CBDC News: Central Bank of Nigeria’s CBDC to take off on 1st October

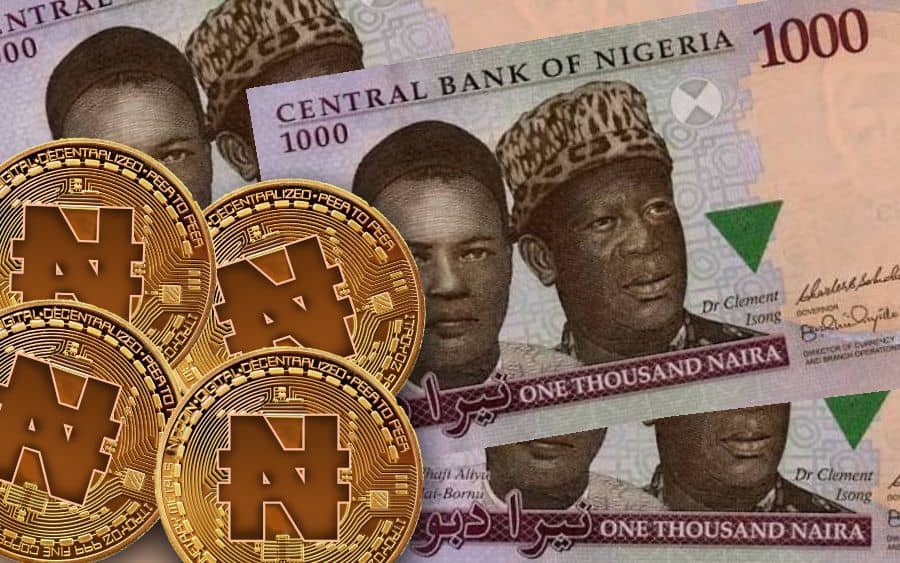

The Central Bank of Nigeria (CBN) presented its Central Bank Digital Currency (CBDC) initiative to stakeholders on Thursday and revealed the launch of the pilot project of CBN’s Central Bank Digital Currency (CBDC) to be on 1st October. The CBDC project, also known as ‘GIANT’, will be operating on the hyper-ledger fabric blockchain, i.e., an open-source project for the development of blockchain-based products, solutions, and applications to be utilized by private enterprises.

The information technology director for the Central Bank of Nigeria (CBN), Rakiya Mohammed, revealed CBN’s continued efforts since 2017 to establish and enable the use of their own CBDC. CBN also shared global data to back their CBDC launch, arguing that over 80 percent of Central Banks have started working towards kick-starting the process to establish and enable the use of CBDCs in their respective regions.

CBN’s Central Bank Digital Currency (CBDC) will be inclusive & efficient

However, before the unveiling of the entire project, CBN has decided to conduct proof of concept in the year, 2021 itself. CBN’s CBDC launch shall expedite and encourage cross-border trade and allow macro-management of the bank’s operations. Additionally, CBN’s CBDC shall promote financial diversity and equality, efficacious monetary policy, consistent enhancement of systematized payments, revenue tax collection, remittance development, and focused social intervention.

Nigeria has joined the long line of nations that are currently in the process of activating their own Central Bank Digital Currencies (CBDCs). Reserve Bank of India (RBI) is another recent nation that has announced the upcoming launch of its CBDC. The Indian central bank has revealed a phased roll-out of the central bank-issued digital currencies. Like Nigeria, the Indian government also plans to run several pilot projects before rolling out the entire project of CBDCs.

UAE Central Bank (UAECB) aims to be amongst the top 10 banks after the launch of its CBDC. UAE Central Bank has been following the footsteps of International Monetary Funds (IMF) and the World Bank, by launching CBDC to promote digital transformation in UAE’s financial services sector, and to do the same, it has announced employing advanced artificial intelligence and big data solutions.

“CBDCs (central bank digital currencies) offers the opportunity to start with a ‘clean slate.’ It is crucially important that central banks take the cross-border dimension into account,” Jon Cunliffe, chair of the Committee on Payments and Market Infrastructures and deputy governor for Financial Stability of the Bank of England said in a report prepared for the G20 meeting in Italy.

- XRP News: Jane Street Emerges Among Key Institutions Driving XRP ETF Inflows

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15