BTC Price Launches New Week Under $26k, Major Rally On The Horizon?

BTC price has started the week beneath the critical pivotal level of $26,000 but seems ready to make a significant recovery. Bitcoin erased the gains it had made early last week above $27,000 amid the hype surrounding Grayscale’s win against the US SEC.

Although the agency delayed the decision to either approve or reject seven BTC spot exchange-traded fund (ETF) proposals, experts in the market believe that Grayscale’s win could usher in the coveted era of regulated spot ETFs.

Before that investors must prepare to stay profitable despite the dilapidated market structure. Trading at $25,992 on Monday, Bitcoin live price has a higher chance of closing the day above $26,000—a move likely to pave the way for another attempt at achieving gains above $30,000.

What Will It Take For BTC Price To Climb Above $30k?

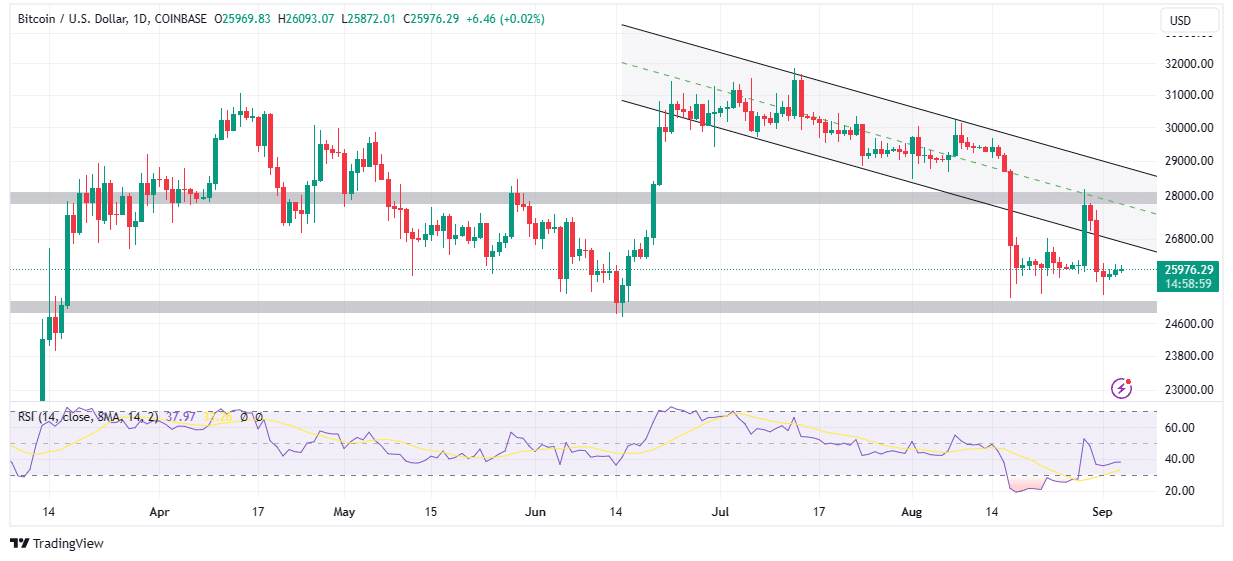

After being briefly oversold in August, Bitcoin shows signs of a recovery taking shape this week. The Relative Strength Index (RSI) currently moving toward the mean line (0.00) reveals that buyers have the upper hand.

A break above $26,000 is bound to call more buyers from the sidelines while encouraging traders to book long positions with targets at $28,000 and $30,000, respectively. Meanwhile, highly conservative traders may want to hold on until BTC price rises above $26,000.

Bitcoin fundamental metrics show that long-term holders are accounting for the majority of the supply as short-term holders face capitulation. In other words, they are selling at a loss as prices drop.

According to on-chain data from Glassnode, long-term holders have recently set new records. Moreover, the prevailing dormant BTC supply is at the highest level of all time, approximately 40.5%.

The number of BTC that has been idle in wallets for more than five years stands at nearly 30%, implying that investors are willing to hold Bitcoin long-term as a store of value as opposed to short-term speculation that often leads to realized losses that could otherwise remain unrealized ahead of the bull market anticipated in 2024/2025.

“Once again, bitcoin short-term holders have capitulated roughly 20k BTC sent to exchanges at a loss,” James Straten a research and data analyst wrote on X (formerly Twitter). Fourth highest amount this year. This will continue to add to the record divergence between long-term holder and short-term holder supply.”

BTC price is still trading below $26,000 and this increases its vulnerability to further dips below $25,000. An extended drop to the support at $23,500 cannot be ruled out yet, therefore, traders must move with caution.

Related Articles

- Terra Luna Classic Crucial Proposal For Dynamic Minimum Commission Is Passed

- Altcoin of the Week, Cardano (ADA) Showing Rising Onchain Transaction Volume

- XRP Lawyer Deaton Asserts Coinbase’s Partial Win Against SEC, But Crucial Than Ripple Case

Recent Posts

- Crypto News

Trump Calls for Rate Cuts as Fed Chair Favorite Hassett Says U.S. Lags on Lowering Rates

Fed chair expectations moved into focus after President Donald Trump called for lower interest rates…

- Crypto News

Aave Labs vs DAO: What Investors Should Know About the AAVE Token Alignment Proposal

AAVE token holders are going through a critical stage of governance as they consider a…

- Crypto News

January Fed Rate Cut Odds Fall to New Lows After Strong U.S. Q3 GDP Report

Market participants, including crypto traders, have further pared their bets on a January Fed rate…

- Crypto News

Breaking: U.S. GDP Rises To 4.3% In Q3, BTC Price Climbs

The U.S. economy grew faster than expected in the third quarter of this year, its…

- Crypto News

Breaking: Bank of Russia Proposes Allowing Investors to Buy Bitcoin and Crypto in Major Regulatory Shift

Russia is willing to transform its approach to cryptocurrencies. According to the Bank of Russia,…

- Crypto News

Crypto ETF Issuer 21Shares Advances Dogecoin ETF Bid with Amended S-1 Filing

Crypto ETF issuer 21Shares has indicated it still intends to launch its Dogecoin ETF, as…