$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments

Highlights

- Citigroup collaborates with Coinbase to start stablecoin transactions using blockchain technologies.

- The pilot will bring efficiency when it comes to cross-border payments across the world.

- Coinbase now offers its cryptocurrency infrastructure services to more than 250 banks.

Citigroup, a top U.S. bank with $2.5 trillion asset under management has partnered with Coinbase. They aim to explore the use of stablecoins for corporate payments. This marks another major step in Wall Street’s embrace of blockchain technology.

Citigroup Advances 24/7 Payments With Stablecoin Pilot

The collaboration aims to help Citigroup’s institutional clients move funds between crypto and traditional accounts more efficiently, per a Bloomberg report. Citigroup said the initiative will focus on developing faster and more flexible payment options for businesses.

Debopama Sen, head of payments for Citigroup’s Services division, confirmed the development. She said that the bank is testing ways to enable on-chain stablecoin transactions in the coming months.

The executive further explained that clients increasingly demand programmable and conditional payments that work around the clock. Traditional systems, by contrast, close on weekends and often take days to settle.

This marks a sharp evolution for Citigroup. The firm recently launched a blockchain-based platform that lets clients transfer tokenized deposits instantly within its network. Earlier, Citigroup began exploring custody services for crypto ETFs and stablecoins as part of its broader digital-asset strategy

Sen called stablecoins “an enabler in the digital payment ecosystem,” saying they can expand functionality for global clients and support the next generation of financial services.

Citigroup, Coinbase Stocks Rise on Stablecoin Optimism

Analysts such as Citigroup’s Ronit Ghose expect the stablecoin market cap to exceed $1 trillion within five years. That would represent an increase of roughly $700 billion from the current valuation.

That growth potential has attracted major banks, asset managers, and payment networks. All of them are seeking to modernize their financial rails using blockchain technology. The news pushed Coinbase (COIN) stock up 4.01% to $368.66. Over the past five days, the stock has gained more than 10%.

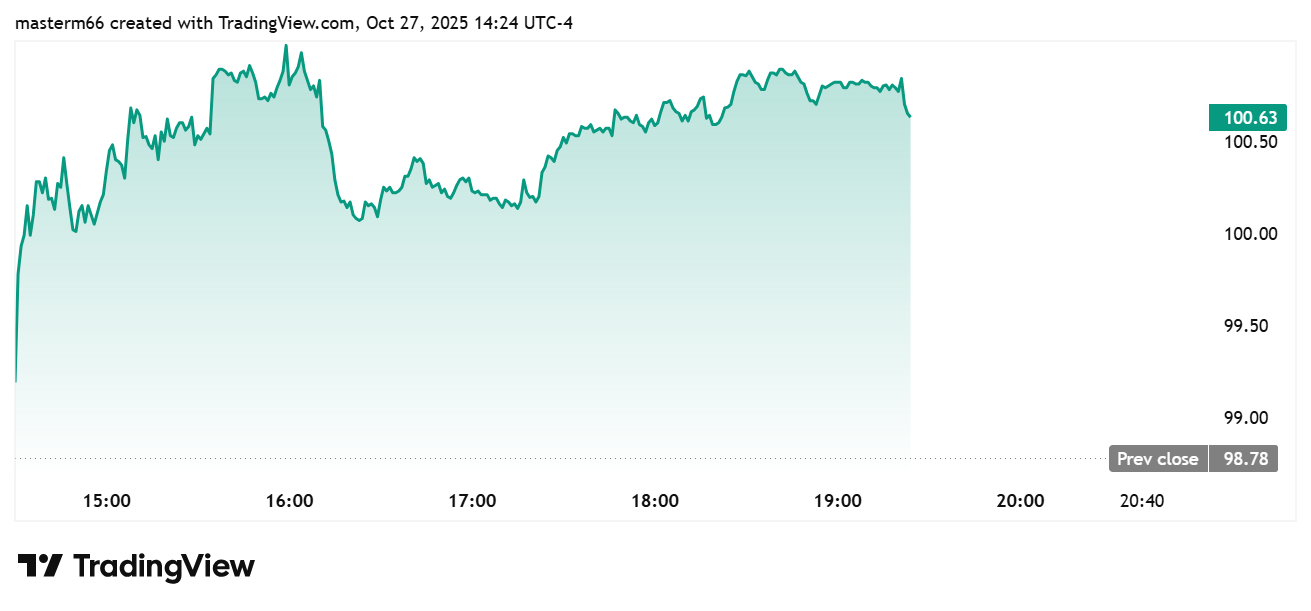

Citigroup shares also edged higher. The bank’s stock (C: US) rose 1.39% to $100.15. The gains by both stocks reflect optimism that its stablecoin pilot with Coinbase could strengthen its digital payments strategy.

Coinbase Expands Institutional Reach

Coinbase continues to deepen its institutional reach. The exchange already provides crypto infrastructure to more than 250 banks and financial institutions worldwide. This expansion follows a recent SEC guidance that allows firms such as Coinbase, Ripple, and BitGo to operate as qualified crypto custodians.

Brian Foster, a Coinbase executive, said the company has built specialized systems for its institutional clients. Through these systems, such clients find it easy to trade and stake in blockchain as well as make payments. Foster commented that the alliance indicates the increasing interest in real-world application of blockchains, especially payments using stablecoins and tokenizing assets.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- BitMine’s Tom Lee Bets on ‘March Turnaround’ to Spark Crypto Market Recovery

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

Buy $GGs

Buy $GGs