MicroStrategy Acquires 15,350 BTC For $1.5 Billion, MSTR Stock Surges

Highlights

- MicroStrategy has bought 15,350 BTC for $1.5 billion, their sixth purchase in six weeks.

- The company now holds 439,000 BTC which it acquired for $27.1 billion.

- MicroStrategy's Bitcoin holdings accounts for over 2% of BTC's total supply.

MicroStrategy has announced another Bitcoin purchase, which they made for $1.5 billion. This comes just days after the software company’s inclusion into the Nasdaq-100, while the purchase marks their sixth in as many weeks. Meanwhile, the MSTR stock has surged on the back of this recent Bitcoin purchase.

MicroStrategy Acquires 15,350 BTC For $1.5B

MicroStrategy revealed in a press release that it has acquired 15,350 BTC for $1.5 billion at an average price of $100,386 per bitcoin and has achieved a BTC yield of 46.4% quarter-to-date (QTD) and 72.4% year-to-date (YTD).

The software company now holds 439,000 BTC, which it acquired for $27.1 billion at an average price of $61.725 per bitcoin. The company holds over 2% of Bitcoin’s total supply and is the public company with the largest bitcoin holdings.

MicroStrategy has shown no signs of slowing down despite already owning over 2% of the total Bitcoin supply. This recent purchase is their sixth in a six-week period, which began in November. Last week, the software company bought 21,550 BTC for $2.1 billion.

The “Bitcoin Standard” has undoubtedly favored MicroStrategy and its co-founder, Michael Saylor. Saylor pushed the company to adopt the Bitcoin Strategy in August 2020. Recently, Saylor highlighted the MSTR stock’s impressive performance this year, partly due to its BTC exposure.

MarketWatch data shows that the stock is up over 540% YTD. The MSTR stock is up over 4% and is currently trading at around $425. This recent surge is also because of the fact that MicroStrategy is set to join the Nasdaq-100, an achievement that can also be partly attributed to the company’s Bitcoin exposure, which has brought immense success.

Number Of Bitcoin Whales Is On The Rise

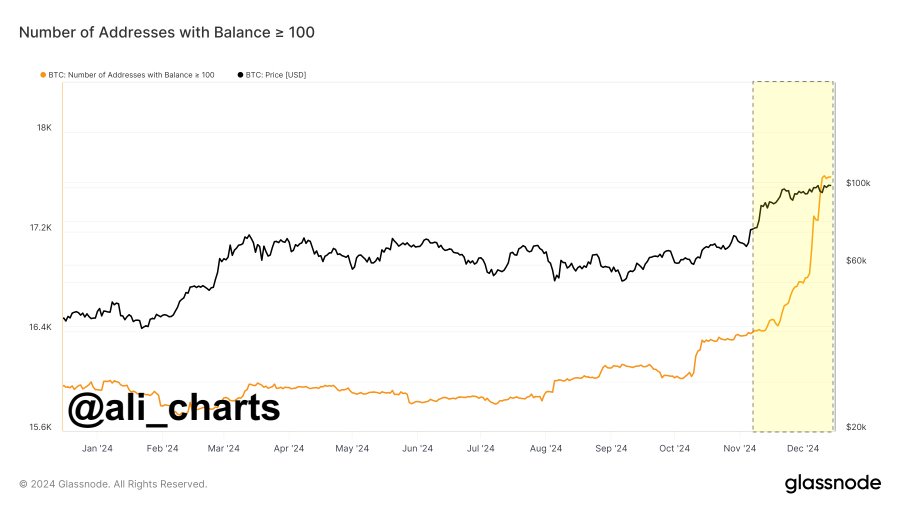

The number of Bitcoin whales like MicroStrategy is on the rise. Crypto analyst Ali Martinez recently revealed that the number of BTC whales on the network has gone “parabolic” since Donald Trump won the US presidential elections.

The number of Bitcoin whales isn’t the only thing that has surged, as the Bitcoin price has also been on a bullish ride since Donald Trump emerged as the US president-elect. The Bitcoin price recently surged to a new all-time high (ATH) of $106,000 amid increased optimism that Donald Trump’s administration would create a Strategic Bitcoin Reserve.

MicroStrategy’s Michael Saylor is one of those who has openly supported the idea of a Strategic Bitcoin Reserve. The tech entrepreneur has even gone as far as advising the US to sell its gold reserves to buy more Bitcoin.

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- XRP Ledger Validator Spotlights Upcoming Privacy Upgrade as Binance’s CZ Pushes for Crypto Privacy

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?