Bitwise Solana ETF to Launch This Week as It Amends Staking, Fees? Bloomberg Weighs In

Highlights

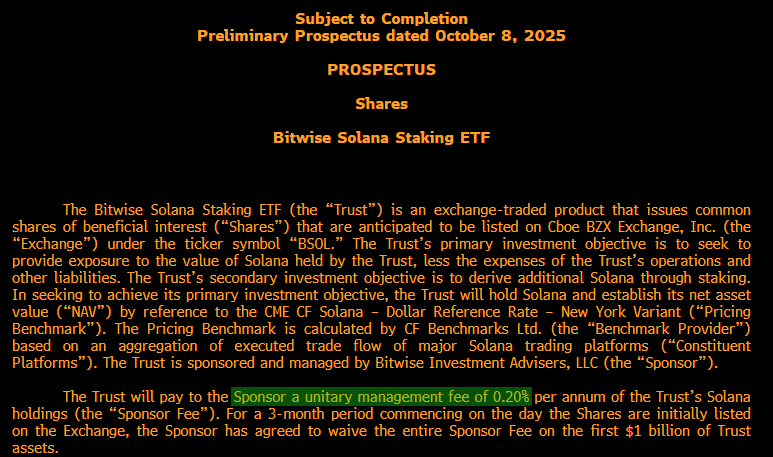

- Bitwise Solana ETF (BSOL) changes name to Bitwise Solana Staking ETF.

- The firm sets a 0.20% management fee, but waives fee for 3 months or until AuM reaches $1 billion.

- Bloomberg analysts addressed concerns on Solana ETF approvals amid US government shutdown.

Bitwise Solana ETF (BSOL) is likely gearing up for launch this week as the issuer amends its application to include staking, ticker, and low fees. The final deadline for the US SEC to decide on Bitwise’s BSOL exchange-traded fund (ETF) is October 16, but the commission could approve all SOL ETFs with a final decision on Grayscale’s due by Friday.

Bitwise Solana ETF Prepares for Launch

According to the SEC filing, asset management firm Bitwise submitted a fifth amendment to its spot Solana ETF application. The firm includes ‘Staking’ in the name and sets a 0.20% management fee. “This is more like they slashed fees right to their bottom level from the get go,” said Bloomberg analyst James Seyffart.

Bloomberg senior ETF analyst Eric Balchunas quoted the low fees as “Bitwise not playing around” as they seek to lead in inflows. Notably, low fees have a near-perfect history of attracting potential investors.

Thought we’d see higher first, need war to get this low. They prob figured it’s gonna end up there anyway so just do it now (veteran Terrordome move right there).

The asset management firm waived fees for the first three months or until assets under management reach the first $1 billion. This signals the Bitwise Solana Staking ETF’s readiness to get listed and trade on CBOE BZX Exchange, awaiting the SEC approval.

Other details disclosed in the filings include Chapman and Cutler LLP as legal counsel, Fenwick & West LLP as tax counsel, and consent from accounting firm KPMG. Also, Attestant as staking, delegated staking and re-staking provider and staking custody agreement with Coinbase Custody.

Can Solana ETFs Get Approval by Friday?

Bloomberg analysts also addressed investors’ doubts on whether Solana ETFs can still get processed and approved after the update. While October 10 is the final deadline for the SEC to decide on Solana ETF, Eric Balchunas confirmed that the U.S. government shutdown has delayed approvals.

As CoinGape reported earlier, the SEC missed its final deadline on the Canary Litecoin ETF due to the government shutdown. Seyffart claimed the deadline date might not matter at all as the SEC asked all issuers to file under the Generic Listing Standards.

SOL price jumped over 4% in the past 24 hours, with the price currently trading at $227.83. The 24-hour low and high are $218.18 and $229.56, respectively. However, the trading volume has decreased by 27% in the last 24 hours.

- XRP Ledger Validator Spotlights Upcoming Privacy Upgrade as Binance’s CZ Pushes for Crypto Privacy

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)