5 Crypto Coins That Performed Worst In 2022

There’s no doubt that 2022 was a tough year for crypto. It might have started with the hangover of 2021’s bull market but was engulfed by Terra’s crash and the collapse of FTX.

With a lot of FUD (fear, uncertainty, and doubt) in the crypto market, many cryptocurrencies saw their value plummet by more than 90%. In addition to crises, crypto-winter pushed new projects into slumber.

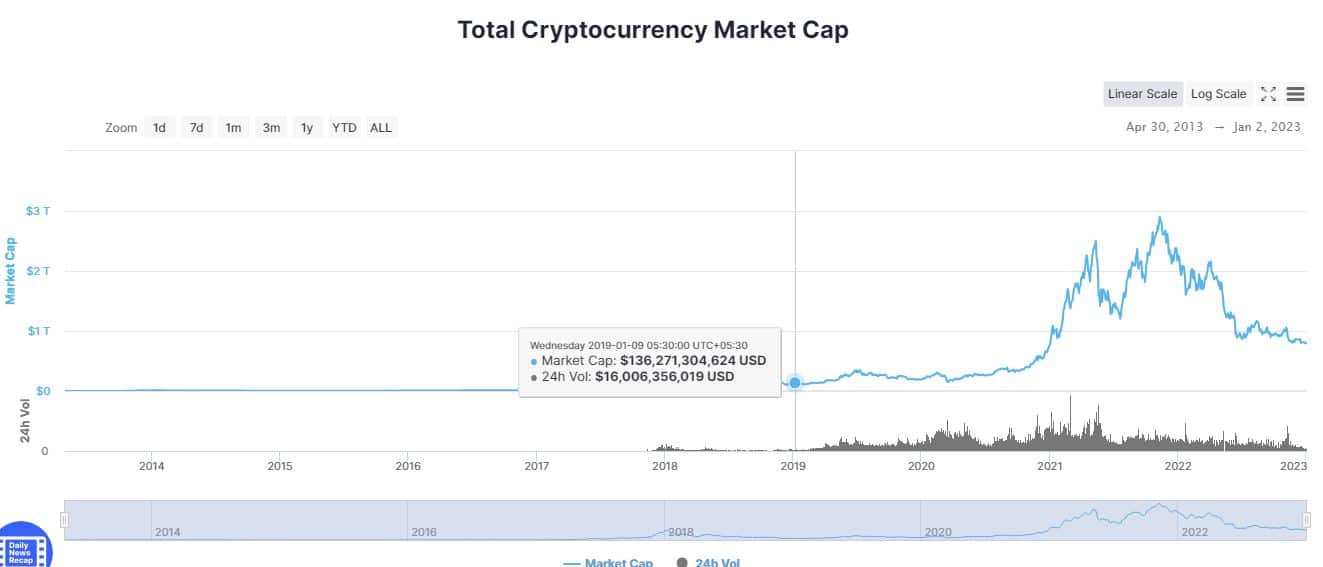

The total market cap of cryptocurrencies declined to the levels of 2020, i.e., $800 billion. Out of a slew of bad performing crypto assets, we have picked some of the worst.

Worst-Performing Cryptocurrencies of 2022

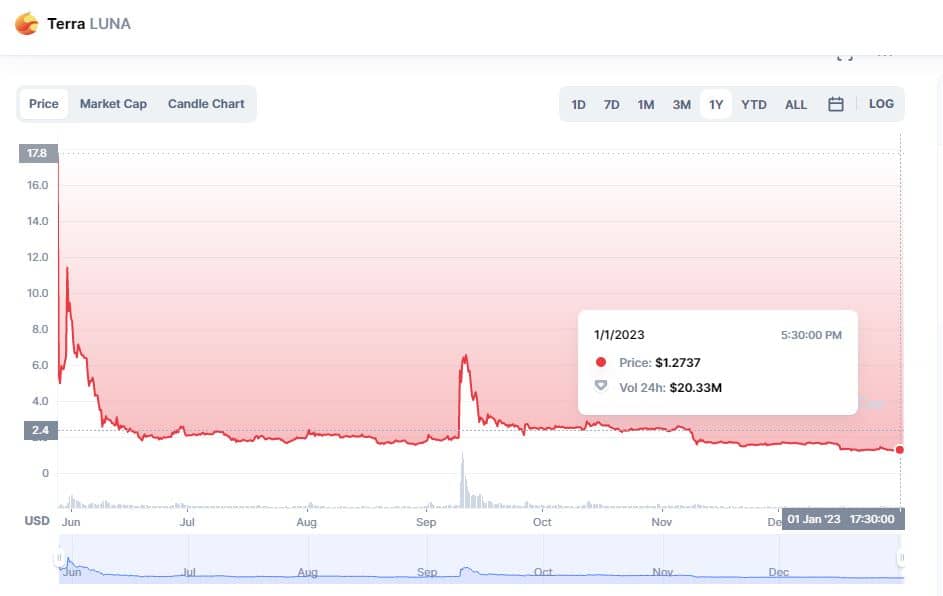

1. Terra (LUNA)

Current Price: $1.30

Current Market Cap: $166 Million

The fall of Terra’s algorithmic stablecoin TerraUSD (UST) was one of the greatest busts in the crypto industry’s history. This debacle caused Terra LUNA prices to crash by 99.99% in May 2022.

Terra’s collapse caused its founder, Do Kwon, to propose a fork in order to resurrect the project. Terra eventually had a chain split, with the old chain labelled Terra Classic and the new chain referred as Terra 2.0.

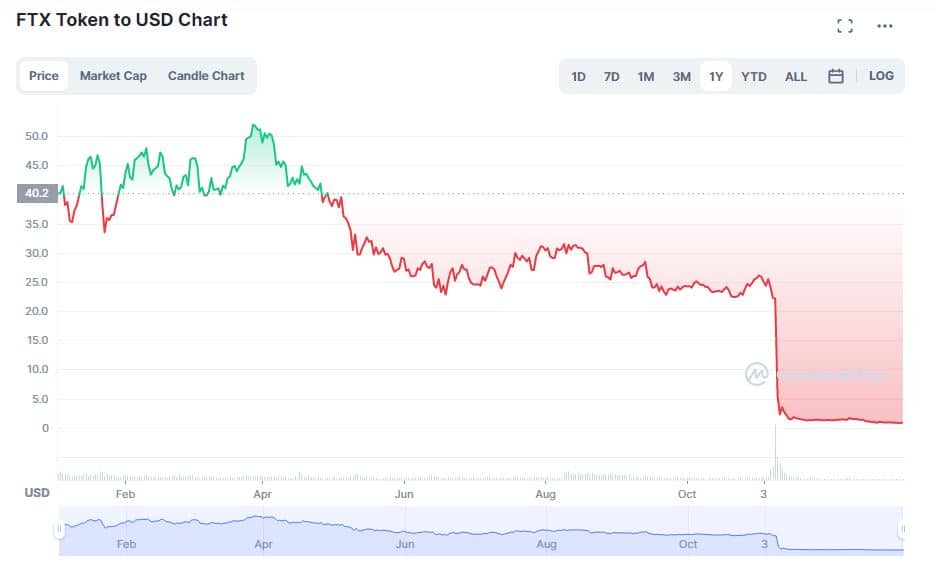

2. FTT Token

Price, 1 year ago: $40

Current Price: $0.875

Current Market Cap: $286 Million

FTT tokens, the native token of the FTX crypto exchange, crashed after the exchange collapsed due to a liquidity crisis. Its prices plunged from $40 to $0.8.

The token is still traded on various platforms, but with little liquidity and volume. It is practically “dead” due to FTX’s defunct state.

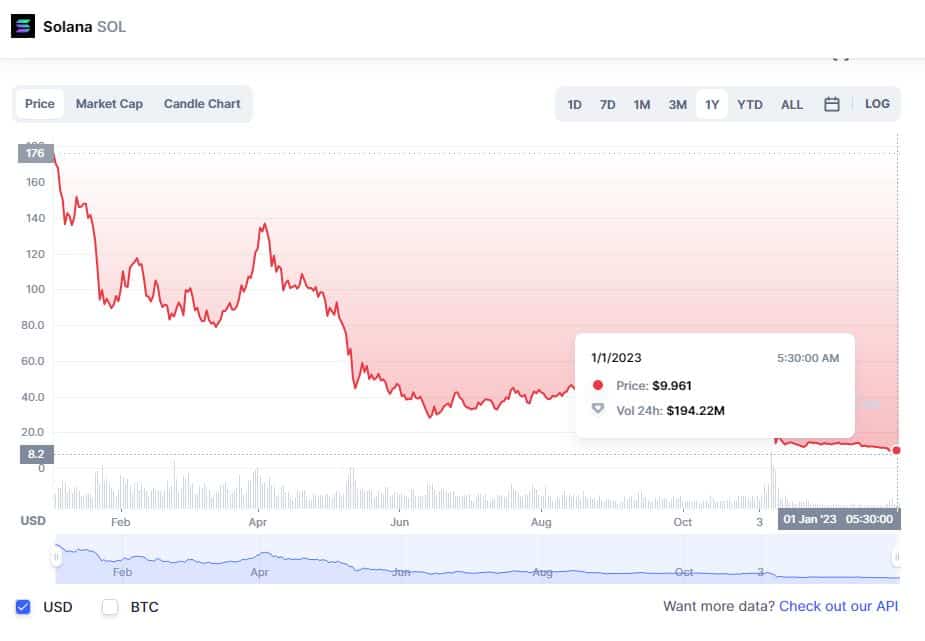

3. Solana (SOL)

Price, 1 year ago: $176

Current Price: $11.06

Current Market Cap: $4 Billion

Solana was hit hard in the year 2022 as a slew of bad news shook investors’ sentiments. This includes six network failures this year, a $200 million hack in a Solana-based wallet, and Solana’s relationship with FTX.

More negative publicity emerged as a result of allegations that Solana is not as decentralised as it claims, leading in SOL being one of the worst performers in 2022.

4. Axie Infinity (AXS)

Price, 1 year ago: $96.5

Current Price: $6.38

Current Market Cap: $600 Million

Axie Infinity (AXS) is primarily used as the governance token for Axie Infinity, a P2E gaming ecosystem. It also serves as legal tender in the Axie Infinity marketplace, where players can buy in-game nonfungible tokens (NFT).

AXS’s prices plummeted as a result of poor player turnout (which decreases token demand), a $650 million hack involving Axie Infinity’s blockchain Ronin in late March, and concerns over the unlocking of 8% of supply in October.

Also Read: Year Ender: 25 Best Crypto Jokes & Memes of The Year 2022

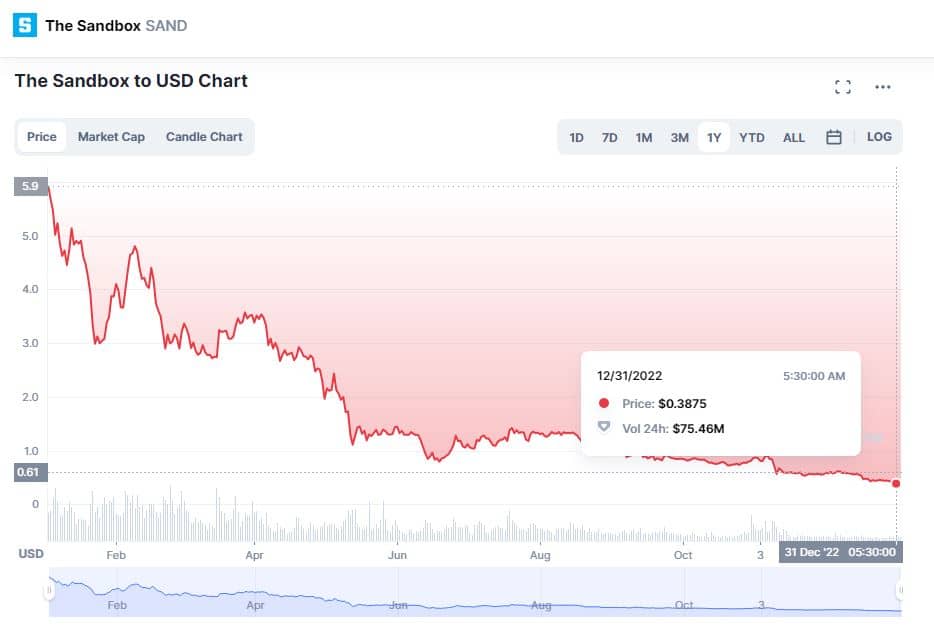

5. The Sandbox (SAND)

Price, 1 year ago: $5.9

Current Price: $0.40

Current Market Cap: $600 Million

Despite its initial success and popularity, this virtual P2E gaming ecosystem has been experiencing low player turnout. As you know, players can create, own, and monetize their gaming skills using NFTs, as well as design virtual worlds that include characters, buildings, works of art, events, and resources.

According to DappRadar, a cryptocurrency marketplace tracker, the Sandbox and Decentraland have less than 1,000 daily active users.

The lower turnout has impacted SAND’s demand across spot markets, causing its price to drop dramatically. Another reason for the decline in interest is a general lack of demand for riskier assets in a rising interest rate environment.

Also Read: Explained: How To Secure Your Crypto Wallet?

- How to Read a DEX Security Report and Spot Risks Before You Deposit

- Kalshi vs Polymarket – Which Platform is Better to Use in 2026

- Is Crypto Futures Trading Profitable in 2026?

- Is KYC Mandatory for Presales? Understanding KYC Vs No KYC Pre-sales

- How to Use On-Chain Analytics to Copy Trade Professional Perp Traders in 2026