Charles Hoskinson Denies Rewriting Cardano Ledger to Hijack $619M

Highlights

- Hoskinson denies rewriting Cardano ledger, says ₳318M moved to custodial account for redemptions.

- Critics allege a 2021 MIR transaction swept unclaimed ICO ADA into reserves using genesis keys.

- Only $7M reached Intersect in 2024, despite Hoskinson citing ₳350M allocated from reserves.

Cardano founder Charles Hoskinson has denied allegations that he rewrote the Cardano ledger in 2021 to take control of ₳318 million (approximately $619 million at the time). This claim, shared widely on X by Masato Alexander, suggests the funds were originally allocated during the Cardano ICO (Initial Coin Offering) and later moved using the project’s genesis keys.

Hoskinson Responds to Accusations and Legal Threats

Cardano founder Charles Hoskinson responded to the claims on X, strongly denying that he or his team hijacked user funds. He stated that the Ada vouchers in question had become unspendable and moved into a custodial account to continue redemption.

“These funds were not stolen,” said Charles Hoskinson. “They were rolled into a custodial account controlled by the TGE that continued distributing the genesis funds to the original buyers for three more years.”

Hoskinson also warned Masato Alexander about spreading the claim, stating that legal action would follow if the defamatory statements continued.

“If you continue to imply that IO stole funds, I will sue you. This is my last warning,” Hoskinson wrote on his X (formerly Twitter) account.

Soon after, Hoskinson confirmed he would proceed with legal action by sending a cease and desist letter to Masato Alexander. However, Masato Alexander continued to assert insider knowledge, stating on x,

“Seriously doubt Charles wants to go through discovery. Already know where to look as half his payroll has been talking to me for years.”

Allegations of Ledger Rewriting and Control Over ICO Funds

The accusations claim that in 2021, during the Cardano “Allegra” hard fork, a modification removed unredeemed presale UTxOs and transferred their value into Cardano’s reserves. These funds, valued at ₳318 million, were allegedly redirected using genesis keys that Charles Hoskinson and Input Output Global (IOG) controlled at the time.

Critics claim that a function called ‘returnRedeemAddrsToReserves’ was used in the update. This function allegedly filtered out ICO-related UTxOs and swept their balances into reserves. The allegations further state that the new ledger state excluded the original holders of those tokens, especially older people from Japan, who had no contact or refund.

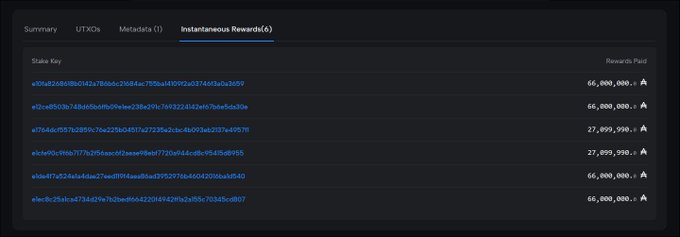

Following the protocol change, the funds were moved using a type of Cardano transaction known as “MIR” (Move Instantaneous Rewards). These transactions are typically used to distribute staking rewards or allocate treasury funds. In this case, it is alleged that the MIR transaction moved the previously swept ₳318 million into an account under centralized control.

Consequently, Masato Alexander claims the transparency is not documented and demands a full accounting of where the funds eventually went and how much was actually used for community or project development. Amid these allegations, Cardano has made big strides lately with a bridgeless transfer of Bitcoin to the blockchain by BitcoinOS witnessed recently.

Questions Raised About Fund Usage and Oversight

Charles Hoskinson has stated that a portion of the ADA from reserves funded Intersect, a governance-focused entity connected to the Cardano ecosystem. According to Hoskinson, the total allocation included ₳350 million in ADA, along with an additional ₳25 million earned through staking.

Intersect’s leadership clarified that the entity only received $7 million in 2024. Jack Briggs, interim executive director of Intersect, confirmed this amount in an X post and pointed to the group’s annual report for further financial details. Backing Cardano founder Charles Hoskinson, Jonathan Morgan, a crypto analyst, noted that no ledger rewrite or reorganization occurred, and the transaction was an authorized, consensus-driven event through protocol upgrades.

According to Morgan, a large portion of the ADA was properly returned:

“Majority (300M ADA) was successfully returned to ICO purchasers. A smaller remaining balance (~18–24M ADA) was openly repurposed into community development (IntersectMBO).”

This discrepancy between the total moved funds and the amount reportedly used to support Intersect has caused renewed scrutiny. Community members and critics are asking for clear records showing the remaining ADA allocations.

Charles Hoskinson has not yet shared a full ledger or audit trail showing the final distribution of the ₳318 million, but he said he will get the names. In addition, despite the claims, the Cardano price has not reacted negatively with ADA exchanging hands at $0.6637 amid fears of a price dip after the Ethereum upgrade.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs