Cathie Wood’s Ark Invest Sells $15 Mln Coinbase Shares As COIN Price Hit 52-Week High

Bitcoin bull Cathie Wood’s investment management firm Ark Invest sells more Coinbase (COIN) shares, making the total selloff of COIN shares to $15 million this week. Cathie Wood remains actively bullish on Bitcoin and crypto exchange Coinbase, and the recent offloading is only a part of its investment strategy. ARK Invest funds’ return improves amid market recovery.

Cathie Wood’s Ark Invest Continues Offloading Coinbase Shares

On November 29, Cathie Wood’s Ark Invest fund ARK Next Generation Internet ETF (ARKW) sold 37,377 Coinbase shares worth almost $5 million, according to transactions seen by CoinGape.

The move comes as COIN price hit 52-week of $131.42, rallying 180% amid crypto marker recovery. Coinbase stock price soared 65% in a month to hit a 52-week high. COIN stock price closed 2.43% lower at $124.72 on Thursday.

Cathie Wood’s Ark Invest funds continues to offload Coinbase (COIN) shares this week. Ark Fintech Innovation ETF (ARKF) sold 43,956 Coinbase shares worth $5 million on November 27 and 37,377 COIN stocks on November 29. Cathie Wood’s Ark Investment sold more than 30,000 COIN shares last month and more than 1.5 million shares in the quarter ending September 30.

Before dumping Coinbase, Ark Invest sold over 550K Grayscale Bitcoin Trust (GBTC) shares amid spot Bitcoin ETF approval speculation.

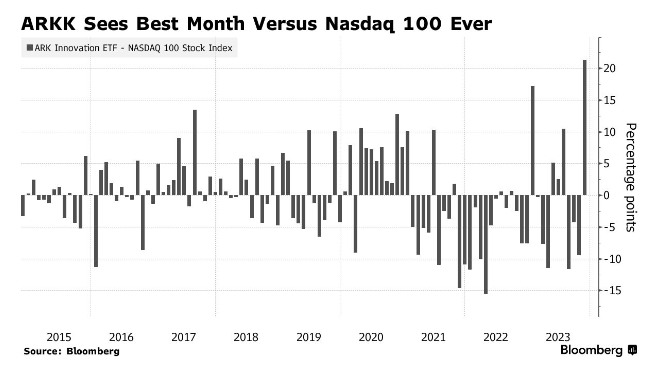

Cathie Wood’s Ark Invest funds are trading better than Nasdaq 100 in November as investors bet on US Fed rate cuts. ARK Invest Innovation ETF (ARKK) gained 31% in November, which hasn’t offloaded its largest holding, Coinbase.

Also Read: Terra Luna Classic All Set For Major Upgrade, LUNC And USTC To Rally Further

Cathie Wood Remains Bullish on Bitcoin

Ark Invest CEO Cathie Wood still bullish on Bitcoin amid the crypto market recovery, upcoming Fed pivot, and Bitcoin halving. While she offloads Coinbase and Grayscale stocks, buying Robinhood Markets (HOOD) shares becomes her recent best bet as Robinhood expands to the UK.

Ark Fintech Innovation ETF (ARKF) purchased 221,759 HOOD shares on November 29. Ark Invest funds made multiple buys of Robinhood shares.

Also Read: BTC Price To Hit $60000 Before Bitcoin Halving, Reports Matrixport

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- $1B Binance SAFU Fund Enters Top 10 Bitcoin Treasuries, Overtakes Coinbase

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP