$500B Crypto Market Crash: Attack on Binance, $700M Wintermute Move, Trump Impact

Highlights

- Crypto market crash erased over $500 billion in total market cap.

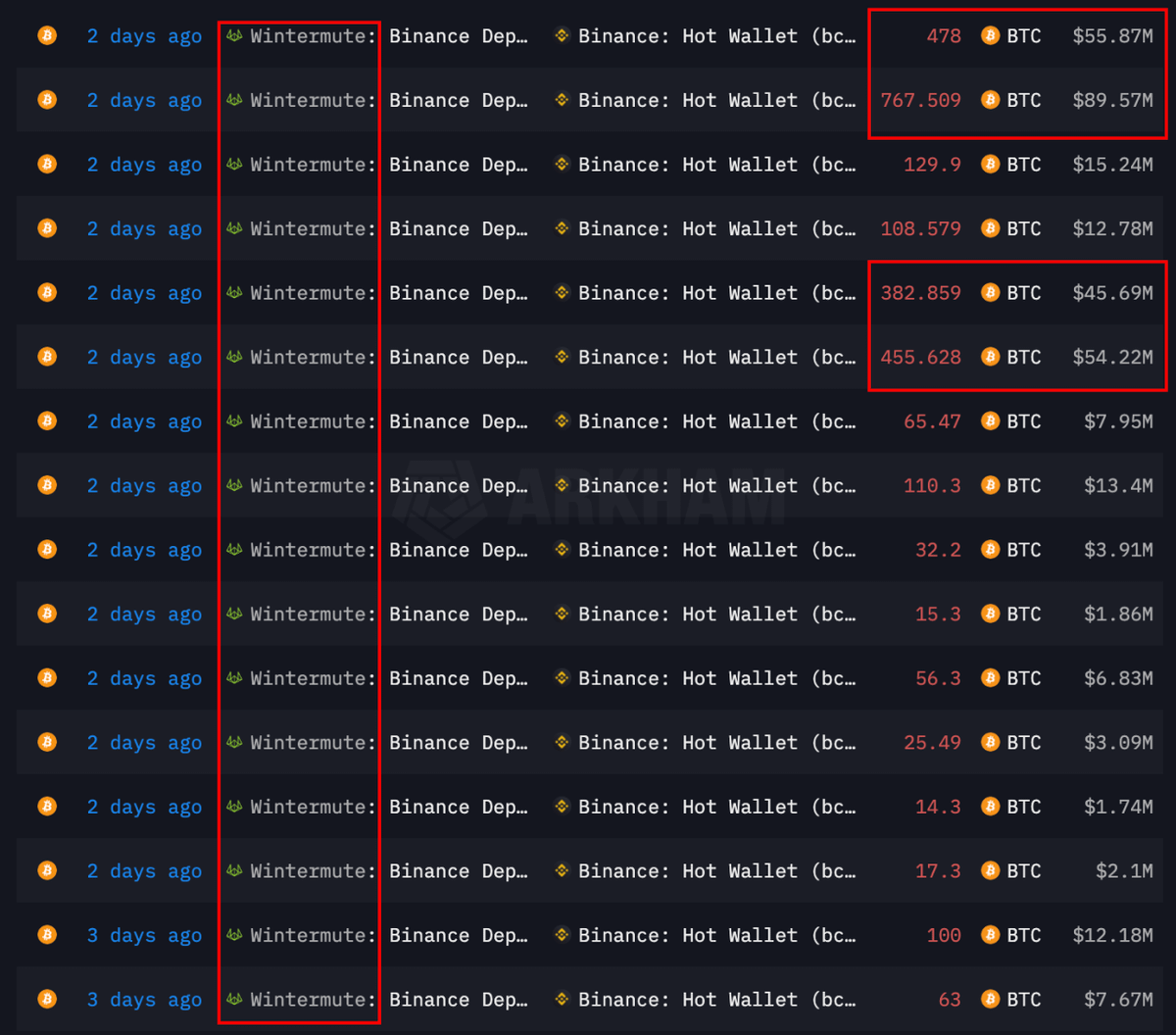

- Wintermute blamed again as it sent $700 million to Binance hot wallet before the crashed.

- Targeted attack on Binance with issue related to using of assets like USDe, wBETH, and BNSOL as collateral.

- Trump's post on 100% China tariffs intensified crash, but WLFI fell 30% before the announcement.

The largest-ever crypto market crash erased over $500 billion in total market cap and triggered nearly $20 billion in liquidations of top crypto assets. Lower timeframes charts revealed Bitcoin broke to a low of $104,582 and Ethereum to $3,460. The crypto community primarily blames crypto exchange Binance, market maker Wintermute, and US President Donald Trump for the flash crash.

Wintermute Sent Massive Bitcoin Before the Crypto Market Crash

The crypto community blamed Binance-linked market maker Wintermute, finding itself at the center of growing controversy amid allegations of market manipulation by major players again. This comes in response to over $700 million deposited by the market maker in the Binance hot wallet before the crash.

In September, crypto traders accused Binance of causing a market crash by sending huge amounts of Solana, Ethereum, and Bitcoin to Wintermute. Right after the transfers, prices fell sharply and wiped out $1.7 billion as traders saw massive liquidations.

In response to $700 million move by Wintermute, EveryCryptoTool’s Hanzo said, “Binance just reminded everyone who really runs this market, this crash wasn’t about Trump, tariffs, or macro, that was noise, the real story happened inside the books.”

He added that order books on Binance went hollow, with no bids, no walls, and a free fall happening. Wintermute stopped defending the price and pulled liquidity, causing ATOM and SUI to crash to $0.001 and 0.56, respectively. Binance users reported that the platform stopped working. Stop orders froze, limit orders hung, and only liquidations were executed.

Targeted Attack on Crypto Exchange Binance

Uphold head of research Martin Hiesboeck claimed the crypto market crash happened after a targeted attack that exploited a flaw in Binance’s Unified Account margin system. Using assets like USDe, wBETH, and BNSOL as collateral caused the issue, as liquidation prices were based on Binance’s own volatile spot market.

USDe fell to $0.65, causing a cascading margin collapse that triggered massive liquidations, including those of major market makers. “The attack was timed to exploit a window between Binance’s announcement of a fix and its implementation, resulting in estimated losses between $500 million and $1 billion,” he added.

ElonTrades blamed Binance’s design flaw as attackers timely exploited the crypto exchange’s internal pricing system, amplified by a macro shock and systemic leverage. Attackers opened $1.1 billion in BTC and ETH shorts on Hyperliquid before the crypto market crash, making $192 million in profit.

Yi He and Richard Teng apologized to the public regarding the depeg issue. Also, Binance promised compensation for victims of USDe and BNSOL depeg losses.

CZ is in damage control, is now retweeting the biggest known scammer from Solana.

It is 100% certain Binance was responsible for the market crash.

Get your funds off Binance immediately. pic.twitter.com/Y7CSMQPTrV

— curb.sol (@CryptoCurb) October 12, 2025

Trump Triggered the Biggest Crypto Market Crash

US President Donald Trump’s Truth Social post about massive tariffs on China sparked panic due to renewed trade war hints. Stock markets started dipping first, followed by the crypto market crash.

Later, Trump officially announced 100% tariffs on all Chinese imports starting November 1. According to Bull Theory, this caused the broader market crash to deepen. It felt structural as if a fund or desk was forced to unwind positions all at once.

DeFiance Capital’s Kyle shared how the Trump family-backed WLFI “magically” dumped 30% before the crash. He claimed insiders knew and sold WLFI first and went to short the market on Hyperliquid. World Liberty Financial purchased WLFI at dips during the crypto market crash.

In other words, Trump’s insiders got their bags filled on the market crash and he wants things to be better now.

Brazen crime! https://t.co/OtpHBn74Ai

— Adam Cochran (adamscochran.eth) (@adamscochran) October 12, 2025

Prices were trading vastly differently on Coinbase during the crash. For instance, DOGE nuked to $0.09 on Binance, OKX, Bybit, and Kraken, but was trading higher on Coinbase. The crypto community questioned whether their market makers were running a completely different playbook or protecting the books. Users reported facing difficulty in tracking prices, trading, or accessing live updates.

- Expert Warns Bitcoin Bear Market Just In ‘Phase 1’ as Glassnode Flags BTC Demand Exhaustion

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?