BlackRock Moves $195M ETH and $101M BTC Amid Mixed Crypto ETF Flows

Highlights

- BlackRock reallocated $297 million BTC and ETH deposits to Coinbase prime.

- IBIT ETF received inflows in a total value of $25.48 million but ETHA ETF experienced outflows of $192.7 million.

- ETH price increased by 1.11 per cent even as BTC price rose slightly.

BlackRock executed significant transfers of Bitcoin and Ethereum into Coinbase Prime on Tuesday, underscoring the scale of institutional activity. The firm’s ETF-linked wallets deposited 900 BTC worth $101.67 million and 44,774 ETH worth $195.29 million.

BlackRock Bitcoin ETF Sees Inflows as Ethereum ETF Faces Heavy Outflows

Arkham data revealed three separate Bitcoin transfers of 300 BTC each, alongside four Ethereum transfers of 10,000 ETH and one of 4,774 ETH. All were sent to Coinbase Prime, the preferred custodian for large-scale institutional inflows. The combined $297 million deposit solidifies Coinbase as the top institutional gateway to regulated digital asset exposure.

The scale of these deposits coincided with contrasting ETF performance. IBIT registered fresh inflows of $25.48 million on the same day. This highlights its momentum as the BlackRock Bitcoin ETF recently surpassed $90 billion in assets under management

BlackRock Ethereum ETF (ETHA), however, posted outflows of $192.7 million, marking one of the largest single-day redemptions since launch. The outflow was exactly 44,774 Ethereum, the same amount was moved into Coinbase Prime accounts. This is in line with the $447 million outflows recorded by spot Ethereum ETFs recently.

This split is a sign of widening sentiment among Bitcoin and Ethereum ETF investors. IBIT continues to draw consistent capital, but ETHA is under redemption pressure despite recent ETH price performance. The difference implies that institutions are conservative with exposures to Ethereum despite its price movement upwards.

Ethereum Price Strength Aligns With Fidelity Inflows But Contrasts Blackrock Outflows

Fidelity FETH ETF recorded inflows of $75.15 million but remains small compared to BlackRock’s withdrawals. The Grayscale ETHE also contributed $9.55 million to the net flows for ETH ETFs.

This rotation is evidence that Ethereum ETFs demand is still active, though investors may be switching between issuers instead of leaving Ethereum exposure altogether. On-chain transfers confirm underlying assets are being held in custodian accounts, but ETF data points to differing investor sentiment.

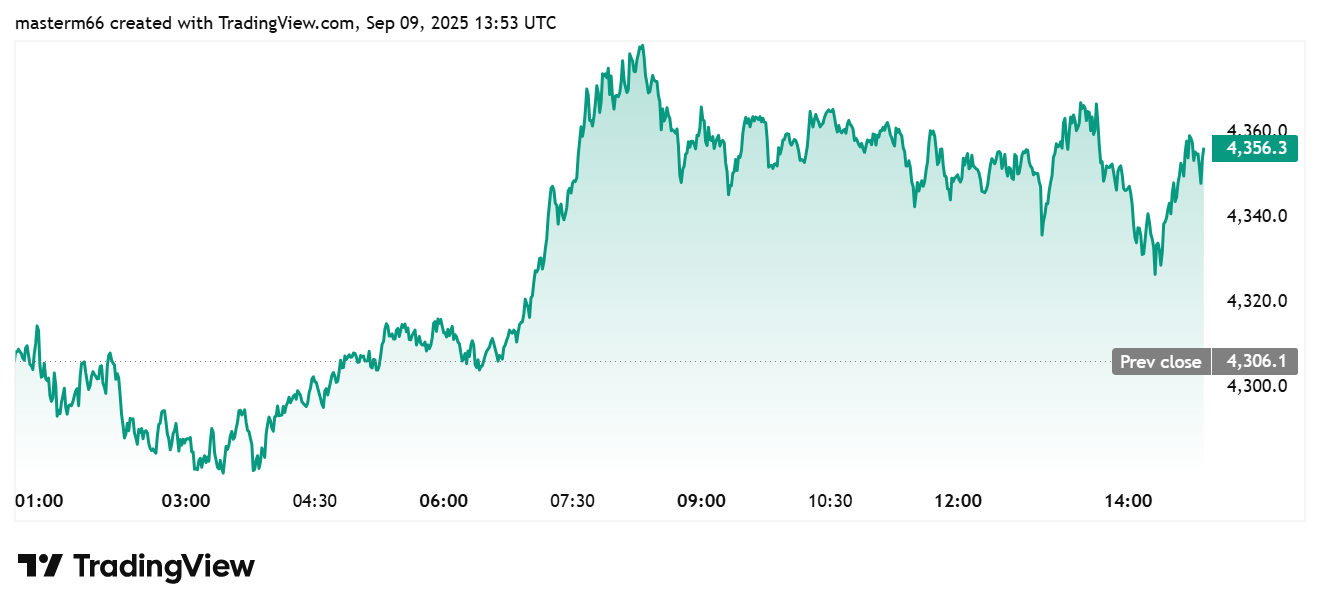

Besides the performance of the BlackRock ETFs, price action adds another layer of context. After climbing 0.53% on the day, Bitcoin trades around $112,668 at the time of writing. Also, the price of Ethereum climbed 1.11% to trade at $4,351. Ethereum price strength contrasted with heavy ETHA withdrawals and raised questions about whether outflows were profit-taking or reallocation into other funds.

On longer time frames, Ethereum price performance has been better than that of Bitcoin price. ETH gained 128% over six months compared to Bitcoin’s 34.6%. Year-to-date, Ethereum rose 30.7% while Bitcoin advanced 20.7%.

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?