BlackRock Ethereum ETF Sees Record 80,768 ETH Inflow After Huge Sell-Off Week

Highlights

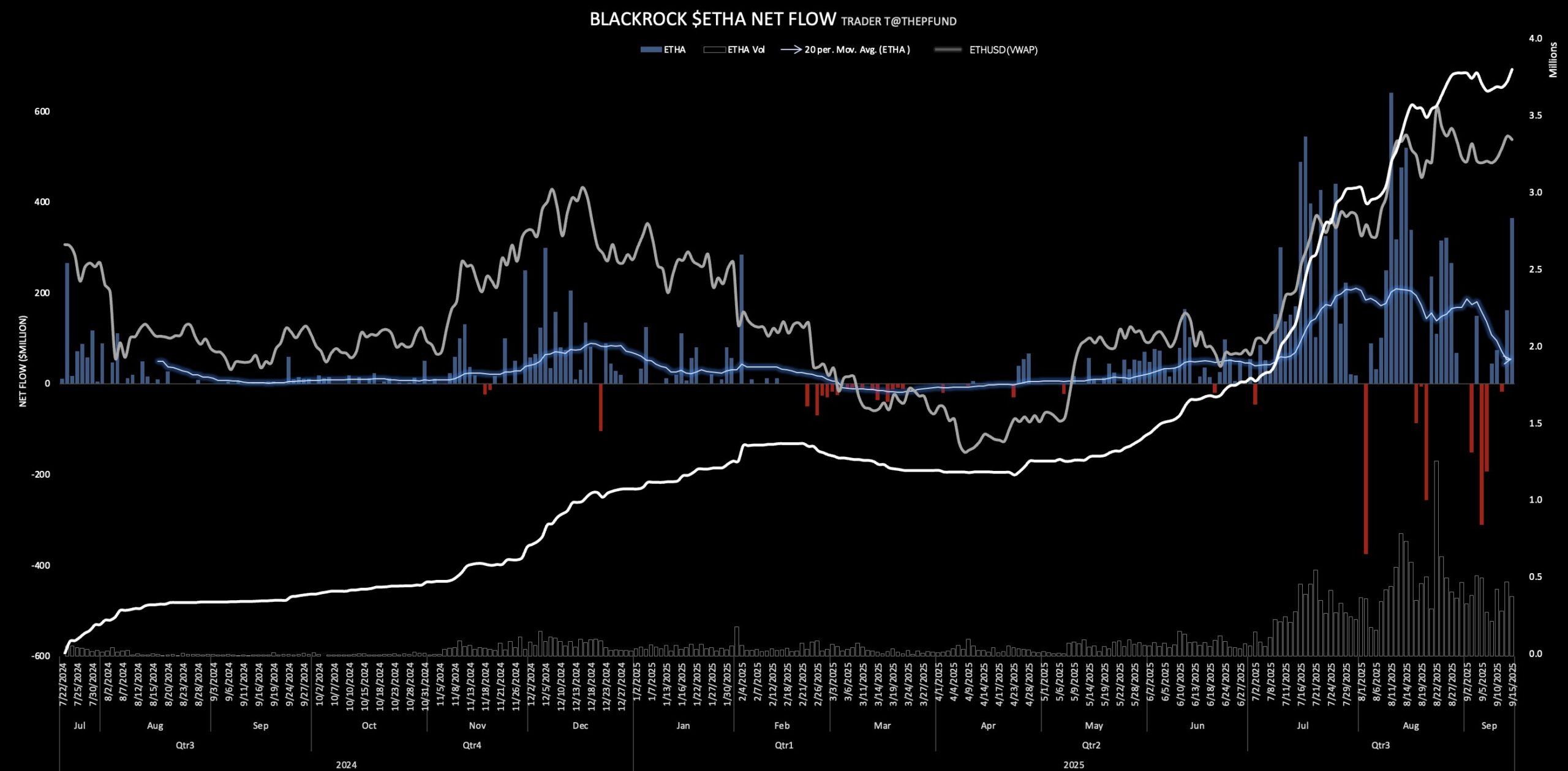

- BlackRock’s Ethereum ETF (ETHA) posted a record 80,768 ETH ($363M) inflow on September 15, its biggest in 30 days.

- Trading volume surged to $1.5B, signaling renewed institutional appetite after a week of heavy outflows.

- Despite ETF momentum, ETH price fell 2.5%, showing short-term pressure.

BlackRock’s Ethereum ETF has recorded its largest ETH inflows in 30 days. This continues the product’s recovery in the market after its previous outflows.

BlackRock’s Ethereum ETF Pulls In Record 80,768 ETH

SoSoValue data showed that BlackRock’s Ethereum ETF (ETHA) attracted 80,768 ETH, roughly $363 million, in fresh inflows on September 15. The move represents the largest single-day intake for the fund in a month. It pushed trading volume to $1.5 billion, showing renewed appetite among investors.

The surge in demand comes after a volatile stretch. Between September 5 and 12, the ETF had suffered net outflows of $787 million. This contributed to a broader sell-off across digital asset markets.

It builds on last week’s recovery, during which spot funds recorded $638 million in net inflows. Fidelity’s FETH led with $381 million in fresh capital. This pushed its cumulative inflows to $2.86 billion since launch.

The firm’s ETHA contributed $165 million during the same period, while Grayscale’s ETHE and Bitwise’s ETHW added smaller but steady amounts. Notably, last week saw no outflows from any of the major funds, indicating steady institutional demand from all providers.

By September 12, Ethereum ETFs collectively managed $30.35 billion in assets. BlackRock holds the largest slice of the pie with $17.25 billion under management. This is roughly 3% of the token’s total market cap.

This comes after BlackRock rotated capital from ETH into BTC. iShares Bitcoin Trust (IBIT) gained $366 million in inflows while ETHA posted $17.3 million in outflows. The change suggested that the company was actively redistributing its exposure between the two biggest cryptocurrencies.

Short-Term ETH Price Pressure

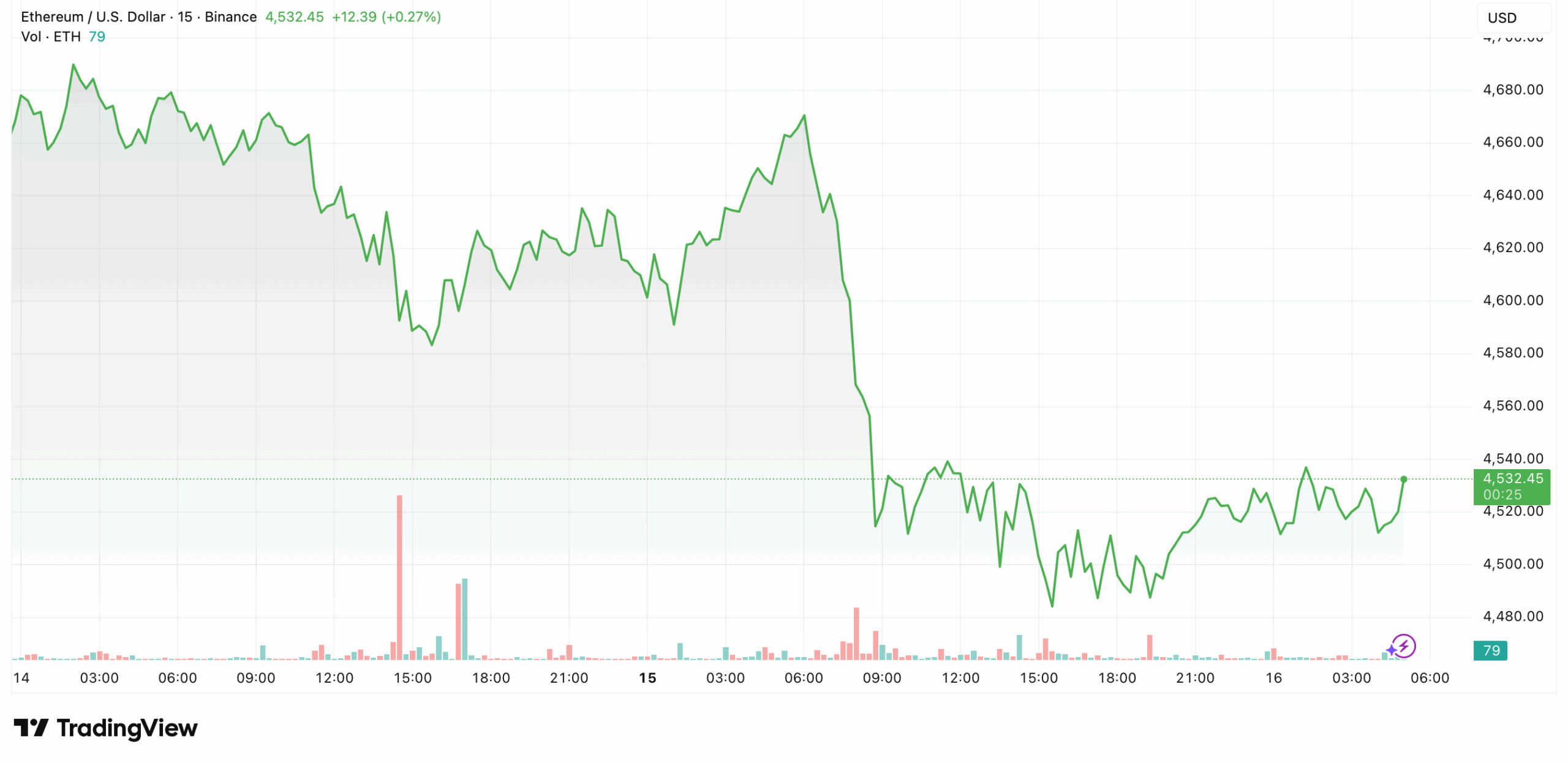

Despite the recovery in inflows, ETH’s price action has shown weakness. The asset underperformed the larger cryptocurrency market, falling 2.5 percent over the past day.

Indicators suggest consolidation may continue. While the MACD histogram indicates waning bullish momentum, the RSI remains close to neutral levels. Liquidations may speed up if there is a clear break below $4,400. Holding that support level, though, might strengthen stability in the short term.

In other developments in its ecosystem, the network’s total stablecoin supply recently climbed to a record $166 billion. This growth shows Ethereum’s enduring importance as a DeFi infrastructure, even during periods of price volatility.

Adding to the firm’s Ethereum ETF momentum, BlackRock is also planning to tokenize ETFs on blockchain infrastructure. Reports suggest the firm is examining ways to bring exchange-traded products, including those tied to real-world assets, on-chain.

The firm’s record inflow of 80,768 ETH provides a strong counterweight to previous weeks’ losses. This could lead to some recovery for the token’s current price downturn.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs