BlackRock Now Holds $6 Billion BTC As Bitcoin ETF Notes $477 Mln Net Inflow

Highlights

- Spot Bitcoin ETFs recorded inflow of more than $477 million on February 15

- BlackRock's iShares Bitcoin ETF holdings surpassed $6 billion

- Bitcoin demand rises more than 10 times than supply

Spot Bitcoin ETFs saw another massive inflow of more than $477 million — the 15th consecutive inflow as demand continues to grow against supply. BlackRock’s iShares Bitcoin ETF holdings surpassed $6 billion and Bitwise Bitcoin ETF saw 2nd largest day since the spot Bitcoin ETF launch.

BlackRock Leads Spot Bitcoin ETF Records Net Inflow

According to the latest data by BitMEX Research, spot Bitcoin ETFs saw $477.4 million net inflow on Thursday. With the latest inflow, Bitcoin ETFs have now recorded a net inflow of over 61,800 BTC in the last 7 days.

BlackRock’s iShares Bitcoin ETF (IBIT) registered a staggering inflow of $339.9 million on Thursday. Bitwise Bitcoin ETF (BITB) comes next with a $120.2 million inflow. However, Fidelity Bitcoin ETF (FBTC) inflow has further slowed to $97.4 million on Thursday.

BlackRock has been leading all its competitors by a wide margin, with total inflow crossing $5.17 billion and BTC holdings of 115,991.3 valued over $6 billion.

GBTC saw a $174.6 million outflow, an increase from Wednesday’s $131.2 million outflow. As a result, the net inflow for spot Bitcoin ETFs, excluding GBTC, was actually $652 million.

BlackRock and Fidelity Wise Origin Bitcoin ETFs now hold over $10.3 billion worth BTCs. The ETFs are buying 10k Bitcoin per day on top of the standard equilibrium and this is reflected in the price appreciation. However, the supply remains quite lower than the supply.

Also Read: Jupiter Faces Crypto Investment Woes Amid EU’s Divergent Approach

Bitcoin High Demand Concerns

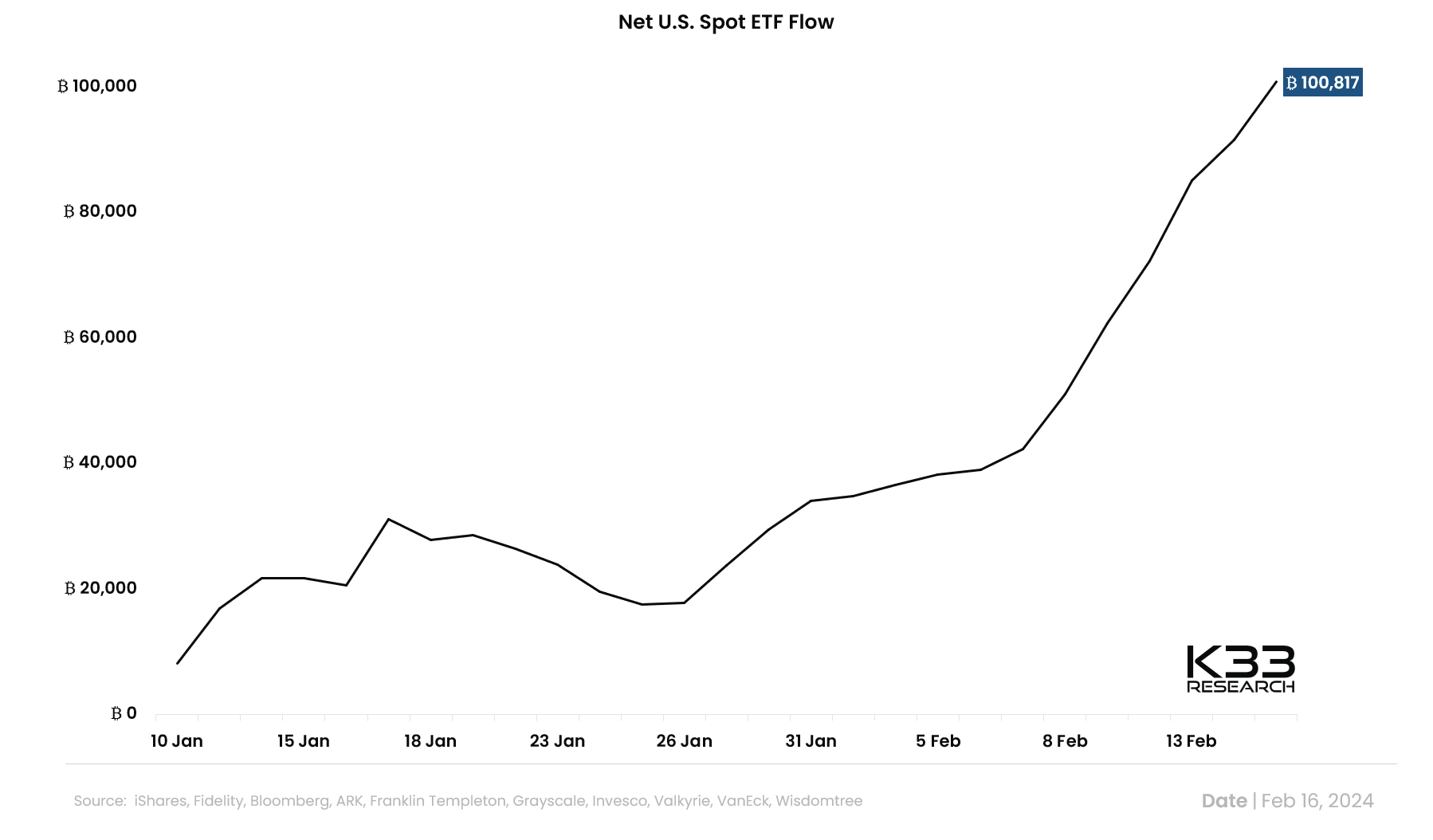

Vetle Lunde, senior analyst at K33 Research on Friday said the net U.S. spot ETF flow has now surpassed 100,000 BTC. This is equal to two-thirds of the annualized reduction in BTC issuance after the upcoming halving.

Bitcoin maximalist Samson Mow raised concerns over high demand from spot Bitcoin ETFs. He said “This level of demand is not sustainable at current Bitcoin prices.”

The demand has crossed 10x supply, with more from other sources. MicroStrategy’s Michael Saylor also pointed out 10x demand than supply dynamics in a recent interview.

BTC price fell 1% in the past 24 hours, with the price currently trading at $51,787. The 24-hour low and high are $51,371 and $52,820, respectively. Furthermore, the trading volume has decreased by 13% in the last 24 hours, indicating a decline in interest among traders.

Also Read: Cathie Wood Ark Offloads $31M Coinbase Shares Post-Earnings As Price Hit 2-Yr High

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise