Just-In: BlackRock Is Selling Bitcoin and Buying Ethereum

Highlights

- BlackRock moved 5,362 BTC worth $561M to Coinbase while buying 27,241 ETH.

- iShares Bitcoin Trust saw $561M in ETF outflows between May 30–June 2.

- Ethereum ETFs posted 11 straight days of inflows, totaling $3.12B so far.

BlackRock has shifted $130 million worth of Bitcoin while increasing its Ethereum holdings with a $69 million purchase. The movement took place between May 30 and June 2 and aligns with major outflows from BlackRock’s iShares Bitcoin Trust.

Blackrock Bitcoin Withdrawals Trigger ETF Rebalancing

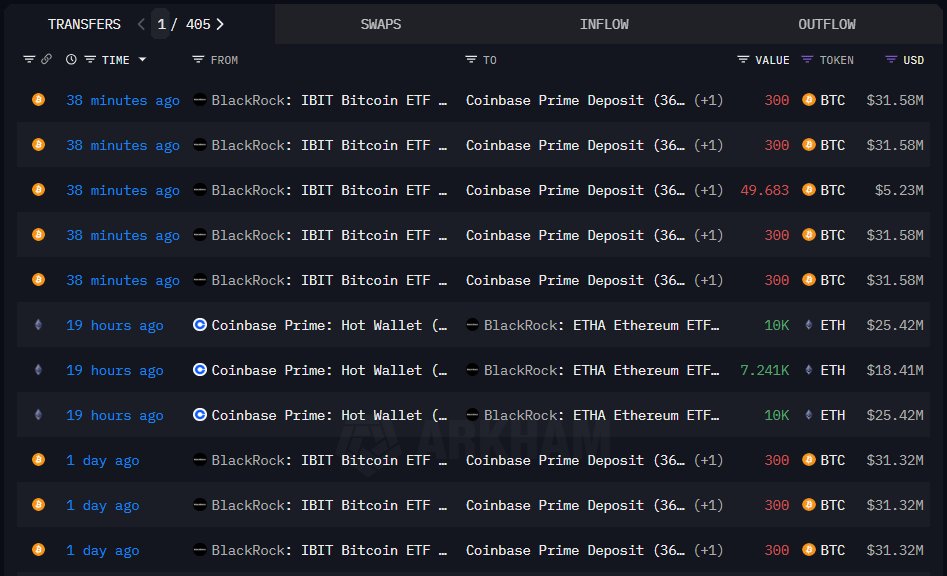

On-chain data shows that BlackRock transferred 5,362 BTC to Coinbase Prime over a two-day period. These withdrawals began on May 30, with 4,113 BTC sent to Coinbase and another 1,249 BTC moved on June 2. The total value of the Bitcoin sent stood at approximately $561 million.

However, data from ETF flow reports confirms that $130.4 million was withdrawn from the iShares Bitcoin Trust on June 2. A larger $430.8 million outflow was recorded on May 30. This brings the two-day total ETF outflows to $561 million, which matches the volume of BTC moved on-chain.

According to Onchain Lens, the Bitcoin was sent in multiple transactions, most in blocks of 300 BTC. All transactions were processed via Coinbase Prime, which is used for institutional-level custody and trading. This suggests that the assets were either sold, rebalanced, or moved to other investment structures.

Ethereum Holdings Increase as BTC is Reduced

While reducing its Bitcoin position, BlackRock added 27,241 ETH to its wallets from Coinbase, valued at around $69.25 million. During the same period, Ethereum spot ETFs saw steady inflows, led by BlackRock and Fidelity.

BlackRock’s iShares Ethereum Trust recorded $48.4 million in net inflows on June 2. Fidelity’s Ethereum Fund received $29.78 million. No other Ethereum ETF providers posted inflows on the same day. Total Ethereum ETF inflows for the day reached $78.17 million.

SoSo Value data confirms that this was the 11th consecutive day of inflows into Ethereum ETFs. Since launch, these funds have collected a total net inflow of $3.12 billion. Ethereum’s rising inflow trend contrasts with the recent slowdown in Bitcoin ETF investments.

Bitcoin Price Movements Influence Trading Activity

Bitcoin price recently reached an all-time high of $112,000 before falling to around $103,000. As of June 3, the price rebounded slightly to $106,600. The recent market dip has led some investors to lock in profits and rebalance their portfolios.

This BTC price movement aligns with the observed ETF outflows. Bloomberg ETF analyst Eric Balchunas noted that ETF redemptions usually force asset managers to reduce their positions. This is likely the reason behind BlackRock’s large BTC outflows.

Despite the recent withdrawals, BlackRock’s iShares Bitcoin Trust remains among the top holders of BTC. The fund currently holds over 661,000 Bitcoin, valued at around $70 billion with Bloomberg analyst predicting Blackrock IBIT to become largest BTC holder. Since its launch, the fund has attracted $48.439 billion in total inflows.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs