Why Did the Crypto Market Crash Today?

Following a week of impressive crypto market rally, there has been a sudden shift early today as bears dominated, casting a reddish tint across the charts. This downturn coincided with Bitcoin’s notable 8% drop after soaring to a record high on March 6, 2024, surpassing the coveted $69,000 mark. As Bitcoin led the decline, the global crypto market followed suit, witnessing a reduction in overall market capitalization over the past 24 hours. In this article, we’ll explore the factors that drove this market downturn.

Current Performance of the Crypto Market

The global cryptocurrency market cap stood at $2.47 trillion, reflecting a slight decrease of 1.00% over the last day. Despite this overall dip in market cap, the total crypto market volume over the past 24 hours surged to $250.19 billion, marking a significant increase of 26.72%.

Within this volume, decentralized finance (DeFi) played a notable role, with a total volume of $17.11 billion, comprising 6.84% of the total crypto market’s 24-hour volume. Meanwhile, stablecoins continued to maintain a significant presence, boasting a total volume of $225.84 billion. This accounted for a 90.27% of the total crypto market’s 24-hour volume, emphasizing the prevalence of stablecoins in the current market landscape.

In terms of dominance, Bitcoin’s share of the market stood at 52.40%, representing a marginal decrease of 0.10% over the course of the day.

Today’s top losers in the crypto market include FLOKI, which saw a significant 14.53% decrease to $0.0001188, despite a remarkable 159.84% increase last week. Filecoin (FIL) dropped 12.71% to $8.92, despite a 17.74% increase last week. 1000SATS (SATS) experienced a 12.57% decrease to $0.0006231, despite a notable 29.78% increase last week. ORDI fell by 11.38% to $76.64, despite a significant 16.05% increase last week. Chiliz (CHZ) declined by 9.85% to $0.1358, adding to a 2.89% decline last week.

Why Did Crypto Market Crash?

1. Bitcoin’s Dominance and Performance:

Bitcoin, often regarded as the flagship cryptocurrency, exerts a significant influence on the entire crypto market. With its dominance decreased by 0.1 to reach 52.52% of the global crypto market capitalization. Bitcoin’s price fluctuations set the tone for other cryptocurrencies. They say when Bitcoin sneezes the entire crypto market catches the cold.

As soon as the Bitcoin (BTC) price rallied past $69,170.63 it faced heavy selling pressure sending it down 8% from the top to $63,500. Following this, the correction has ensued across the broader cryptocurrency market losing more than $150 billion in the last 24 hours.

Early Bitcoin miners have been observed moving 1,000 Bitcoins to Coinbase, selling at each rise to $69,000, according to CryptoQuant. This increased selling pressure coincided with Bitcoin price rally past $69,000, ultimately leading to a 7% correction and triggering a broader cryptocurrency market crash.

2. Trading Volume and Market Sentiment:

Despite the drop in value, the crypto market has saw a notable increase in trading volume, up by 26.72%. This rise indicates a surge in market activity and more people getting involved, as they react to market changes and look for opportunities amidst the ups and downs. The boost in volume reflects a cautious attitude among investors, suggesting many are selling and expecting prices to keep falling. This pattern shows that the market is currently weaker, with more people selling than buying. Additionally, increased trading may also mean more speculation, as traders take advantage of price changes to try and make quick profits.

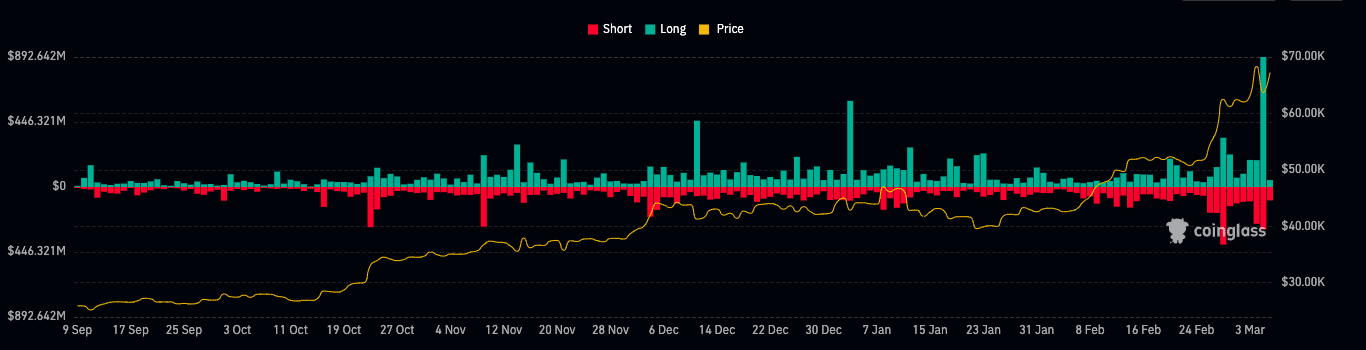

3. Liquidation Activity:

Rapid and volatile price movements in the crypto market led to a significant increase in liquidations, resulting in over $1.05 billion worth of derivatives trading positions being wiped out in the past 24 hours, according to data from CoinGlass. The liquidations which saw 295,329 traders liquidated, primarily affected long positions, totaling approximately $870 million. The largest single liquidation order happened on Bitmex valued at $9.00 million. Bitcoin, Ethereum, and Solana were among the most affected cryptocurrencies, with Bitcoin leading individual liquidations at $210.76 million.

Liquidations occur when exchanges forcibly close leveraged trading positions due to traders’ inability to cover losses with their initial margin. This dynamic often intensifies during sharp price declines, triggering a domino effect of liquidations that amplifies losses and further depresses prices. Major liquidation events like these are often seen as indicators of potential turning points in asset prices.

Will the Crypto Market Fully Recover?

Market sentiment plays a crucial role in determining the future course of the crypto market.A fear and greed index of 86 amidst a crypto market crash indicates a sentiment of extreme greed among investors. Despite the crypto market crash that was experienced, the high fear and greed index suggests that market participants are exhibiting a strong appetite for risk and speculative behavior. This could imply that investors are optimistic about potential recovery or are viewing the current market conditions as an opportunity to buy assets at discounted prices. However, it’s essential to exercise caution, as excessive greed can lead to irrational decision-making and further volatility in the market.

Additionally, it may indicate a disconnect between market sentiment and underlying fundamentals, highlighting the importance of conducting thorough research and practicing risk management in navigating the crypto market.

At the time of writing the global crypto market has recovered slightly by 0.49%

Buy $GGs

Buy $GGs