BlackRock’s Bitcoin ETF Leads ETFs With $3.5B Weekly Inflows as It Eyes $100B in AUM

Highlights

- BlackRock’s $IBIT leads all U.S. ETFs with $3.5 billion weekly inflows.

- Spot Bitcoin ETFs log seven-day inflow streak as institutional demand surges.

- Bitcoin price rose above $122,000 as BTC ETFs continue to attract more inflows.

BlackRock’s Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has become the most bought exchange-traded fund in the United States this week. The spot Bitcoin ETF pulled an impressive $3.5 billion in weekly inflows, outpacing some of the biggest equity and bond funds on Wall Street.

BlackRock’s Bitcoin ETF Captures 10% of All U.S. ETF Inflows

According to Bloomberg analyst Eric Balchunas, the Bitcoin ETF ranked first among all U.S. ETFs by net inflows, securing about 10% of the total inflows across the market. This means that one in every ten dollars entering ETFs last week went into BlackRock’s Bitcoin product.

$IBIT is #1 in weekly flows among all ETFs w/ $3.5b which is 10% of all net flows into ETFs. Also notable is the rest of the 11 OG spot btc ETFs all took in cash in past week, even $GBTC somehow, that’s how hungry the fish are. Two steps forward mode. Enjoy while it lasts. pic.twitter.com/iNrcgiRVHV

— Eric Balchunas (@EricBalchunas) October 8, 2025

That spike indicates renewed institutional interest in Bitcoin market as the coin gains traction once again in the last quarter of 2025. Conventional ETFs such as Vanguard VOO, State Street SPLG and Invesco QQQ lagged behind by a distance. This indicates that investor focus is returning to digital assets.

Balchunas further wrote that flows were unprecedented and massive. He pointed out that even GBTC from Grayscale received inflows during past sessions.

Bitcoin ETFs Extend Seven-Day Inflow Streak

Fresh data from SoSoValue supports this momentum. Spot Bitcoin ETFs registered a total net inflow of $875.61 million on October 7, and have had seven days of positive flows. BlackRock’s IBIT was the most popular among the spot Bitcoin ETFs, having received $899.42 million in inflows on this day.

The FBTC by Fidelity experienced no outflow whereas the GBTC by Grayscale experienced outflow of $28.62 million. Valkyrie BRRR and ARKB of Ark Invest noted minimal inflow of funds.

The high inflow of funds means that Bitcoin as an investment tool is gaining popularity. The BlackRock Bitcoin ETF is on the brink of becoming the largest ETF with assets under management at almost $100 billion. IBIT is BlackRock’s most profitable fund to date, reinforcing its dominance in the ETF landscape.

Inflows continue to skyrocket, pushing it closer to this historic milestone. Once it reaches this milestone it will be among the biggest ETFs in the world. Although it is still not up to two years old, its growth has been extraordinary.

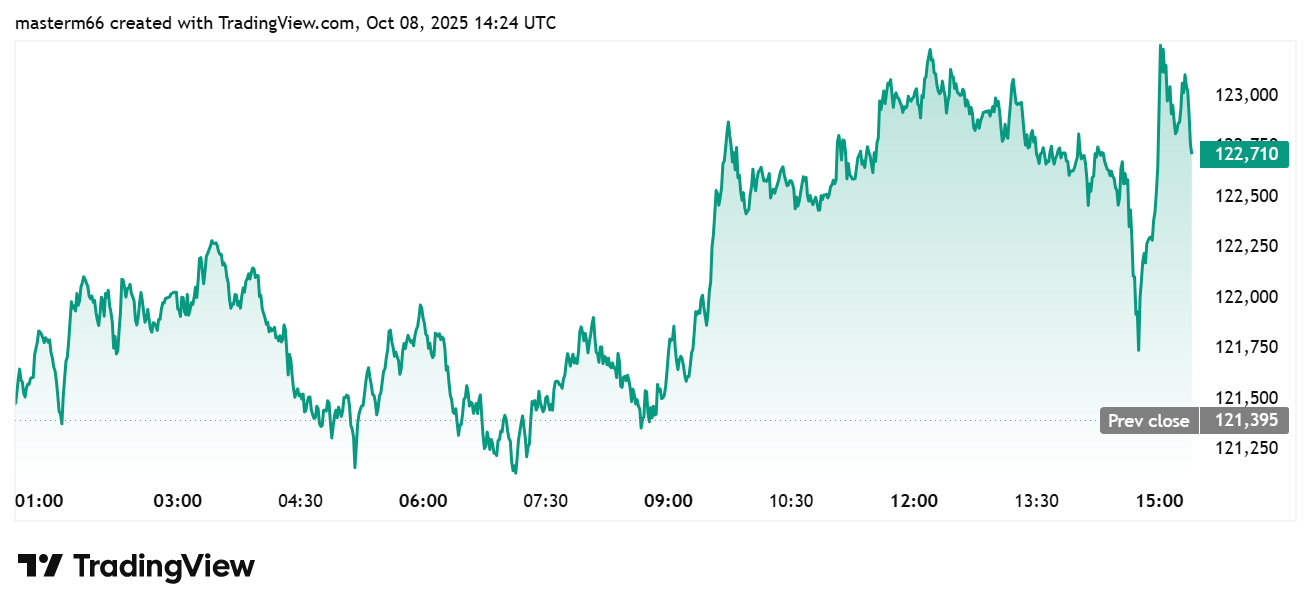

Bitcoin Surges Past $122,000

The surge in ETFs has also been positively responded to by Bitcoin price, which has soared more than $122,000. TradingView data shows that BTC was trading at approximately $122,719. It has risen by 1.09% in 24 hours and 7.55% in the last one week.

Also, the Bitcoin rally aligns with broader market reactions to macroeconomic uncertainty, including concerns over a potential U.S. government shutdown. As regulated exposure gains traction, BlackRock’s leadership positions it at the center of this expanding financial bridge between Wall Street and crypto.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs