Breaking: Cream Finance Faces Second Flash Loan Attack in 2021, Loses $18 Million

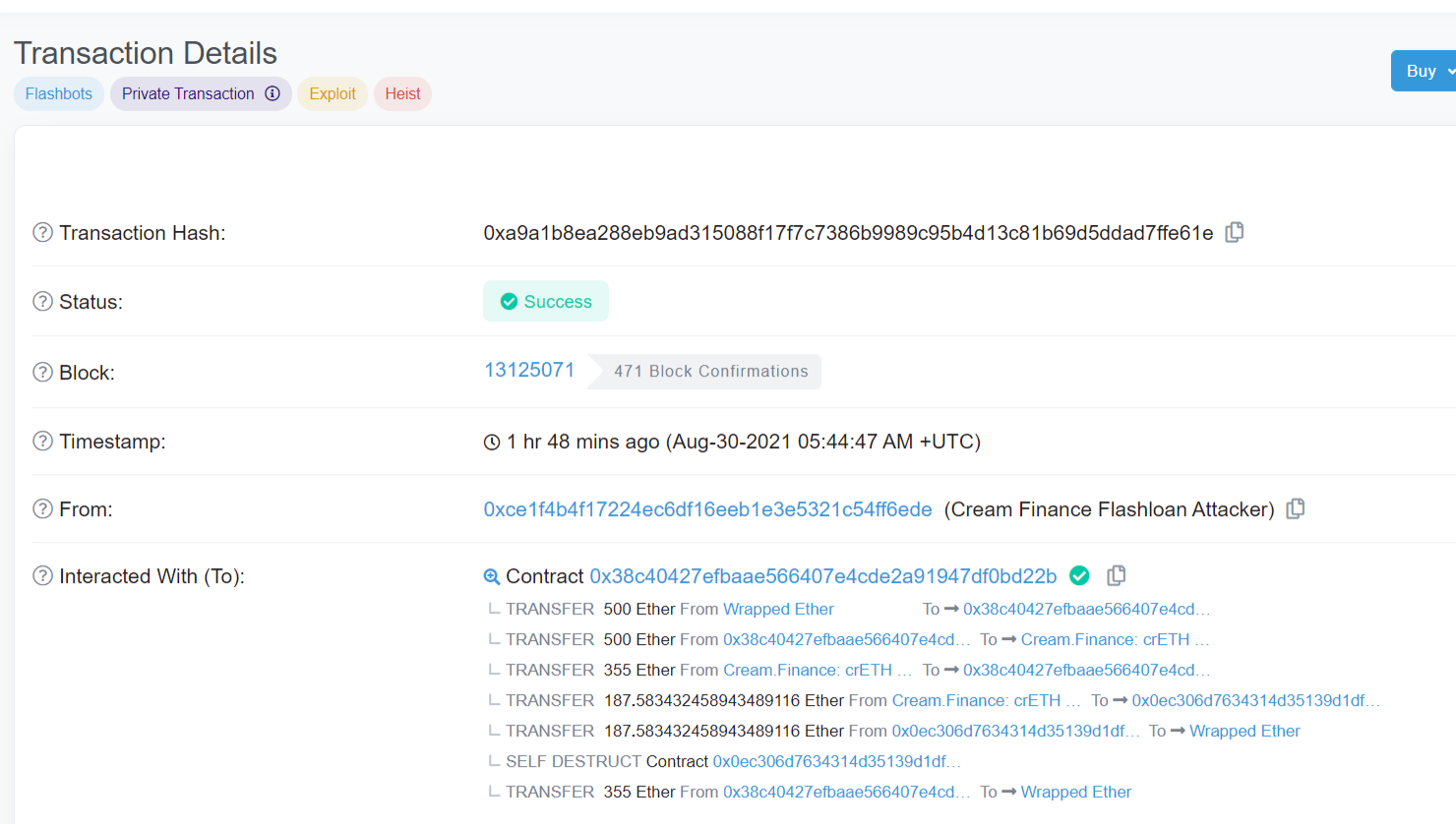

Cream Finance, the Defi lending protocol has become a victim of another flash loan attack in which the losses are estimated to be about $18 million. According to early reports from Wu Blockchain, there were two attackers behind the exploit that carried out the heist in 17 transactions.

Panic Shield, blockchain security, and the analytic firm were the first to detect the attack and alerted the defi protocol about it. They said they have found the root cause of the attacks and asked Cream Finance to contact them for further details.

@CreamdotFinance We have located the root cause and feel free to contact us!

— PeckShield Inc. (@peckshield) August 30, 2021

Flash loan attacks are one of the most common forms of Defi exploits as it is cheaper to pull off and easier to get away with. The attackers exploit the uncollateralized loans enforced by smart contracts that lend money to people with no need of collateral and no cap on the borrowed loan either, given the borrower can pay back the loan in the same transaction. Most traders use it for arbitrage on the price difference of an asset on two different platforms.

The hackers manipulate the Flash Loan functionality by first borrowing a large amount in collateral and then use it to manipulate the prices of tokens in the pools. The Cream Finance attackers reportedly managed to get their hands on a lot of $AMP and then the market dumped flash crashing its price.

Defi Market Exploits at its Peak

Defi Market exploit seems to be at its peak as in this month alone there has been nearly half a dozen exploits on various protocols. While the largest Defi hacks on PolyNetwork worth $610 million were returned, but it did highlight how vulnerable funds are in these Defi protocols. Security has been a major concern since its inception but despite all the measures the exploits keep on happening.

The US SEC is currently working towards regulating the crypto market and has recently partnered with a blockchain security analytic firm to help them analyze the vast market. Thus the slew of attacks could play against one of the fastest-growing crypto ecosystems.

- XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking

- Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year

- Breaking: Tom Lee’s BitMine Adds 40,613 ETH, Now Owns 3.58% Of Ethereum Supply

- Bitget Partners With BlockSec to Introduce the ‘UEX Security Standard’ Amid Quantum Threats to Crypto

- Breaking: Michael Saylor’s Strategy Buys 1,142 BTC Amid $5B Unrealized Loss On Bitcoin Holdings

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th