Breaking: Crypto Asset Funds Record First Week Of Outflow, Institutions Selling Bitcoin?

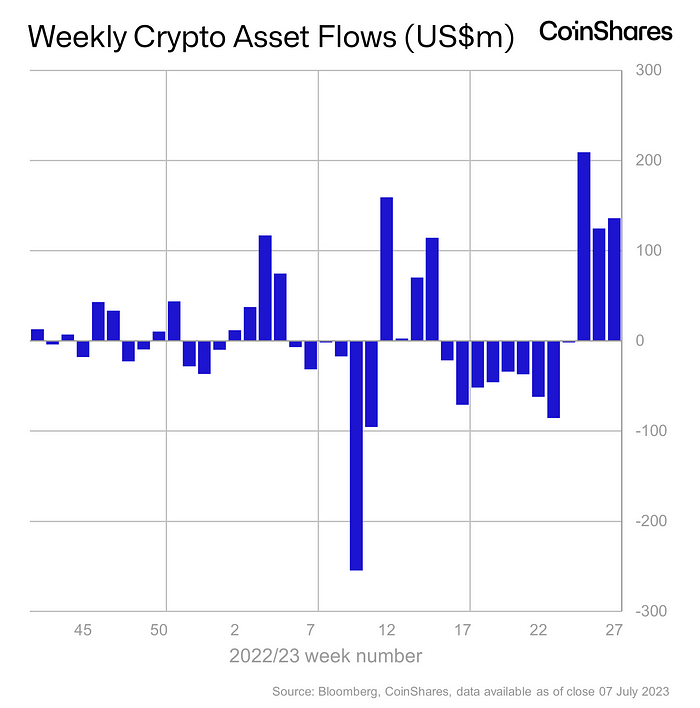

Crypto asset investment products recorded the first week of outflows after four consecutive weeks of inflows from institutions that totaled $742 million, according to a report by CoinShares on July 24. Crypto asset investment products saw minor outflows totaling $6.5 million. Traders speculate whether the institutional buying is over as they offload some Bitcoin holdings.

Crypto Funds Record Outflows Amid Profit Booking in Bitcoin

Crypto asset funds saw a total of $742 million of inflow in the last four weeks. The inflows brought year-to-date flows to a net positive despite nine weeks of outflows. Bitcoin recorded huge inflows amid spot Bitcoin ETF filings by BlackRock, Fidelity Investments, and other financial giants.

However, $6.5 million in crypto asset outflows last week raised speculation of correction in the crypto market. Investors sold Bitcoin worth $13 million and switched to Ethereum, which saw $6.6 million inflows. Also, short Bitcoin investment products recorded the 13th consecutive week of outflows totaling $5.5 million.

After Ethereum, XRP recorded the most inflows of $2.6 due to Ripple’s partial win against the US SEC. Other altcoins Solana, Uniswap, and Polygon (MATIC) saw inflows totaling $1.1 million, $0.7 million, and $0.7 million, respectively. Trading volumes decreased significantly last week.

ProShares ETFs, ETC Issuance GmbH, and Purpose Investments recorded the most outflows last week. Negative sentiment was primarily focused on the North American market, which saw 99% of outflows ($21 million). This was offset by $12 million in inflows into Switzerland and $1.9 million into Germany.

Also Read: Binance And Other Crypto Exchanges Announce Worldcoin (WLD) Listing

Bitcoin, Ethereum, and Altcoins Saw Sudden Fall

A broader selloff across the crypto market saw over $90 million worth of crypto assets liquidated in an hour and $150 million liquidated in the past 24 hours. BTC price fell sharply to the $29,000 level, with the price currently trading near $29,200. Meanwhile, ETH price trades near $1850, falling comparatively less than Bitcoin.

Government bond yields around the world retreated, with the US 10-year Treasury note yield falling to 3.81%. Traders also bracing for key events such as interest rate decisions from the US Federal Reserve, the ECB, and the Bank of Japan.

Read More: Crypto Market Selloff – Bitcoin, ETH, XRP Price Falling Sharply; What Happened?

- $3.5T Banking Giant Goldman Sachs Discloses $2.3B Bitcoin, Ethereum, XRP, and Solana Exposure

- Why is XRP Price Dropping Today?

- Breaking: FTX’s Sam Bankman-Fried (SBF) Seeks New Trial Amid Push For Trump’s Pardon

- Fed’s Hammack Says Rate Cuts May Stay on Hold Ahead of Jobs, CPI Data Release

- $800B Interactive Brokers Launches Bitcoin, Ethereum Futures via Coinbase Derivatives

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?