Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week

Highlights

- Crypto ETFs saw nearly $1 billion in weekly inflows.

- Digital asset investment products attracted $921 million in inflows, with U.S. funds leading at $843 million.

- The surge comes ahead of the Federal Reserve’s FOMC meeting, where traders expect another rate cut.

Crypto ETFs record nearly $1 billion in weekly inflows. This marks one of the strongest performances since mid-year. The move comes as traders brace for a potential Fed Rate Cut this week.

Massive Inflows Into Crypto ETFs as Confidence Returns

According to the latest report from CoinShares, digital asset investment products attracted $921 million in inflows last week after several volatile sessions. The surge comes ahead of a major economic week, especially the upcoming FOMC meeting.

Encouraged by softer-than-expected inflation numbers, investors are betting that the Federal Reserve will deliver additional rate cuts before year-end. That optimism helped keep crypto ETF trading volumes elevated. Data showed that weekly turnover hit $39 billion, well above the year-to-date average of $28 billion.

Regionally, the United States led the inflow race with $843 million, while Germany recorded $502 million. This marks one of its strongest weeks on record. Meanwhile, Switzerland experienced $359 million in outflows. Analysts, however, attributed the movement largely to internal fund transfers rather than active selling.

Bitcoin remained the primary driver of crypto etf inflows. It pulled in $931 million last week, pushing cumulative inflows since the Fed began its current rate-cut cycle to $9.4 billion. In contrast, Ethereum experienced its first withdrawals in five weeks, as $169 million left the asset class.

Solana and XRP also saw weaker inflows, recording $29.4 million and $84.3 million, respectively. This comes as investors await updates on pending ETF applications in the United States.

Fed Rate Cut Expected to Shape Market Outlook

All eyes now turn to the Federal Reserve’s FOMC meeting scheduled for this week. According to Reuters, policymakers are expected to trim interest rates by 25 basis points.

This comes after the first interest rate cut of the year. The federal funds rate was reduced by 25 basis points, with the target range lowered from 4.25%–4.5% to 4%–4.25%.

Notably, many factors indicate a potential Fed rate cut. For instance, the U.S. CPI data came in lower than expected. The index rose 3% year over year through September. Moreover, unemployment insurance claims have been trending higher, suggesting a gradual slowdown in hiring.

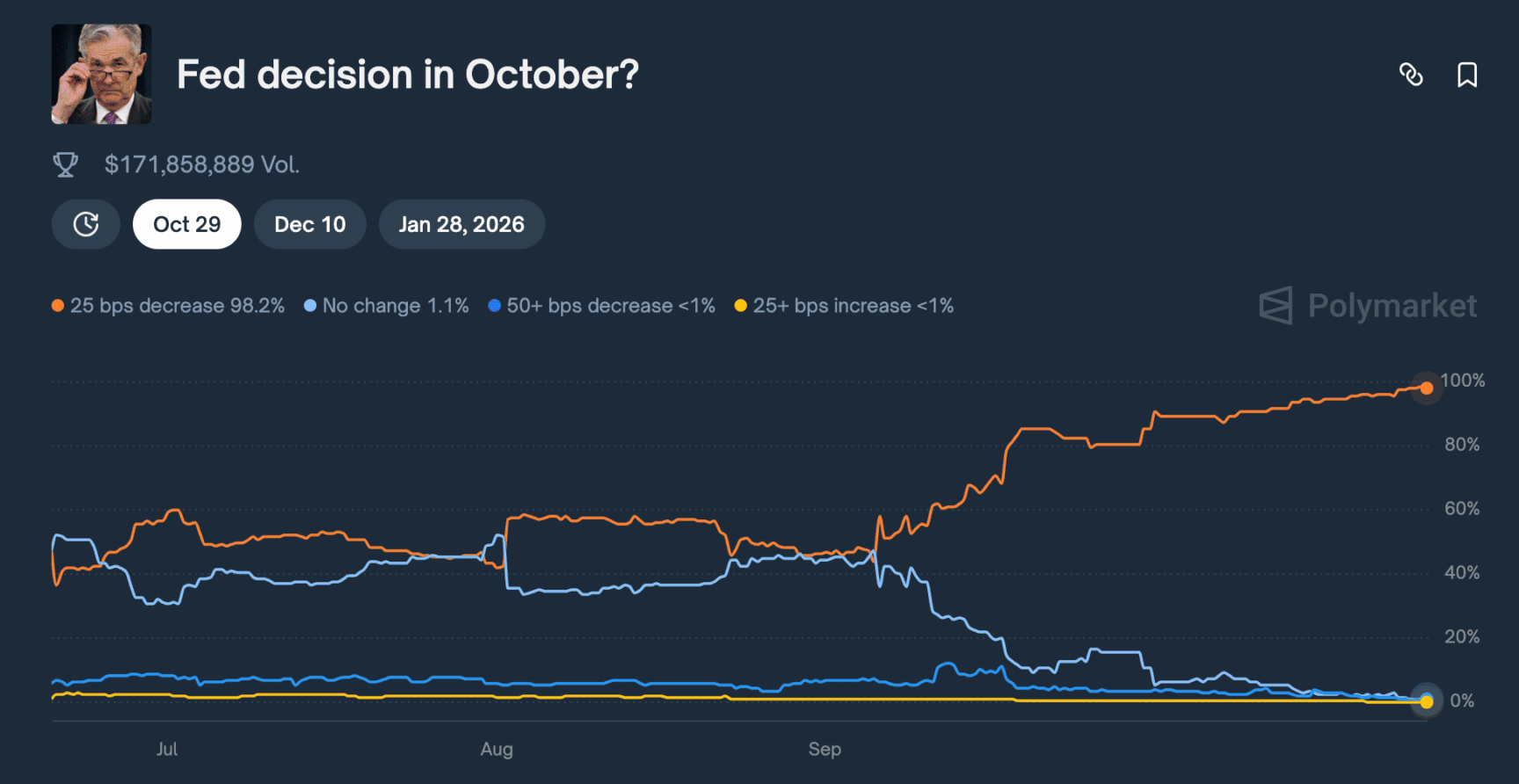

A quarter-point Fed rate cut on Wednesday would place the policy rate between 3.75% and 4.00%. Traders are already pricing in additional cuts for December and January. According to Polymarket data, 98% of traders are betting on a 25bp cut in the FOMC meeting.

Fed Vice Chair Michelle Bowman recently suggested that the committee’s earlier reference to “additional adjustments” implied a willingness to act again if economic conditions warrant. However, some policymakers remain cautious. Fed official Lorie Logan stressed that a premature rate cut could rekindle price pressures, as inflation remains above the 2% target.

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter