Crypto Exchange Binance Lists DeFi Token Cream Finance [CREAM], Faces Backlash

Cryptocurrency exchange Binance announced earlier today that it will list DeFi token Crean Finance (CREAM) on its platform. Binance will offer open trading for CREAM by for trading pairs with Binance Coin (BNB) and its own stablecoin BUSD.

Cream Finance is a forked version of Compound Finance and a decentralized peer-to-peer lending platform. The name CREAM basically stands for Crypto Rules Everything Around Me. This project started with the mission of providing an accessible financial system by leveraging the power of blockchain-based smart contracts.

The CREAM Finance platform has established its footing in the DeFi market by riding around the latest craze of Yielf-farming, also called Liquidity mining. It aims to create a DeFi ecosystem that simplifies the process of lending, exchange, and payment along with other asset tokenization services. CREAM has launched on Ethereum with an aim to offer its services more efficiently.

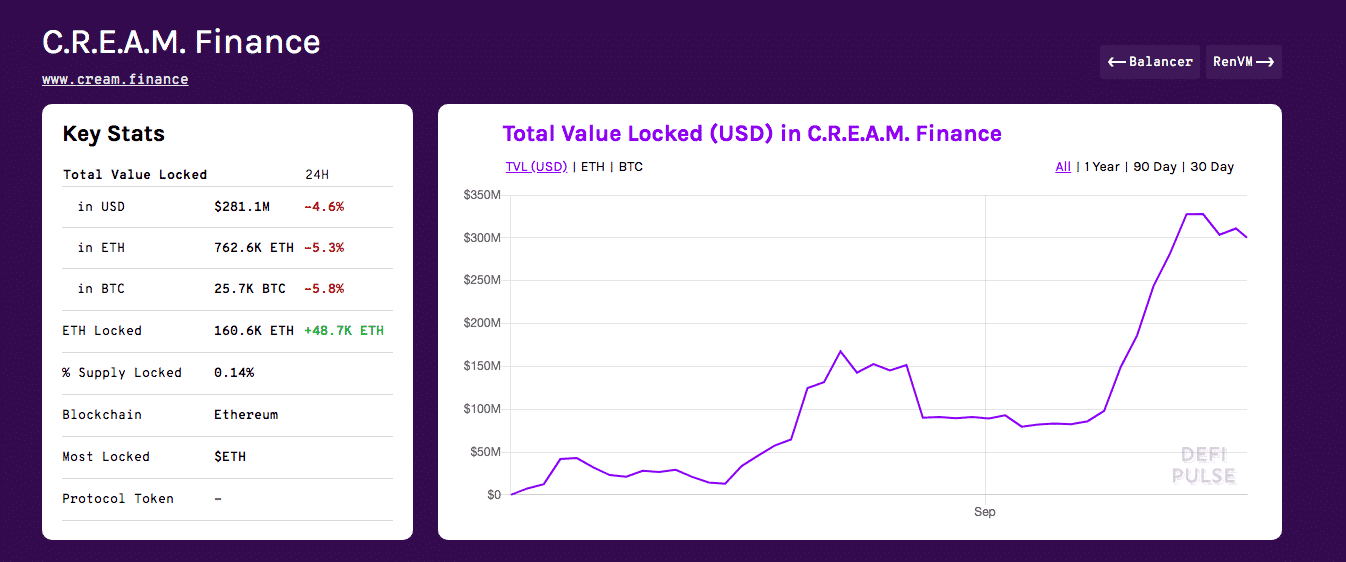

The native CREAM tokens also serve as the governance tokens of the CREAM Finance Network. The CREAM Finance Network has seen massive growth in September so far. Since September 1, the total value locked in CREAM Finance has surged over three-fold, from $89 million to $300 million at press time, as per Defi Pulse.

Binance Faces Backlash for Listing CREAM

Crypto exchange Binance has been eager to ride the DeFi wave and has been listing DeFi tokens off-the-bat. Recently, it has received flak from the community for listing cryptocurrencies with a dubious background. The community members believe that CREAM is just another dubious project with a small market cap of $14 million.

However, Binance CEO Changpeng Zhao defended the listing saying that they are not loosening its listing policies just to capitalize on the DeFi hyp.

“Binance has always provided access to a large number of projects. Newer projects are higher risk,” wrote CZ.

Binance also received backlash for listing the SUSHI token that created much controversy after its pseudonymous founder Chef Nomi liquidated all his stake from the platform. Soon after, the price of SUSHI tokens crashed 70 per cent with many calling it an exit scam.

Decentralized Finance (DeFi) is the latest buzz in the crypto space as major analysts think that the DeFi space is currently sailing through its golden period. However, some big analysts have also warned against some scammy projects, especially among the exploding yield-farming tokens that promise high-interest rewards.

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter