Bitcoin and Ethereum Testing Key Support Levels; Is Another Crypto Crash Ahead?

Bitcoin and Ethereum price broke below $30,000 and $2,000 psychological levels this week after a “long squeeze” amid several factors including fresh interest rate hike fears and Binance opening staked ETH withdrawals. An over 21% fall in total crypto market volume in the last 24 hours clearly indicates selling amid volatility in the broader market. Furthermore, the Crypto Fear and Greed Index fell from 68 (greed) to 50 (neutral) in just a week.

Huge BTC And ETH Options To Expire April 28th

Crypto expiry on Friday, April 21 to exert further selling pressure on the crypto market. As per Deribit data, 25,000 BTC options are set to expire, with a notional value of $0.72 billion. The put call ratio is 0.7 and the max pain point is $29,000. With the price already trading below the max pain level, it weakened the bullish scenario for Bitcoin.

Meanwhile, 217,000 ETH options are about to expire, with a notional value of $0.42 billion. The put call ratio is 0.83 and the max pain point is $1,950. Ethereum price is also under pressure with the possibility of breaking below $1900.

The monthly expiry on April 28 is even larger this expiry. Thus, traders will be looking to offload amid a possible selloff at the month’s end.

Also Read: Binance CEO “CZ” Downplays Post-Halving Bitcoin Price Prediction By ChatGPT

Bitcoin and Ethereum Price Showing Weakness

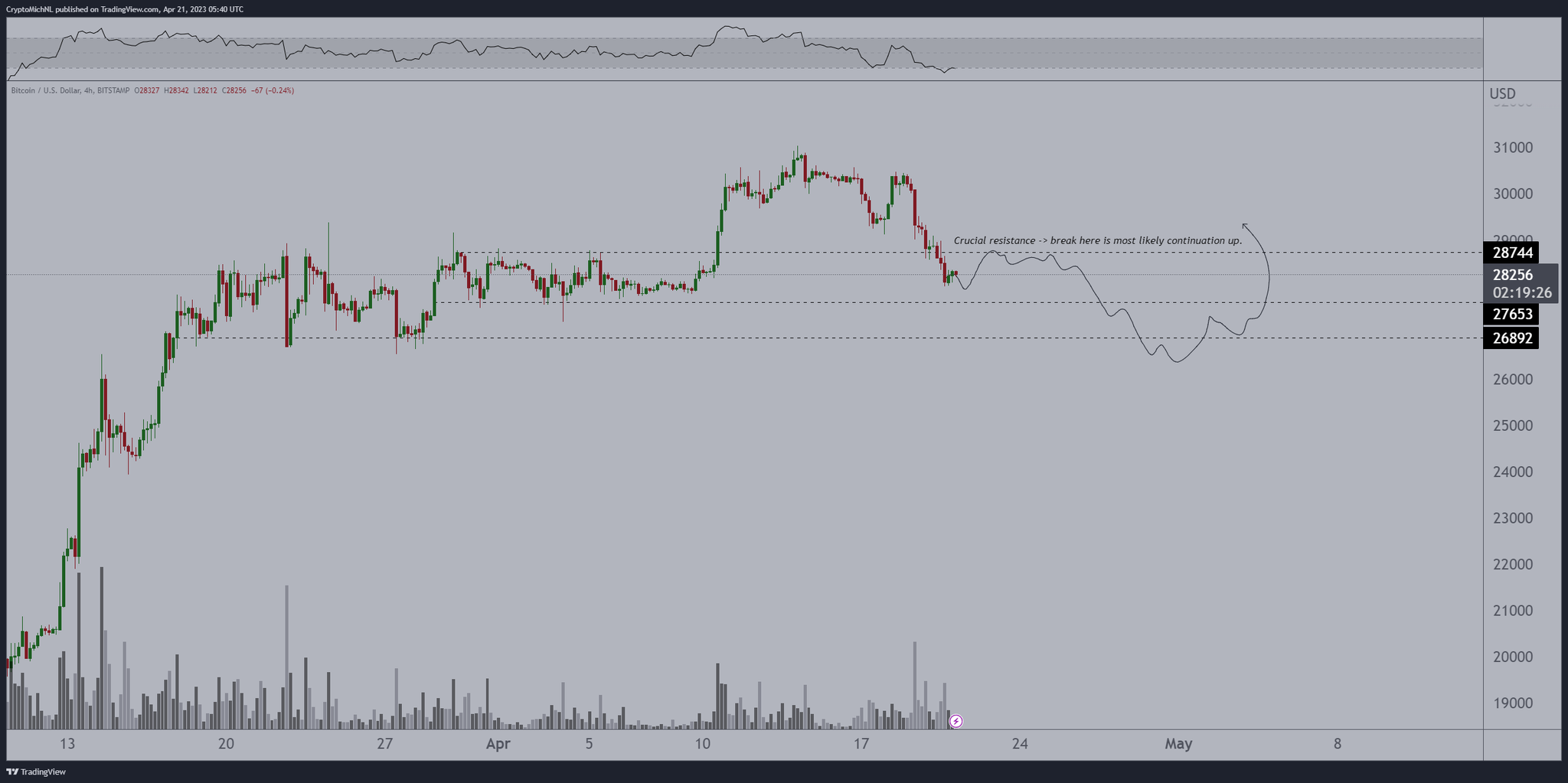

Bitcoin price fell below $28,000 on Coinbase. BTC price fell 3% in the last 24 hours, continuing the downfall since Wednesday. The price is currently trading at $28,166, with a 24-hour low and high of $28,037 and $29,076, respectively.

Popular crypto analyst Michael van de Poppe asserts Bitcoin is currently showing weakness after losing one of the crucial levels. The next support level is at $27,600. If the BTC price doesn’t recover to $28,800, then a move to $26,200 can be witnessed.

Meanwhile, ETH price is trading at $1,932, down 2% in the last 24 hours. The 24-hour low and high are $1,918 and $1,979, respectively. Continued ETH withdrawals after Shanghai finally put selling pressure on Ether, with whales transferring massive ETHs to Binance and other crypto exchanges.

Also Read: Dogecoin Price: Analyst Predicts When DOGE Reclaims New High

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown