Crypto Exchanges See $1.7 Billion in Stablecoin Inflow, Here’s How It Can Help Bitcoin (BTC) Cross $50K

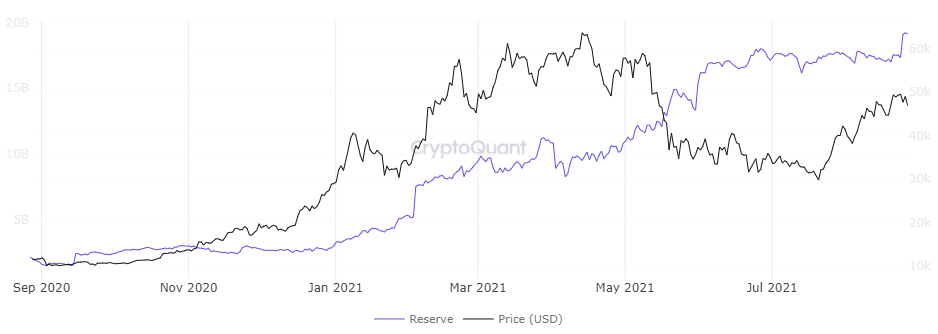

Crypto exchanges registered a massive inflow of stablecoins over the past couple of days amounting to $1.7 billion. Such a large inflow of stablecoins is often considered bullish given the general perception that people send stablecoins onto exchanges to invest more in cryptocurrency. The massive inflow of stablecoins has also pushed the stablecoin reserves on centralized exchanges to an ATH of $19.22 billion.

Ki-Young Ju, the founder of Bitcoin analytic firm CryptoQuant stated two possible outcomes behind the recent massive stablecoin inflow onto exchanges. He said Exchanges fill up stablecoins too,

- buy crypto assets as user request (or exchange side)

- prepare user withdrawals before the dip

$1.7B worth stablecoins flowed into exchanges lately.

Theoretically, exchanges fill up stablecoins to

1/ buy crypto assets as user request (or exchange side)

2/ prepare user withdrawals before the dipHopefully, we’re in scenario 1.

Chart 👉 https://t.co/5ogQVhn3z4 pic.twitter.com/zAJLZHpB2e

— Ki Young Ju 주기영 (@ki_young_ju) August 27, 2021

The analyst hoped that we are in the first scenario but reiterated that in the long term it is bullish since people are converting fiat into crypto.

“Either way, it’s long-term bullish since fiat money is converting to crypto assets. It’s easier to buy crypto assets via stablecoins rather than using fiat money.”

Can Stablecoin Inflow Boost Bitcoin Price Above $50K?

Bitcoin (BTC) broke out of a three-month-long bearish price range of $30K-$40K in the first week of August and built a healthy bullish momentum to record a new three-month high of $50,400. However, the top cryptocurrency faced rejection at $50K levels as it couldn’t hold onto the support and currently moving sideways above $47,0000.

It is also important to note that exchanges also registered the biggest Bitcoin inflow since July 2019 as 1.68M $BTC flowed onto exchanges. Young presented three possible scenarios that could occur as a result of the biggest BTC inflow in three years,

- Increase selling pressure.

- Increase volatility as $BTC is used as collateral for derivatives.

- Alt season with BTC pairs.

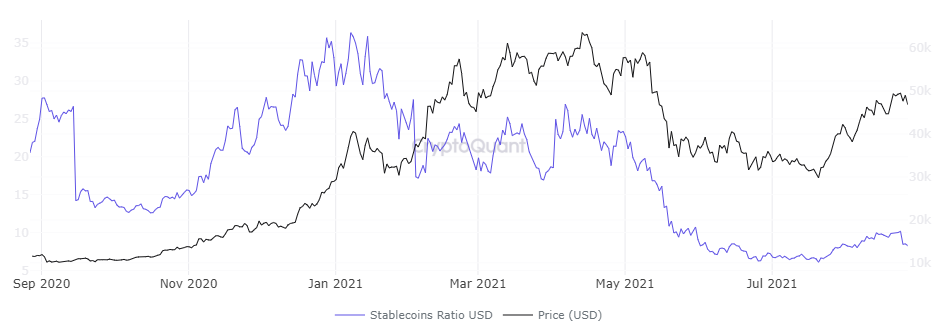

The Bitcoin Stablecoin ratio hit a new low indicating the selling pressure is on the lower side. An increase in the stablecoin ratio indicates high selling pressure. The top cryptocurrency lost key support of $47,000 yesterday but managed to rise above it soon after. $50K is the critical resistance that BTC needs to convert into support to retest its ATH $64,683.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs