BlackRock’s Bitcoin ETF Smashes $70B Mark in Record Time, 5X Faster Than Gold

Highlights

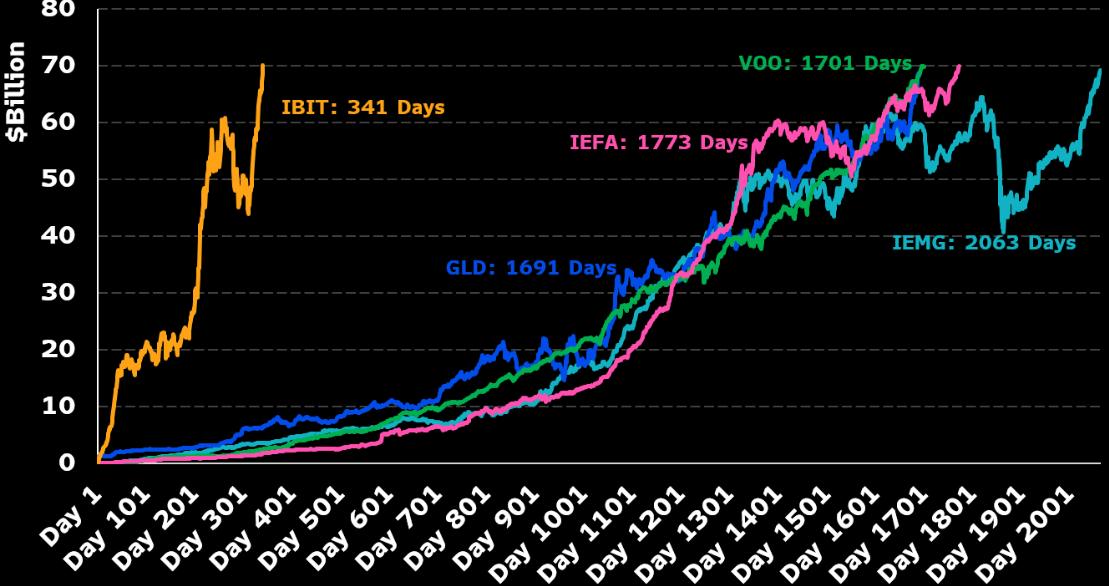

- BlackRock's IBIT has surged past $70 billion in only 341 days.

- The meteoric rise sees it break the previous record held by GLD.

- BlackRock's ETF has been recording a wave of consistent inflows since launch to rise to the top of the Bitcoin ETF rankings.

Consistent inflows have propelled BlackRock’s spot Bitcoin ETF past the $70 billion mark, setting a world record in the process. BlackRock’s IBIT reached the milestone in less than one year since it began trading, five times faster than the previous record holder.

BlackRock’s IBIT Sets New Bitcoin ETF Record

According to market data shared by Bloomberg Senior ETF analyst Eric Balchunas, BlackRock’s iShares Bitcoin Trust (IBIT) has crossed the $70 billion valuation mark. This surge in valuation makes it the fastest ETF in history to reach the milestone.

Specifically, the ETF reached the milestone in 341 trading days, five times faster than the SPDR Gold Shares ETF (GLD). For context, GLD took 1,691 days to reach a $70 billion valuation, while IEFA and VOO reached the milestone in 1,773 and 1703 days, respectively.

BlackRock’s ETF Is Courting Institutional Attention

BlackRock’s Bitcoin spot ETF has been setting records since its market debut in 2024. After a blistering start, it entered the top-five US ETF list with over $9 billion in inflows since the start of 2025.

Meanwhile, the impressive metrics around BlackRock’s Bitcoin ETF have triggered institutional interest. The Moscow Stock Exchange has listed Bitcoin futures linked to IBIT, offering access to accredited investors.

Furthermore, JPMorgan has confirmed plans to offer Bitcoin ETF loans, beginning with BlackRock’s IBIT, with broader expansion planned in the future.

Currently, the ETF holds 661,457 BTC on behalf of investors, making it the largest institutional Bitcoin holder, surpassing Michael Saylor’s Strategy. Shares of the ETF are trading at $61.46, up by 3.71% over the last day, buoyed by rising inflows.

Meanwhile, recent reports of BlackRock selling Bitcoin to acquire Ethereum have done little to dampen investor enthusiasm for IBIT. Given its rapid growth, analysts predict IBIT could surpass Satoshi Nakamoto’s Bitcoin holdings as early as 2026.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs