BTC Price Analysis: Surge in Demand Pushes Bitcoin Price Out of Consolidation, Bulls Are Back!

Bitcoin BTC’s price surged by 9.88% on the first day in October ’21, as it heads for Plan B’s October $63K price target. PlanB, famous for the stock-to-flow model predicts that Bitcoin as a store of value would attain the $98K mark in November and the $135K mark in December. He also mentioned a floor model (Worst-case scenario), that’s not based on S2F-Stock to flow, but on-chain and price data as the S2F already suggests $100K at the current time.

Let’s try to validate some of his thoughts, starting from the daily time frame, and concluding on the 4HR time frame.

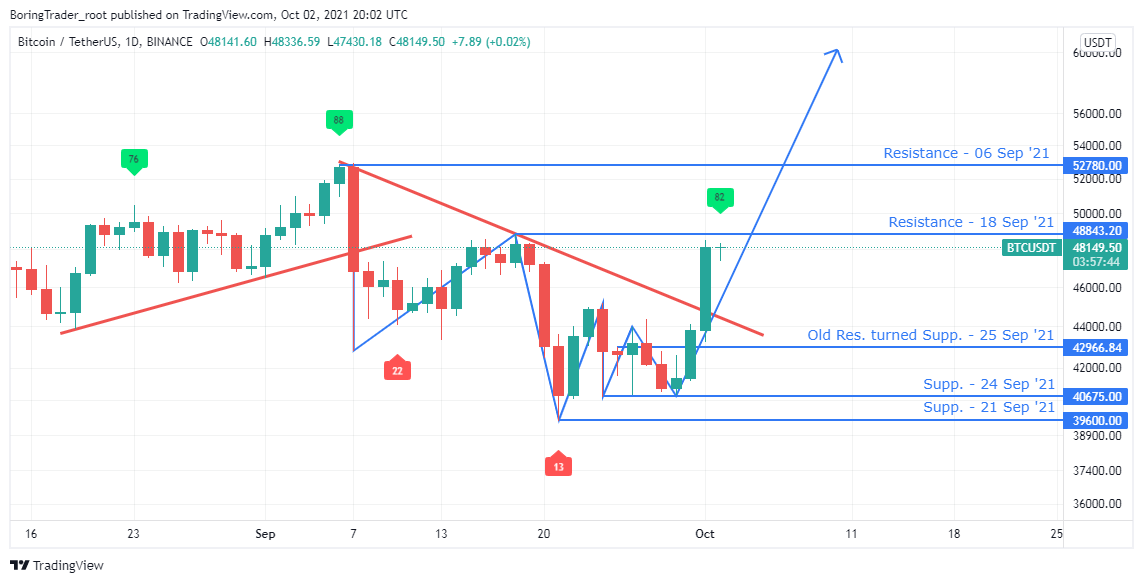

Bitcoin (BTC) Daily Chart Analysis

The BTCUSDT slumped and entered into a price consolidation, following a breakdown of the uptrend line on 07 Sep ’21.

A price close above inside bar resistance [$42969.90] on 26 Sep ’21, hinted an end to the consolidation phase, which was later followed by a price surge to the 18 September resistance level [$48800.00]. If the $48800.00 resistance holds, we might see a temporary price pull-back before a full surge to the ATH, and perhaps a new price discovery.

Bitcoin (BTC) 4HR Chart Analysis

A step down to the 4HR time frame shows how the 21 September 20:00 bullish divergence support proved to be a hard nut to crack after which the 28 September 20:00 bullish divergence confirmed the uptrend.

The RSI continues to set new highs as a sign of exiting the sideways price structure into an uptrend. There’s no hope for the bears at this point as they get squeezed with new Bitcoin BTC price discovery on the 4HR time frame.

Bullish/Bearish Scenario

As analyzed on the daily and 4HR charts, the RSI [4] proves our bias towards an upbeat campaign, as the BTCUSDT knocks on the $48800.00 resistance at press time.

The uptrend stays valid even if the RSI dips below level-25 on the 4HR time frame on the condition that the RSI stays above level-25 on the daily time frame.

With that said, trading without leverage [spot] or with the least leverage [2X] will keep you safe.

Bitcoin (BTC) Intraday Levels

- Spot rate: $48221.8

- Mid–Term Trend [H4]: Uptrend Starts

- Volatility: High

- Support: $$39571.00, $40875.0, and $44345.80

- Resistance: $48800.00 and $52827.30

- Michael Saylor’s Strategy Bitcoin Position Hits $4.5B in Unrealized Loss Amid BTC Crash Below $70K

- Gold vs BTC: Why JPMorgan Suggests Buying Bitcoin Despite Price Crash?

- Epstein Files: Bitcoin Crash, Backlash Erupts Against Adam Back, Gavin Andresen, Tether’s Brock Pierce

- Vitalik Buterin Dumps More ETH as Ethereum ETFs Record $80M in Outflows

- Trump’s World Liberty Faces House Probe Amid Claims of Major UAE Investment

- Why XRP Price Struggles With Recovery?

- Dogecoin Price Prediction After SpaceX Dogecoin-Funded Mission Launch in 2027

- Solana Price Crashes Below $95 for the First Time Since 2024: How Low Will SOL Go Next?

- Ethereum Price Eyes a Rebound to $3,000 as Vitalik Buterin Issues a Warning on Layer-2s

- Pi Network Price Outlook as Bitcoin Faces a Strong Sell-Off Below $80k

- Bitcoin Price Prediction As US House Passes Government Funding Bill to End Shutdown