Citigroup Predicts Bitcoin Could Climb to $231,000 in 12 Months

Highlights

- The banking giant has set a target of $231,000 for Bitcoin in the next 12 months as their bull case.

- The base case is that BTC could reach $181,000.

- The bear case if that the flagship crypto drops to $82,000.

Banking giant Citigroup has revised its Bitcoin prediction to $231,000 in the next 12 months, marking this as the bull case for the flagship crypto. Citigroup also outlined its Ethereum prediction and how high the largest altcoin by market cap could reach within a similar period.

Citigroup Predicts Bitcoin Rally To $231,000 As Bull Case

The banking giant predicted that BTC could rally to $231,000 as their bull case, while the base and bear cases for the flagship crypto are $181,000 and $82,000, respectively. Meanwhile, they forecast that the flagship crypto could reach $132,000 by year-end, which would mark a new all-time high (ATH).

Furthermore, Citigroup expects continued upside from investor demand next year, noting that the flagship cryptocurrency is trading above statistical measures based on user activity. The banking giant also expects positive flows into Bitcoin to continue, which the firm predicts will come through increased adoption as institutional investors and financial advisors initiate crypto investments.

Citigroup also predicted that the Ethereum price could reach $7,300 in the next 12 months as their bull case for the altcoin, while $5,400 and $2,000 are the bear cases, respectively. They expect ETH to reach $4,500 by year-end. The firm had earlier predicted that ETH could crash to $4,300 by year-end, although the altcoin dropped below that level shortly after, reaching as low as $4,000 in the process.

Meanwhile, Citigroup stated in its most recent research report that they are more positive on Bitcoin compared to Ethereum, as the former captures an outsized portion of incremental flows into crypto markets. They suggested that there is uncertainty around the investor demand for ETH and user activity on the Ethereum network, with this uncertainty reflected in the targets for the altcoin.

Massive Inflows Return For BTC

Citigroup’s revised Bitcoin prediction comes just as the BTC ETFs see record daily net inflows again. According to SoSoValue data, these funds have recorded over $1.6 billion in inflows over the last three days.

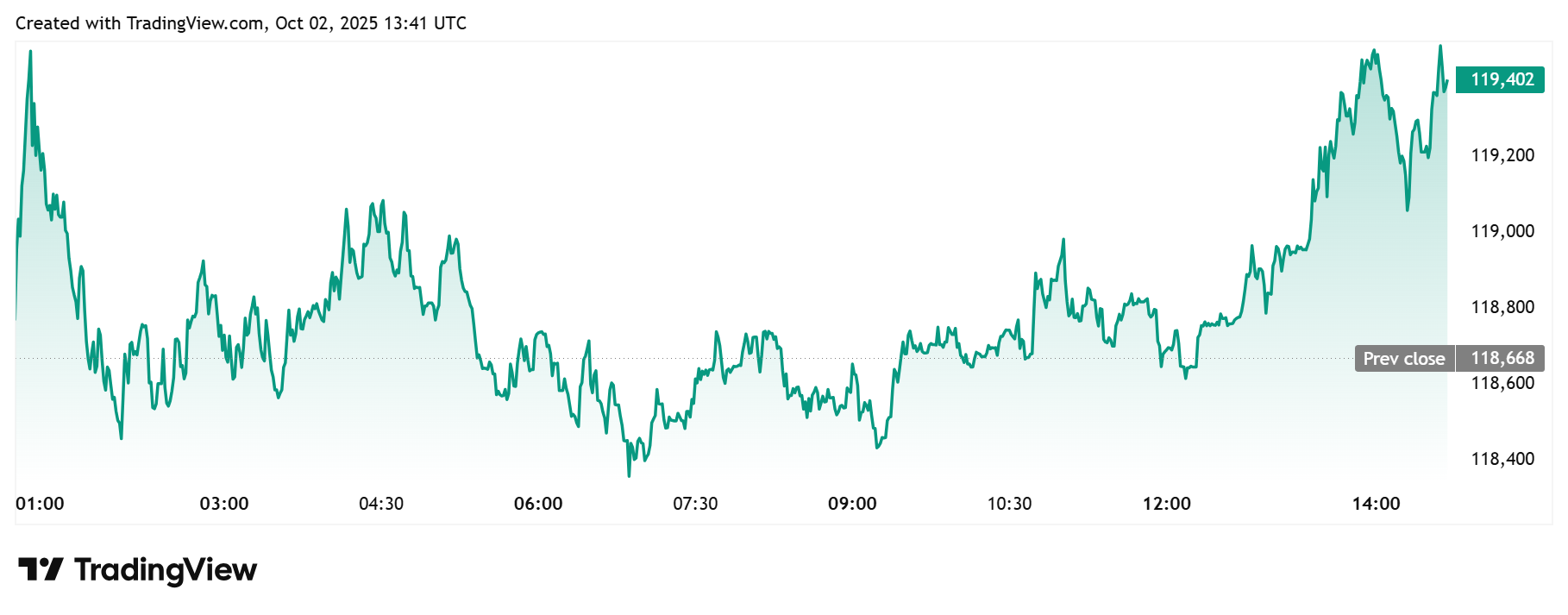

On October 1, they recorded $675.81 million in net inflows, marking their biggest daily outing since September 10, when they saw a net inflow of $757.14 million. This development also coincides with the BTC price rally, which began yesterday, with the flagship crypto rising from around $114,000. The flagship crypto is already up 4% to start the month, currently trading above $119,000.

As CoinGape reported, another recent positive for Bitcoin was the ADP jobs report released yesterday, which showed that the labor market is still weakening. As a result, the odds of a Fed rate cut at the October FOMC meeting have risen to 99%.

The market is possibly pricing in the possibility of the Fed cutting rates, which has also contributed to the rally at the start of this month. Meanwhile, it is worth mentioning that October is BTC’s second-best-performing month, recording an average gain of over 20% in this month over the years.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs