Chainlink Price Prediction: LINK Soars 30%, Bulls Aim Higher Towards $14

- Chainlink decouples from Bitcoin and other major currencies, rallying to highs above $10.

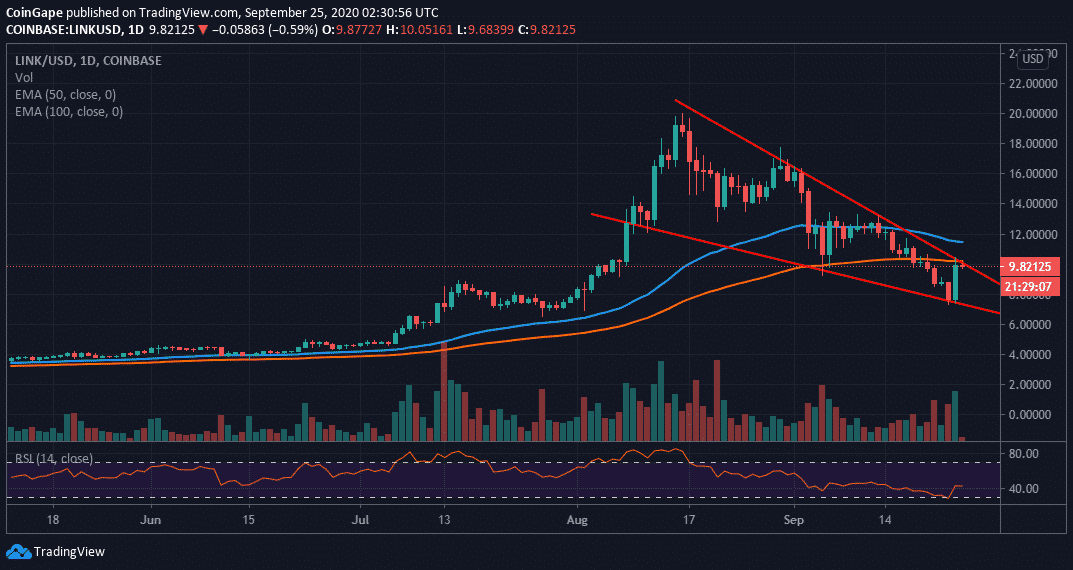

- LINK/USD has the potential to keep the uptrend going, a descending wedge pattern breakout is in the offing.

Chainlink rallied massively in the last 24 hours, reminding investors in the cryptocurrency market that we are still in a bullish market. The last three weeks have not been particularly rewarding for not only LINK but also other digital assets. For instance, Chainlink continued with the downtrend started in August after trading all-time highs of $20.

Initially, support was established at $14, and for some time, it kept bears in check while allowing buyers to focus on higher levels. A minor recovery just before September revisited the resistance at $18. However, declines ushered in the new month, leading to losses under $10. Chainlink explored the rabbit hole towards $7.

Over the last 24 hours, the smart decentralized oracle live price feed token resumed the uptrend. LINK climbed above key levels including $10. Unfortunately, it has been an uphill task breaking the resistance at the 100 Exponential Moving Average (EMA) in the daily range. LINK/USD has retreated to $9.8 amid attempts from the bullish camp to pull above the $10 key level.

Read also: Bitcoin Technical Analysis: BTC Retreat Imminent After Hitting Barrier At $10,800

LINK/USD daily chart

Intriguingly, Chainlink still has the potential to continue with the uptrend. The losses incurred in the past few weeks have narrowed into a descending wedge. LINK/USD is very close to breaking the upper trendline resistance. The much-anticipated move depends on the ability of the bulls to disperse the seller congestion at the 100-day EMA. Following the breakout, more resistance should be expected at the 50-day EMA ($11.45) as well as $14.

LINK Intraday Levels

Spot rate: $9.80

Relative change: -0.07

Percentage change: -0.53

Trend: Short term bearish bias

Volatility: Low

- Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent?

- Trump Backed Rick Rieder Now Leads the Odds for New Fed Chair

- Trump Threatens 100% Canada Tariffs as Bitcoin Holds $89K

- Is a Bitcoin Bull Run Possible in 2026? Here’s Why Arthur Hayes Thinks Yes

- Trump’s World Liberty Bank Charter Advances as OCC Rejects Senator Warren Criticism

- PEPE vs PENGUIN: Can Pengu Price Outperform Pepe Coin in 2026?

- Binance Coin Price Outlook As Grayscale Files S-1 for BNB

- Solana Price Prediction as SOL ETF Inflows Outpace BTC and ETH Together

- Bitcoin and Gold Outlook 2026: Warsh, Rieder Gain Traction in Trump’s Fed Pick

- PEPE Coin Price Eyes 45% Rebound as Buyers Regain Control on Spot Markets

- Pi Network Price Prediction: Will PI Coin Hold Steady at $0.18 Retrace Lower?