Breaking: U.S. Unemployment Rate Falls To 3.4%; Crypto Market Turns Red

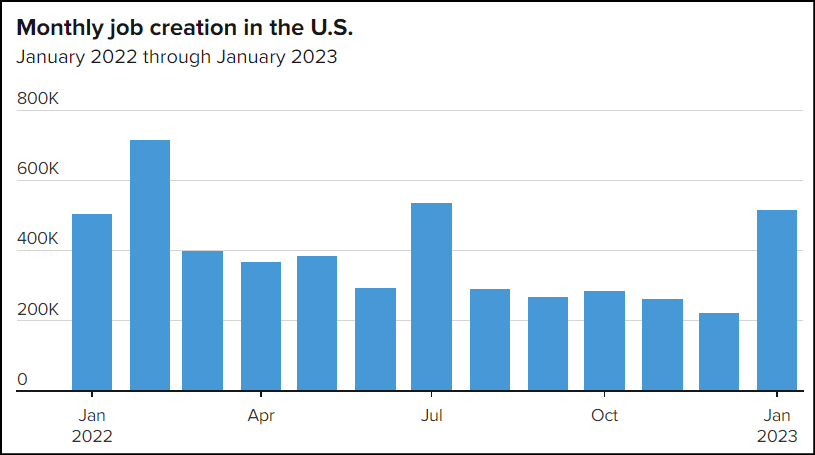

The most current report on nonfarm payrolls from the Bureau of Labor Statistics indicates that the United States added 517,000 jobs for the month of January. Although this is a higher number than the previously reported 223,000 jobs in December, it’s much greater than the 187,000 jobs that economists had expected would be added. The unemployment rate has been reported to be 3.4%, which is the lowest jobless level since May 1969.

Signs Of No Recession?

In spite of the tsunami of layoffs that hit some of the nation’s largest employers, the unemployment rate unexpectedly fell, and the labor market added back more jobs than expected in January. These developments contributed to signs that the U.S. economy may not be slowing down enough for the Federal Reserve to turn away from its aggressive campaign to tame rising prices.

This enormous outperformance in comparison to the prediction was majorly pushed by growth across a wide variety of industries. The leisure and hospitality sector led among all other industries in terms of job growth, adding 128,000 positions. Professional and business services (82,000), government (74,000), and health care (58,000) were other big gainers. In addition, wage growth for the month has been reported to be significantly high as the growth in average hourly earnings was 0.3%, which was in line with the projection.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

Crypto Market Reaction

In minutes following the release of the unemployment news, the price of Bitcoin (BTC) remained unchanged at $23,353. With the headline number of 517,000 new jobs gained, the crypto market slightly slid into the red zone as per Coingape’s crypto tracker. This represents a decline of 0.61% over the past 1-hour, in contrast to a jump of 2% over the last seven days.

Ethereum’s (ETH) price, on the other hand, is currently exchanging hands at $1,639; reporting a decline of 0.71% in the past one hour while recording a significant jump of 4% in the course of the past week. The prices of XRP, DOGE, and BNB, as well as the prices of a handful of the other notable cryptocurrencies also decreased by approximately 1% in response to the news.

Following Federal Reserve Chairman Jerome Powell’s statement that “the disinflationary process has started” at his post-FOMC press conference, both stocks and cryptocurrency markets surged earlier this week. However, the robust payrolls number from this morning could shatter traders’ hopes that the Fed would delay rate hikes or perhaps consider rate reduction later in 2023 in the event that the U.S. employment situation significantly worsened.

Also Read: This Country Will Launch World’s First Govt-Backed Crypto Exchange

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs