Trump Tariffs: Canada to Lift Retaliatory Tariffs on U.S. Goods, Boosting Crypto Market Rally

Highlights

- Canada to lift tariffs on U.S. goods, boosting crypto market optimism.

- Prime Minister Carney’s tariff shift sparks investor confidence in digital assets.

- Bitcoin surges past $115,900 while Ethereum rallies 9% on trade easing.

Canada is on the path of removing retaliatory tariffs on United States goods to diffuse the tense trade situation between the two nations. The crypto market has shot up as Bitcoin and Ethereum recorded sharp gains.

Move Shows Softening Approach As Crypto Market Responds

A Bloomberg report revealed that the decision is anticipated to be announced by Prime Minister Mark Carney after cabinet meetings, proving a huge shift in Canadian tariff policy. The modification will eliminate a 25% tariff on several U.S. produced consumer items so long as they are within the U.S.-Mexico-Canada agreement (USMCA).

This is viewed as a symbolic move towards President Donald Trump who has persistently announced stronger trade measures against many countries. Meanwhile, investors have noticed the implication of this decision on the crypto market.

However, Ottawa is maintaining tariffs on U.S. steel, aluminum, and automobiles. The government of Canada is committed to keeping these duties as a means of protecting its home industries. Accordingly, the crypto market has already with notable price gains.

Officials familiar with the matter say Canada’s counter-tariff strategy will now stress the importance of preserving that agreement, while maintaining flexibility on politically sensitive sectors. Analysts believe the softer tone could indirectly influence investor confidence in the crypto market.

Carney previously threatened to escalate retaliation after the White House doubled tariffs on steel and aluminum, but ultimately refrained. Canada also did not adjust tariffs when the Trump administration increased duties on Canadian fentanyl-related exports.

Economists note that despite years of tariffs, Canada has avoided significant inflationary fallout. Statistics Canada reported consumer prices rose just 1.7% in July, below the Bank of Canada’s 2% inflation target.

Bitcoin and Ethereum Lead Strong Crypto Market Rally on Trade Optimism

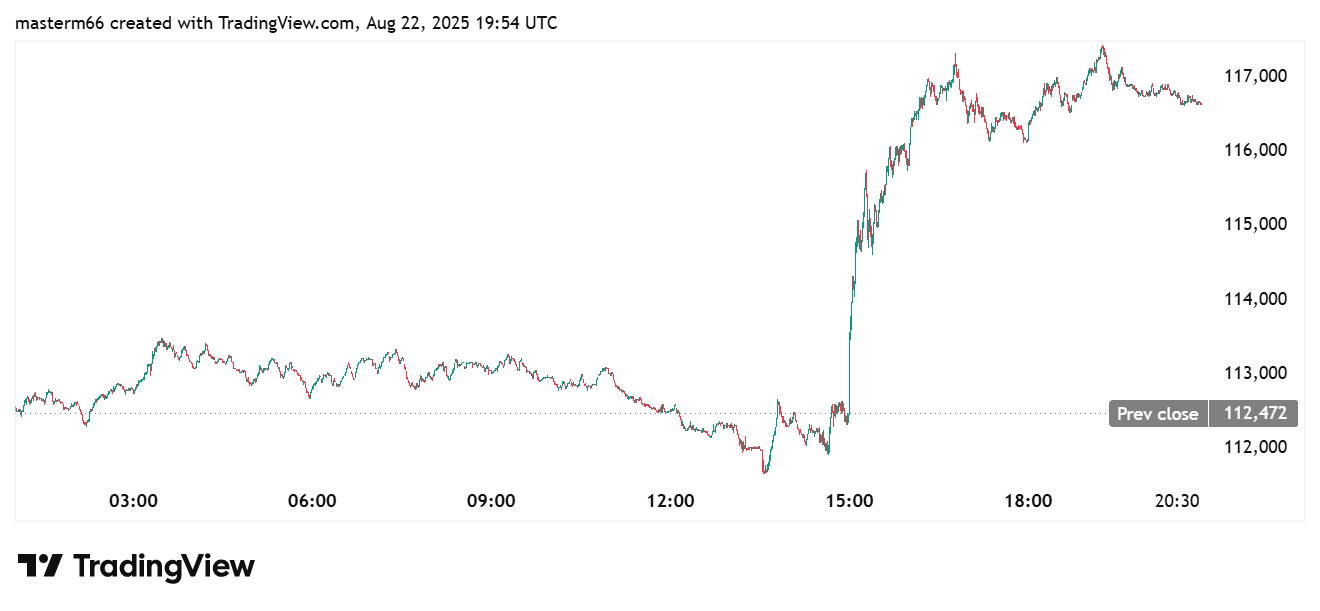

Based on TradingView data, the expected decision has stirred optimism in financial markets, including the crypto market. The flagship cryptocurrency, Bitcoin, grew 3.62% throughout the day and reached more than $116,500 after briefly dropping to around $112,000. The bounce is an indication of increasing demand in digital assets as a safe-haven asset. Over the past year, Bitcoin has gained more than 90%, with year-to-date gains above 24%, underscoring its strong performance within the crypto market.

Ethereum price outpaced Bitcoin with an even stronger move, jumping more than 9% to trade near $4,600. The asset’s explosive daily rally pushed monthly gains above 23% and yearly growth to more than 75 %. Its year-to-date climb now sits at nearly 39%, with long-term investors, like Tom Lee, seeing more than 1,000 % growth over five years.

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter