Bear Signal Or Bear Trap? BTC Price Faces Selling Pressure

In the previous 24 hours, bears strengthened their hold on BTC price, which fell from $29,320.13 to $28,933.74. At press time, BTC was trading at $29,107.02, down 0.59% from its recent high. The multi-contact point trendline, originating from the 2023 bottom, is now under serious scrutiny as bearish momentum threatens to break through.

Bitcoin seriously challenging multi-contact point trendline from 2023 bottom. Move through Aug low would be bear signal or bear trap. $BTC pic.twitter.com/FR5eqwgJis

— Peter Brandt (@PeterLBrandt) August 16, 2023

However, there’s hope for Bitcoin enthusiasts. The $28,933.74 support level represents a crucial line of defense. If bears breach this level, the next support is around $28,800. Significantly, this level has historically acted as strong support and could attract buyers to prevent further decline.

Moreover, the market capitalization of Bitcoin has dipped by just 0.62% to $566,398,762,995 during this recession. In contrast, its 24-hour trading volume surged by 20.25% to $14,172,016,761. This indicates that there is still robust interest in BTC, even amid the bearish momentum.

BTC/USD technical Indicators

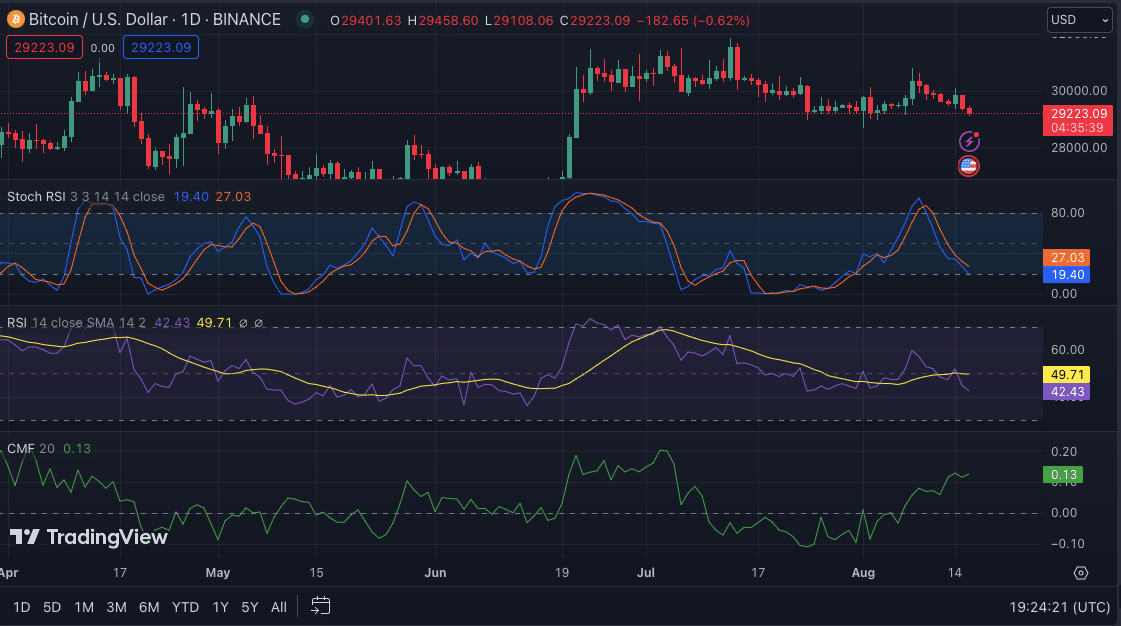

The stochastic RSI, with a reading of 19.40 and pointing downward, suggests that the bearish momentum is currently strong. Consequently, selling pressure may continue soon, pushing prices lower. However, a bullish reversal remains possible below the oversold threshold of 20.

Source-TradingView

Meanwhile, the RSI, having shifted below its signal line with a reading of 42.93, indicates that the market sentiment leans towards bearishness. Hence, a further price decline may be anticipated as the RSI has not yet reached oversold levels.

Besides these, the Chaikin Money Flow (CMF), currently at a positive reading of 0.14, suggests that there is still some buying pressure in the market. This trend could drive a bullish reversal, as the buying pressure may increase prices.

Bullish recovery or bearish breakdown?

As Bitcoin tests the waters at this critical support level, a recovery hinges on how the cryptocurrency responds. If BTC price bounces back above the $29,200 resistance level, it may signal a shift in sentiment, attracting more buyers and leading to a bullish recovery. However, we may witness further price declines if the bears breach the $28,933.74 support level.

In conclusion, while the bearish momentum poses a challenge, the potential for a bullish rebound remains. By monitoring Bitcoin’s response to the current support levels, investors can better understand the cryptocurrency’s future trajectory.

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- CLARITY Act: Crypto Group Challenges Banks Proposal With Its Own Bill Suggestions

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?