Breaking: US Nonfarm Payrolls Surge To 256K, What Next For Bitcoin?

Highlights

- Nonfarm payrolls data showed that US employment increased to 256,000 in December while unemployment rate dropped to 4.1%.

- Traders are now betting a first-half Fed rate cut and predict that there will be only one rate cut this year.

- The Bitcoin price has held on well amid these macro developments.

The latest nonfarm payrolls data shows a surge in the US employment rate for December. Meanwhile, the unemployment rate also came in lower than expected. These macroeconomic figures could significantly impact Bitcoin and the broader crypto market.

US Nonfarm Payrolls Surge To 256,000

The Labor Department data shows that the total nonfarm payroll employment increased by 256,000 in December, beating the estimates of 160,000. This again represents a strong US job data after an increase to 227,000 in November.

The unemployment rate dropped to 4.1%, as against the expected 4.2% recorded in November. Following the release of this nonfarm payrolls report, traders are now betting against a first-half rate cut from the Federal Reserve.

These traders predict that the Fed will only cut rates once this year, and it is unlikely to happen earlier than June. Specifically, they project that the only interest rate cut this year will occur in October.

This development presents a bearish outlook for the BTC price, considering how this macro data could play out in the minds of investors. The Fed made three interest rate cuts last year, which makes a potential one rate cut this year more disappointing.

Treasury Yields Rise To Highest Levels Since 2023

Following the release of the nonfarm payrolls report, the US 10-year and 30-year treasury yields rose to their highest levels since November 2023. This macro data also presents a bearish outlook for Bitcoin and the broader crypto market.

Meanwhile, as expected, the US dollar has strengthened amid the strong US job data report. These macro factors have already added to the significant volatility that is being experienced in the crypto market today.

There had already been a lot of volatility since the day began due to the 19,000 BTC options, which expired just before the release of these macro data.

All eyes will be on the Producer Price Index (PPI) and Consumer Price Index (CPI) inflation figures, which will come out next week. Those inflation figures will likely further dampen expectations of a Fed rate cut in the first half of the year.

What Next For The Bitcoin Price?

The Bitcoin price flash crashed to as low as $92,000 following the release of the nonfarm payrolls data but is now back above $93,000. However, the flagship crypto is still at risk of a significant price correction, especially with the likelihood of the US government selling its $6.5 billion Silk Road BTC stash before Donald Trump takes office.

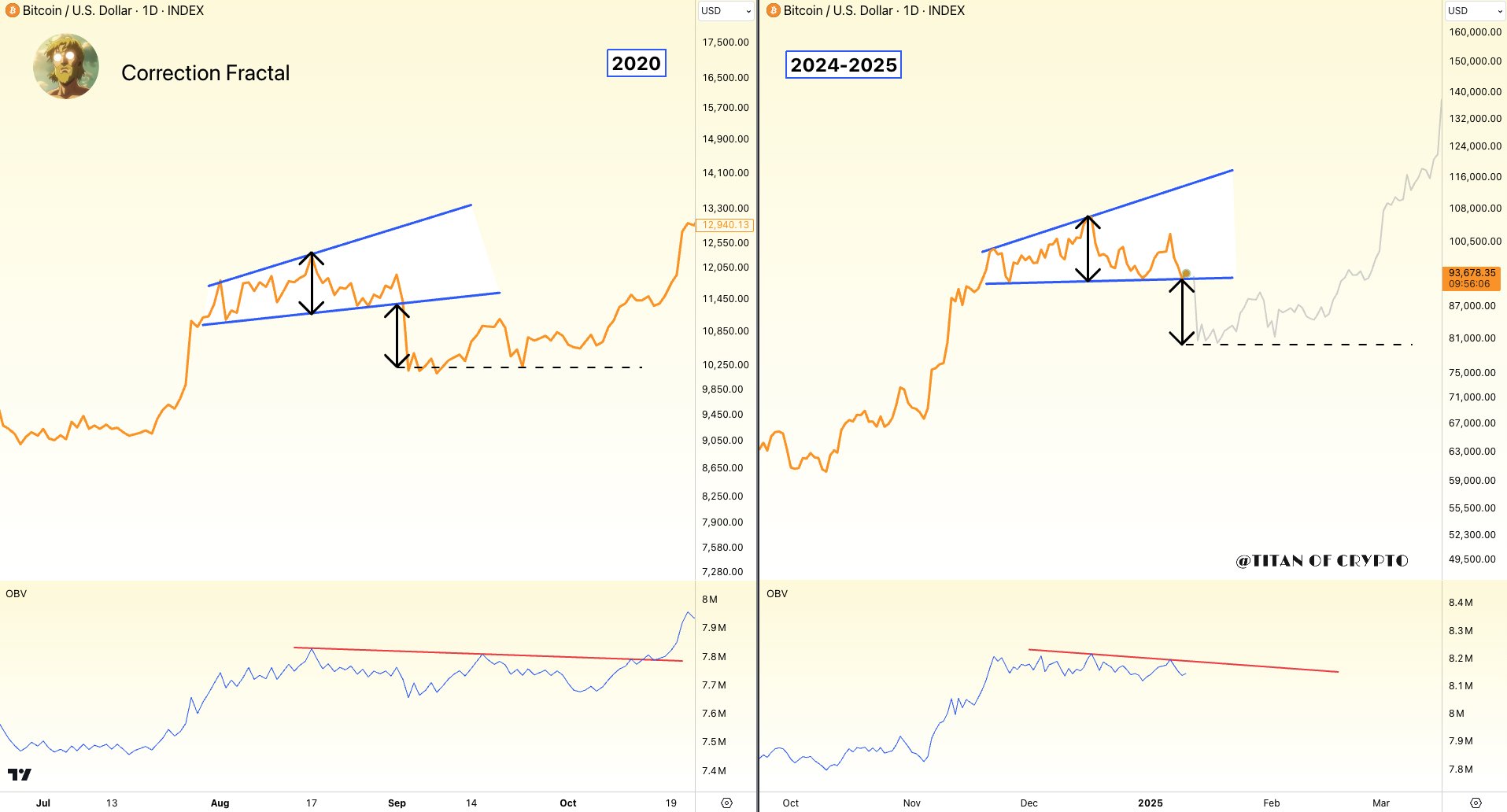

Crypto analyst Titan of Crypto has also drawn the crypto community’s attention to a Bitcoin correction fractal from 2020 that is unfolding following the strong US job data.

The crypto analyst remarked that there are mixed implications ahead for risk assets like BTC and other cryptocurrencies. His accompanying chart showed that BTC is at risk of falling to as low as $81,000, depending on how this plays out.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs