BTC Price Declines Signal “Overheated Bull Phase” Before Bitcoin Halving

The market participants are witnessing sudden Bitcoin price movements because the bear market is officially coming to an end. While timing the market is a bad strategy, the Bitcoin market has some advantages such as on-chain historical data depicting exact days and patterns after which massive BTC price rallies can be expected.

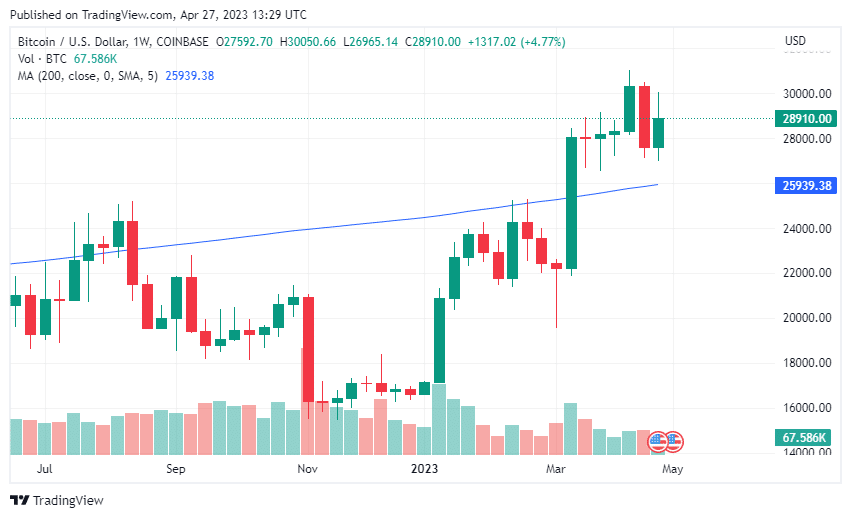

BTC price fell 10% last week after surpassing the $30,000 psychological level, which signals the start of the “overheated bull phase” as bulls takeover bears. The recent BTC price rally from $20,000 was actually supported by Bitcoin entering the bull market cycle in January and crossing the key 200-weekly moving average (WMA) in March.

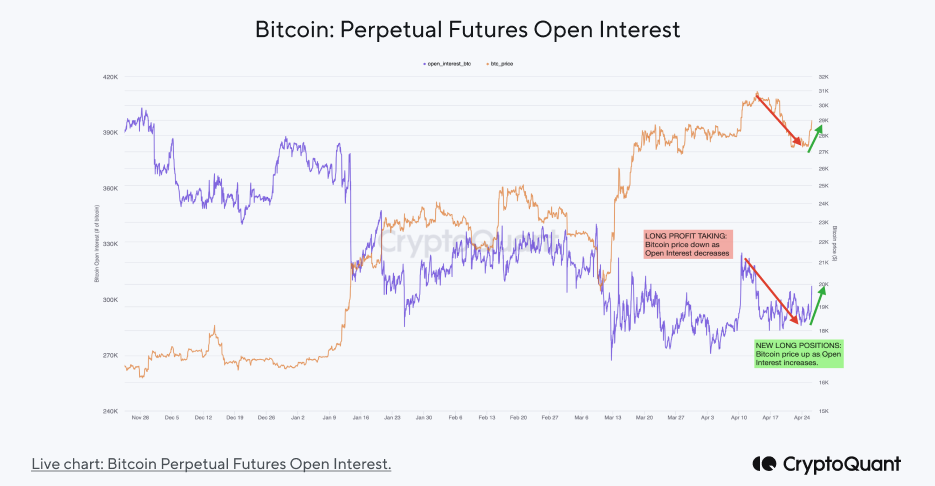

The recent declines in the Bitcoin price are due to profit-taking by traders in the perpetual futures markets, with open interest falling. The “long squeeze” caused massive liquidations, giving investors an opportunity to “buy the dip.” Traders also took profits as the ETH price jumped over $2,000 after the Shanghai upgrade on April 12 and Binance opened Ethereum withdrawals on April 19.

Traders have again started opening long positions and spending activity of whales remains higher. Typically, price rallies occur during whale spending activity with at least 20% of total coins being moved, but Spent Output Value Bands indicate whale spending activity rose above 40%. In fact, whales with over 10k BTC had a spending activity of 25%, the first time since the FTX fallout. This coincides with many dormant whales waking up after 8–10 years.

Bitcoin Price Begins Bull Run

Bitcoin price currently trading in the $28k-30k range, with volatility rising as the bull market starts. The short-term cost basis or the realized price is at $24,000, indicating the key support level for this bull market.

Traders wait for two key events before a rally can potentially start, Friday’s monthly expiry and the U.S. Fed rate hike decision on May 2. This could be the last rate hike by the Fed before it looks to cut the funds rate from September.

While the global market keeps an eye on the U.S. debt ceiling crisis, Republicans are actively working to increase the debt ceiling amid risks of a recession. The US dollar is also weakening, which will likely increase BTC prices.

With Bitcoin halving to happen in April 2024, the BTC price is likely to surpass $135,000 and probably we will never see BTC below $20,000 again.

Also Read: Crypto Market Recovery: Bitcoin and Ethereum Price Begins Major FOMO Rally

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs