggest outing this week came on October 25 when they recorded a net inflow of $402 million. However, amid this development, there remains the possibility that the Bitcoin price could drop below $60,000. This would be as result of factors like the Tether investigation which could spark a widespread crypto selloff from both Bitcoin ETFs and “HODLers.”

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- BlackRock Signals $257M Bitcoin and Ethereum Sell-Off Ahead of Partial U.S. Government Shutdown

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15