Breaking: Trump To Meet China’s President On October 30, Bitcoin Bounces

Highlights

- Trump and Xi are to gather in Washington later this month, an event that would cause renewed hope in financial markets.

- Bitcoin surged by over 3% with traders responding to the new U.S.-China meeting.

- The meet up would likely resolve trade imbalances, tariffs, and technology cooperation challenges.

Bitcoin surged above $111,000 after confirmation that President Donald Trump and Chinese President Xi Jinping will meet later this month. The move came as traders reacted to news of renewed U.S.–China dialogue, fueling optimism across global markets and lifting risk assets.

Trump–Xi Meeting Will Boost Market Optimism

The announcement was made by White House Press Secretary Karoline Leavitt, who briefed reporters earlier today. The meeting between President Trump and President Xi is expected to take place Washington. This will mark their first in-person engagement since Trump’s return to office, following their phone conversation in June 2025.

During Thursday’s press briefing, she reaffirmed the administration’s economic stance amid rising global attention on the planned meeting. The remarks come thirteen days after Trump imposed a 100% tariff on Chinese imports, a move that triggered one of the largest crashes in crypto market history.

White House Press Secretary Karoline Leavitt said that President Trump “will not tolerate unfair trade practices.” Leavitt said the U.S. remains focused on ensuring fair economic competition and bringing critical manufacturing back to the United States.

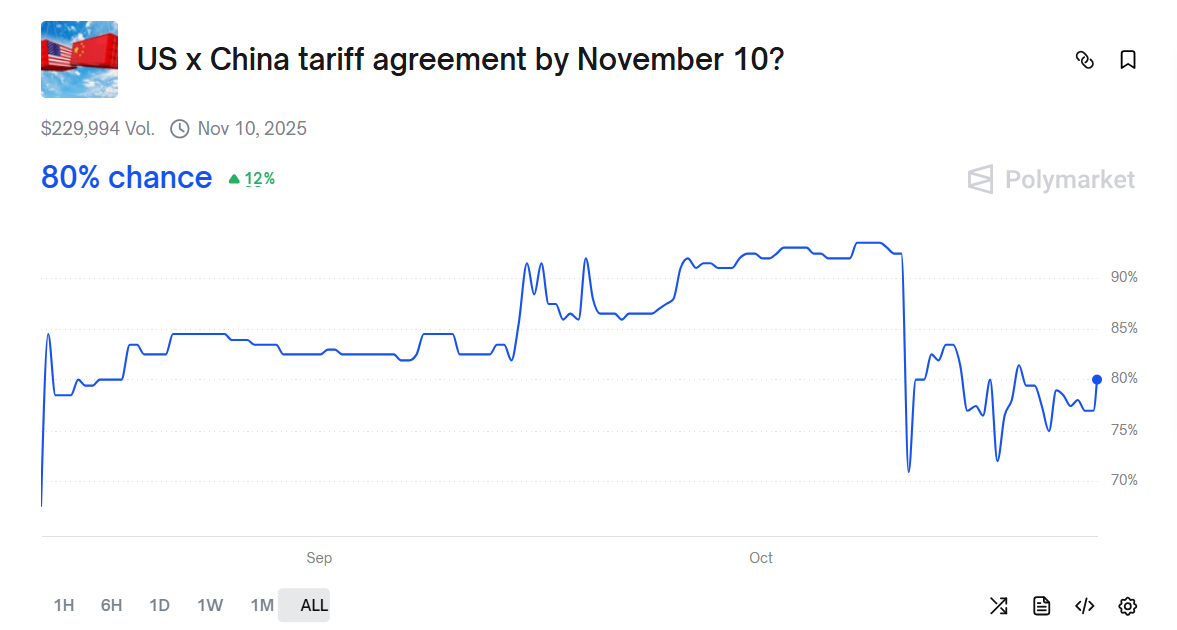

Polymarket Odds Signals Confidence in Positive Trump–Xi Talks as Bitcoin Rises

According to the Polymarket prediction platform, there is an 80% chance that the United States and China will agree on tariff terms by November 10. This indicates increasing optimism on talks regarding tariffs and other important matters that could influence Bitcoin price and the broader crypto market.

The probability has increased by 12% within the last week. It is a good sign that investors are considering the Trump-Xi meeting as a determinant of stability in trade policies.

Recent analysis by Standard Chartered on Bitcoin suggests that prolonged trade tensions could temporarily push its price below $100,000. This highlights how macro developments continue to shape crypto performance

The announcement of the meeting injected short-term confidence into equities and crypto markets. Bitcoin price gained more than 3% on the day, according to TradingView data. The Bitcoin rally also comes amid broader anticipation that the U.S. Federal Reserve will soon end its quantitative tightening cycle.

The discussions are likely to cover trade imbalances, tariffs, supply-chain resilience, and technology cooperation. Observers believe that the two leaders could use the meeting to reset diplomatic channels after years of strained relations between Washington and Beijing. Combined with diplomatic optimism, the meeting announcement added momentum to risk assets that had traded cautiously earlier in the week.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs