Breaking: Crypto-Friendly TD Bank Terminates Merger Deal With First Horizon Bank

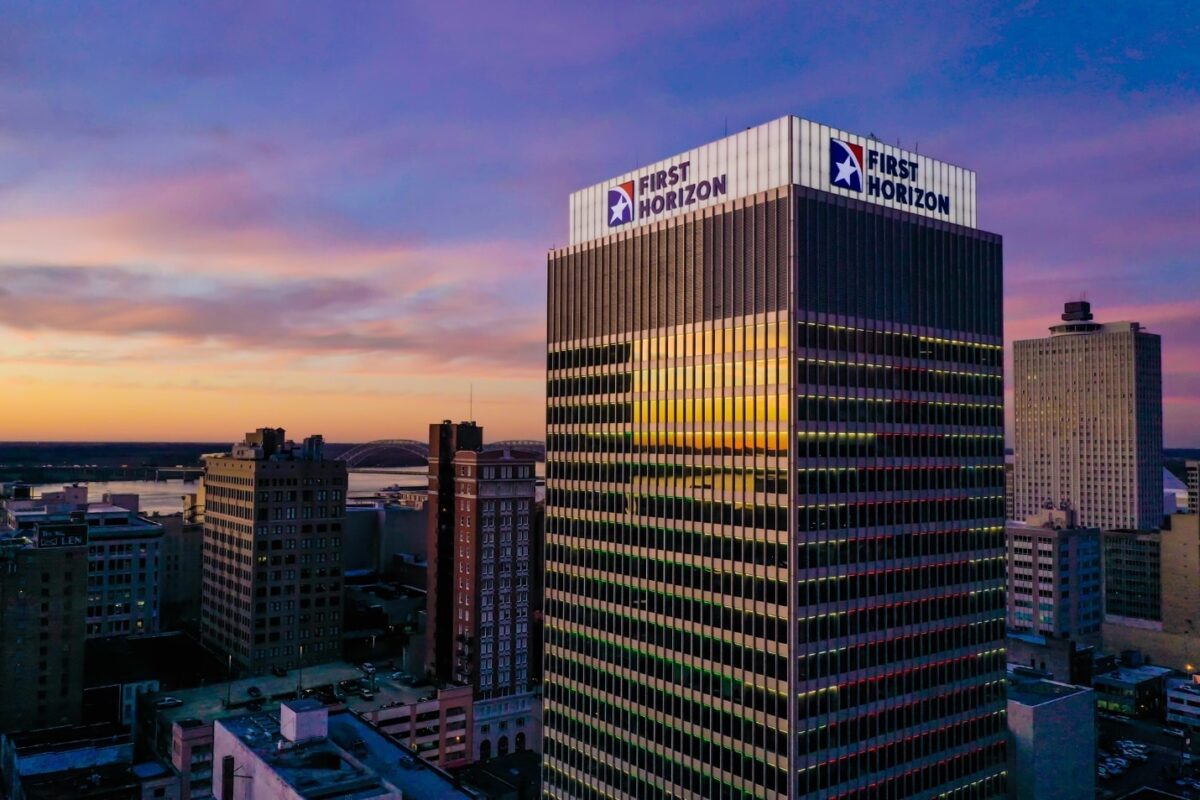

Canada-based crypto-friendly TD Bank and First Horizon Bank on Thursday agreed to terminate their $13 billion merger agreement announced earlier in February 2022. TD Bank cites regulatory uncertainty as the reason to terminate the merger, and it has nothing to do with First Horizon Bank.

First Horizon Bank (FHN) shares fell over 50% in pre-market hours after the merger with TD Bank is canceled. In contrast, TD Bank (TD: NYSE) stock price jumps 2% in pre-market hours.

Also Read: WallStreetBets-Related Memecoin Tumbles 90%, WSBMod Considers FBI Report

TD Bank and First Horizon Bank Ends Merger Agreement

TD Bank Group and First Horizon Corp have entered into a mutual agreement to terminate their merger agreement, as per a press release on May 4. TD Bank has been increasing its crypto exposure in recent times and completed the acquisition of financial services Cowen Inc in March this year.

The regulatory uncertainty in the U.S. regarding crypto and the ongoing banking crisis have resulted in TD Bank getting no time for approval about the merger. TD Bank reached First Horizon to inform that TD does not have a timetable for regulatory approvals.

Bharat Masrani, CEO of TD Bank Group, argues the decision offers clarity to colleagues and shareholders about the developments and growth of the bank in the US. The merger deal, which was first announced in February last year, faced regulatory uncertainty for months and recently came under pressure from TD’s investors amid the banking crisis.

First Horizon Chairman, President and Chief Executive Officer Bryan Jordan, said:

“While today’s announcement is unfortunate and unexpected, First Horizon will continue on its growth path operating from a position of strength and stability.”

TD Bank will make a $200 million cash payment to First Horizon as per the terms in the termination agreement, with an additional $25 million fee reimbursement.

Also Read: Non-Crypto PacWest Bank Confirms Sale, Bitcoin Set To Hit $35K

Banking Crisis to Take Several Banks Down

The US government seized and sold First Republic Bank to JPMorgan Chase & Co this week after shares plunged 60% after it reported a fall of nearly $100 billion in deposits. Now, PacWest Bancorp has confirmed strategic options including a potential sale after shares slide over 40% in pre-market hours on Thursday.

Fed and Wall Street experts such as Former Federal Reserve Bank of Dallas President Robert Kaplan said the banking crisis is just getting started.

Also Read: Data Shows More US Bank Failures Ahead, Who Will SEC Blame Now?

Recent Posts

- Crypto News

Breaking: U.S. Jobless Claims Come in Below Expectations; BTC Price Drops

The U.S. initial jobless claims fell last week, way below expectations, suggesting that the labor…

- Crypto News

BlackRock Deposits Millions in Bitcoin and Ethereum as CryptoQuant Flags Growing Bear Market Risk

Asset manager BlackRock has transferred millions of dollars in Bitcoin and Ethereum to the crypto…

- Mining

NiceHash Review: Trade HashRate and effectively manage your POW mining facility

Hashrates are essential in POW mining. They determine profitability and contribute to network security. Running…

- Crypto News

US SEC Deliberates Nasdaq Bitcoin Index Options Approval amid Rising Derivatives Demand

The US Securities and Exchange Commission (SEC) is moving forward with its review of a…

- Altcoin News

Arthur Hayes Moves Another 682 ETH To Binance: A Major Sell-Off Ahead?

Arthur Hayes, a legendary trader and BitMEX co-founder, has made a bold move, sparking a…

- Altcoin News

Is XRP Selling Pressure Easing? Here’s What On-Chain Data, ETF Flows Signal

XRP price has remained in a downtrend for nearly 6 months amid massive selling pressure…