Compound’s Total Supply Surpasses $1 Billion

Prominent lending platform, Compound has evidently elevated the DeFi space. Earlier today, the platform’s total supply breached past $1 billion.

Compound’s Latest Breakthrough

The decentralized finance [DeFi] space has been gaining popularity in immense magnitudes. All thanks to lending protocol Compound Finance and decentralized exchange, Balancer. All the other DeFi platforms took a backseat and watched how these protocols took the crypto-verse by storm.

This month panned out to be eventful for both Compound as well as Balancer following the release of their governance tokens. Balancer released its BAL token last week and Compound rolled out its COMP token the week before. Both these tokens were lauded for their price movement.

Compound’s COMP token has undoubtedly been the talk of the crypto town. The token had outperformed every DeFi application in the space. Apart from the value that Compound has been locking and its price movement, there’s another factor that deserves attention. Earlier today, the founder of Compound Finance, Robert Leshner announced on Twitter that there was more than 1 billion USD supplied to the Compound protocol.

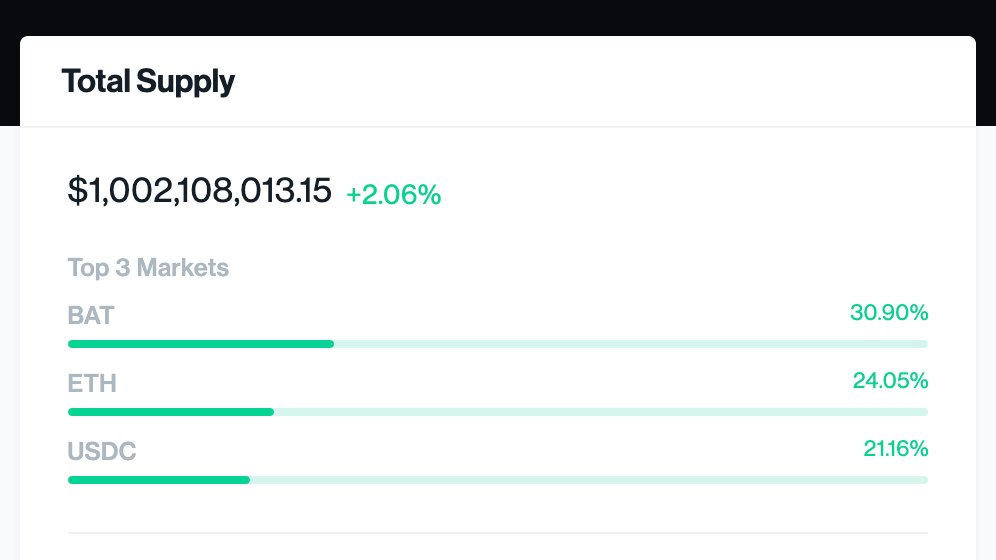

As seen in the image the total supply stood at a whopping $1,002,108,013.15. However, during the time of writing the total supply had witnessed a slump as the figures went down to $992,628,897.37 with a 0.40 percent drop.

However, the crypto community congratulated, Leshner for Compound’s recent breakthrough. In his tweet, Leshner added,

“Excited for $COMP holders to expand & upgrade Compound, taking it past the next major milestone”

Compound has continued to sojourn in dominance in the DeFi space and has locked a whopping $637 million. Maker continues lounging in the second position as it had locked $450.2 million, at the time of writing. Decentralized exchange, Balancer wasn’t far behind as it locked a total of $120 million and was looking at a 10.19 percent increase.

Even though it seems like the Compound platform has everything in place, the price of the token has been depreciating over the past week. After soaring up to a high of $372.27, the price of the COMP token has gone downhill. At the time of writing, the token was trading at $233.97 with a 5.6 percent drop.

Is The Hype Around DeFi A Bubble?

If you have been following the crypto space off late, you must have come across the term “yield farming.” This has been the latest interest of the crypto community. Several DeFi products as well as protocols are leveraged in order to create high return rates. However, several in the community believe that this might be a bubble that would soon burst.

Adam Back, the CEO of Blockstream tweeted about the same. His tweet read,

is it just me or is "defi yield farming" scam 3.0 / ICO^3 when ICO^2 (ICO funded ICO platform) ran out suckers to rekt and spooked by regulator ire?

— Adam Back (@adam3us) June 26, 2020

Do you think yield farming is here to stay or just a nine days’ wonder? Let us know in the comments!

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter