Bitwise CIO Calls Crypto Crash a ‘Blip’ as Market Bounces Back With $338M ETF Inflows

Highlights

- Bitwise CIO Matt Hougan calls the recent crypto market crash a short-lived panic.

- Bitcoin fell 15% and Solana 40% following U.S.–China trade tensions but quickly rebounded to $115,000.

- ETF inflows surged by $338 million, signaling renewed institutional confidence.

Bitwise CIO Matt Hougan said the recent crypto crash is a “temporary blip” in a strong bull market. This comes as the crypto market bounces back due to rising ETF inflows.

Bitwise CIO Dismisses Crypto Crash as Short-Lived Panic

In a recent post, Matt Hougan, Chief Investment Officer at Bitwise, addressed the crypto crash. He described it as a “momentary shakeout” that failed to dent the industry’s long-term outlook.

The crash, which erased billions in leveraged positions, began late Friday after President Trump announced plans for a 100% tariff on Chinese imports. The move led to Bitcoin plunging as much as 15% and altcoins like Solana tumbling as much as 40%.

However, the market quickly stabilized. By Monday morning, Bitcoin had climbed back to around $115,000. This nearly erased the losses from the sudden downturn. Hougan noted that while such volatility can be unnerving, “nothing fundamental” about the crypto landscape had changed.

“Events like these test the system,” the Bitwise CIO said. “But the infrastructure held up well. DeFi protocols such as Uniswap, Aave, and Hyperliquid performed flawlessly, even as centralized exchanges like Binance faced temporary disruptions.”

He added that the episode showed how much stronger the digital asset ecosystem has become. “In traditional markets, such a rapid unwind could have had deeper consequences. Here, we saw the market reset, catch its breath, and continue forward.”

Hougan emphasized that such volatility is “par for the course” in emerging markets, especially when global uncertainty spills into digital asset trading. He believes the long-term picture remains strong, supported by increasing institutional allocation.

Market Recovers as ETFs See $338 Million in Fresh Inflows

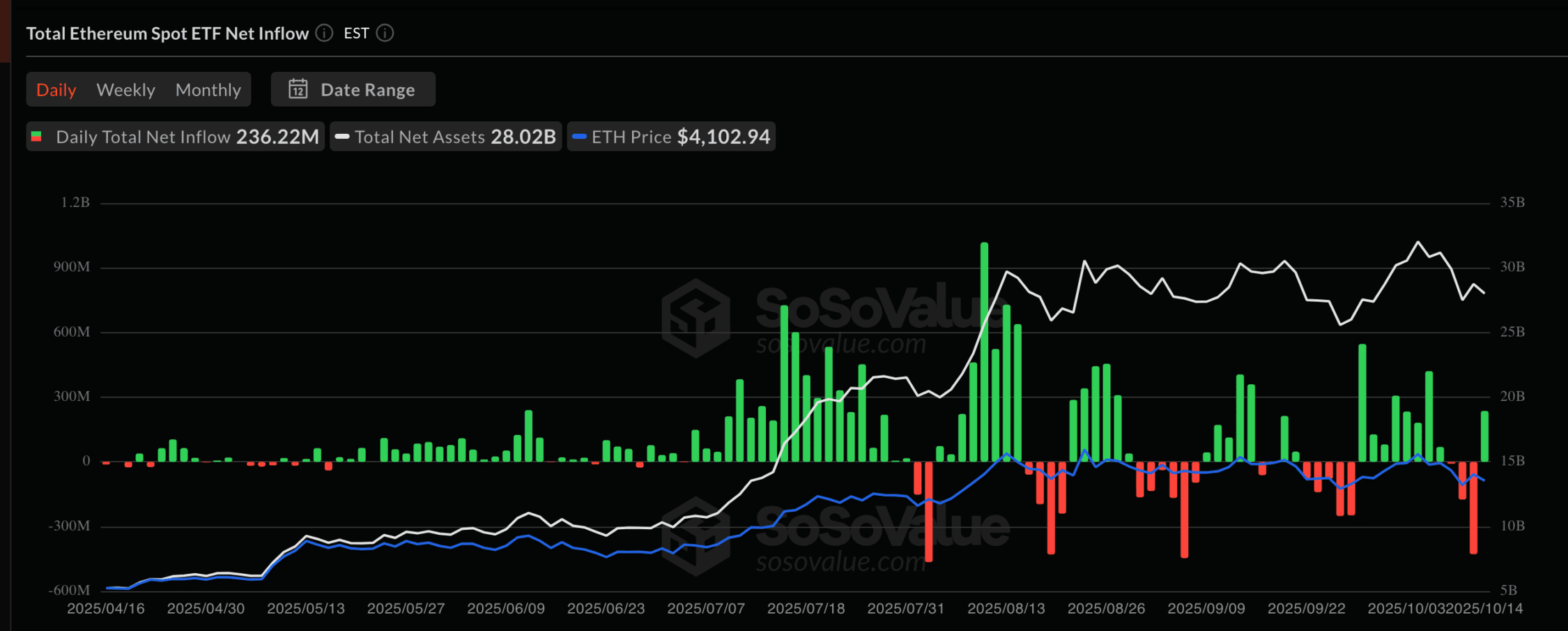

In line with Bitwise CIO optimism, crypto markets showed strong signs of recovery. According to SoSoValue data, on October 14, spot Bitcoin and Ethereum ETFs recorded net inflows of $338 million.

Bitcoin spot ETFs brought in $102.6 million in net inflows, led by Fidelity’s FBTC with $133 million. Bitwise’s own BITB added $8 million, while ARK & 21Shares’ ARKB gained $6.8 million. Although BlackRock’s IBIT and Valkyrie’s BRRR saw outflows totaling $44.85 million, the overall trend shows that institutional confidence is growing again.

Additionally, Ethereum ETFs saw significant inflows of $236.22 million, led by Fidelity’s FETH once more with $154.62 million. Other issuers, including Grayscale, VanEck, Franklin Templeton, and Bitwise, also reported strong demand.

This rebound came just days after one of the worst outflow sessions of the year. Yesterday, investors pulled out $326 million from Bitcoin ETFs, and Ethereum funds lost $428.5 million during the crypto crash.

Notably, BTC price increased by 1.11% in the last 24 hours, reaching $112,606. Ethereum also rose by 4.09%. However, both assets are still below their highest values before the market crash.

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand