BlackRock Bitcoin ETF’s Biggest Outflow Ever Sparks Panic, But Kiyosaki Stays Bullish

Highlights

- A record BlackRock Bitcoin ETF outflow signals a severe cash shortage across the world.

- Analyst data shows a sharp divide, with cash flowing into major assets.

- Robert Kiyosaki aims to buy more Bitcoin despite a historic ETF market sell-off.

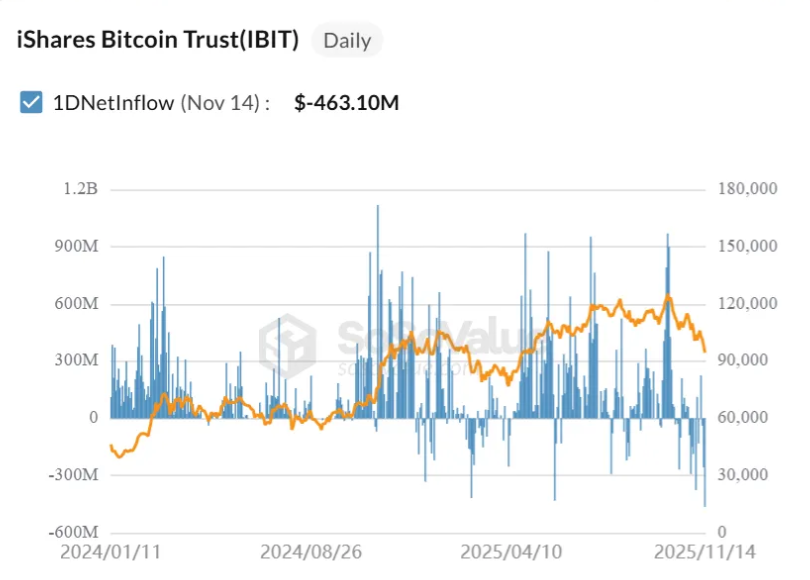

Fresh data showed that BlackRock pulled about $473.72 million worth of Bitcoin in a single session. This marks the biggest withdrawal in USD terms since the asset manager entered the market. The massive exit added pressure during a week already filled with fear and massive sell-offs.

Major Bitcoin ETFs Record Sharp Withdrawals

SoSoValue data confirmed the scale of the movement. Withdrawals from the BlackRock Bitcoin ETF was $463.10 million. Fidelity’s FBTC posted more than $2 million in outflows. Grayscale’s GBTC shed $25.09 million, continuing its long pattern of red flows.

Only one smaller Grayscale product added $4.17 million, providing little support against the heavy withdrawals. Other major issuers, including Ark 21Shares, Bitwise, VanEck, Invesco, Valkyrie, Franklin, and WisdomTree, recorded no inflows at all. The record withdrawal happens weeks after JPMorgan disclosed holding shares of IBIT worth over $340 million.

Many people are cashing out, showing a serious shortage of cash in the market. Many institutions appear to be selling not because they doubt Bitcoin, but because they urgently need cash.

Analyst Highlights Sharp Performance Divide Across the Crypto Market

In addition, data from Daan Crypto Trades added context to the market stress. His chart showed that the prices of the majority of crypto assets fell between 10% and 30% over the past month. Only a few dozen coins managed returns above 30%. According to him, the results show extreme separation between winners and losers, a pattern seen throughout the cycle.

Daan said performance has been uneven all year. He explained that investors cannot hold every token and expect strong results. The analyst said traders must stay nimble or focus only on Bitcoin and major assets. His analysis supports the growing view that liquidity concentrates around major coins during stress.

Kiyosaki Maintains Bullish Outlook Despite Market Fear

Despite these conditions, Robert Kiyosaki remains optimistic. He said he is not selling Bitcoin and plans to buy more when the crash ends. He argued that Bitcoin’s fixed supply continues to give it long-term strength.

The popular author recently reiterated this view recently. Kiyosaki described Bitcoin as “real money” rather than a speculative asset.

He also said he does not need cash, which allows him to stay calm while others panic. Kiyosaki again referenced the “Big Print” thesis from analyst Lawrence Lepard. He believes global debt levels will force governments to create new money, increasing the value of scarce assets. He reflected on past mistakes and said his financial discipline came from painful experiences.

He urged followers to study markets, learn from failure, and work together in groups. He said such groups help people stay grounded during sharp downturns.

Kiyosaki ended by saying he does not give investment advice. He shares only his actions and accepts he could be wrong.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs