Breaking: $30 Billion ETF Firm Global X Files for Bitcoin ETF

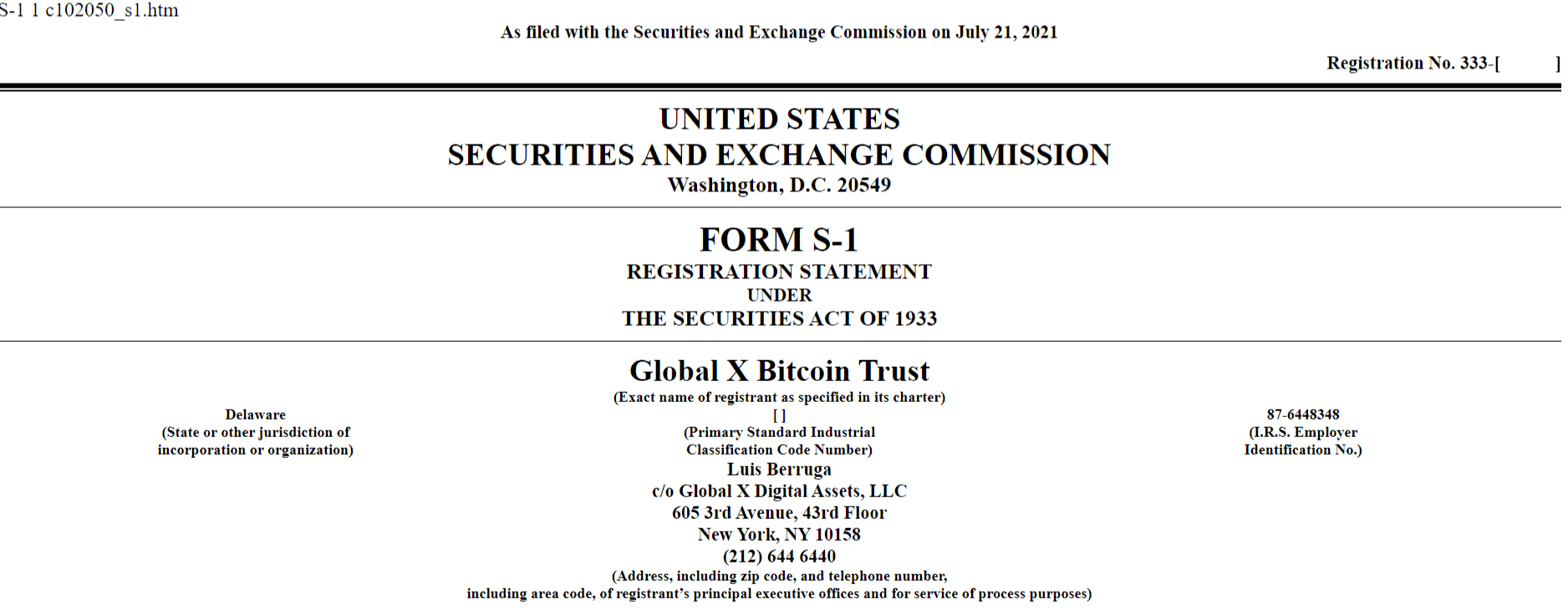

Global X, a New York-based global provider of exchange-traded funds with $30 billion in AUM has filed for a Bitcoin ETF with the US SEC. The filing dated 21st July revealed that the name of the ETF would be Global X Bitcoin Trust and it would trade on Cboe BZX Exchange, Inc on approval.

The firm plans to hold Bitcoin in its trust to back the fund rather than using any index or benchmark to trace the price of the ETF. The official filing read,

The Global X Bitcoin Trust (the “Trust”) is an exchange-traded fund that issues common shares of beneficial interest (the “Shares”) that trade on the Cboe BZX Exchange, Inc. (the “Exchange”) under a ticker symbol to be announced prior to commencement of trading. The Trust’s investment objective is to reflect the performance of the price of bitcoin less the expenses of the Trust’s operations. The Trust will not seek to reflect the performance of any benchmark or index.

Bitcoin ETF Applications Piling Up, But SEC Continues to Delay its Decision

The number of Bitcoin ETF proposals has risen to over a dozen this year including Fidelity, WisdomTree, Wilshire Phoenix, VanEck, and First Trust SkyBridge. The SEC has delayed its decision on three ETF applications already including WisdomTree, VanEck, and Skybrdge capital. While the demand for a regulated Bitcoin product has risen to an all-time high, SEC seems to be in no hurry.

While SEC continues to delay its decision on a Bitcoin ETF, other nations have approved Bitcoin ETFs that are trading on national exchanges with great success. Purpose Bitcoin ETF currently trading on the Toronto stock exchange with nearly $900 million worth of BTC under its management. Many in the US hoped the success of the first Bitcoin ETF would influence the US regulators to take similar steps.

SEC commissioner Hester Peirce and Former CFTC chairman have both called upon SEC to approve the first Bitcoin ETF in the US. Peirce said if SEC used the same criteria as traditional ETF products for Bitcoin, it should have been passed by now.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Gold vs. Bitcoin: Can Gold Outperform BTC Amid US–Iran Conflict?

- Bitcoin Faces $1.8B in Panic Selling as U.S.-Iran Airstrikes Escalate; Will BTC Crash Below $60k?

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs