Chainlink holders patiently waiting for the ultimate liftoff to $18

- Amount of LINK held by top-non exchange holders at a near all-time high as price breaks above $14.

- LINK/USD is largely in the hands of the bulls but higher support above $14 is need for the final leg up to $18.

Chainlink finally stepped above the crucial level at $14. The impressive price action followed a breakout above the x-axis of an ascending triangle pattern. Meanwhile, a minor retreat occurred pulling LINK slightly under $14 to trade at $13.92 at the time of writing.

Chainlink top-non exchange holders waiting patiently for a breakout

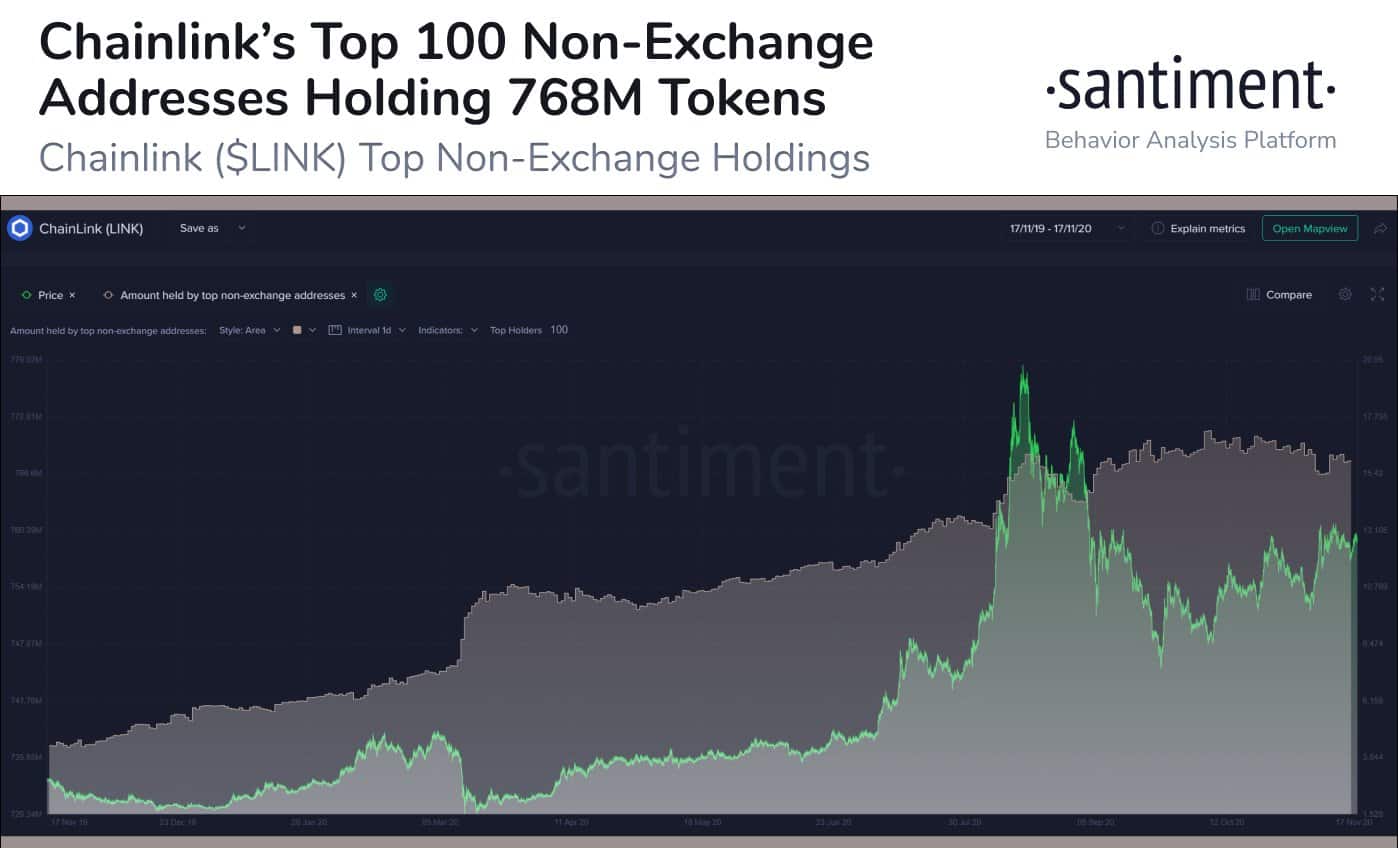

According to Santiment, Chainlink’s top non-exchange holders have accumulated a total of 768 million tokens. This number of LINK tokens is shy of their recent all-time high of roughly 771 million coins. The chart provides prints a gradual accumulation pattern that is looking very solid. It is intriguing that LINK holders have been adamant to capitulate to the surging Bitcoin.

The Relative Strength Index is almost piercing its way into the overbought region, which emphasizes the improving bullish picture. On the other hand, on-chain metrics show that buying pressure behind LINK is also on the rise.

At the moment, all attention is channel toward lifting above $14 and establishing higher support. The final leg to $18 will come as a result of the fear of missing out (FOMO) and greed among investors who currently anticipate Chainlink to hit new all-time highs before the year ends.

LINK/USD 4-hour chart

It is worth mention that the bullish narrative will be invalidated if LINK closes the day under $14. On the other hand, a retest of the x-axis must hold to ensure that bulls do not lose focus of the ultimate lift-off to $18 and $20, respectively. A break under the a-axis might seek refuge at the 50 Simple Moving Average, 100 SMA, and 200 SMA.

Chainlink Intraday Levels

Spot rate: $1.8

Relative change: 0.4

Percentage change: 3%

Trend: Bullish

Volatility: High

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

- Dalio’s Warning on World Order Sparks Fresh Bullish Outlook for Crypto Market

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value