Crypto Market Reacts Positively After FTX Withdrawals Open, CPI Data

Crypto Market, FTX Withdrawals News Updates: The cryptocurrency market reacted positively to the news of FTX opening withdrawals, following prolonged bearish momentum earlier in the week. On chain data showed that the crypto exchange finally reopened withdrawals for its customers. In what comes as a positive sign after days of negative sentiment in the market, the crypto prices turned positive following the news. Bitcoin (BTC) price stands at $17,793, up 3.82% in the last 24 hours, according to price tracking platform CoinMarketCap.

Sam Bankman-Fried’s Message After FTX Meltdown

Earlier, FTX CEO Sam Bankman-Fried said the exchange’s global entity has a total market value of assets and collateral higher than client deposits. He clarified, however, that the assets and collateral value is different from the liquidity scene of the crypto exchange. The FTX CEO said his focus is currently on doing everything to raise liquidity. Meanwhile, he also made a comment on the US entity of FTX. SBF said FTX US was not financially impacted by the whole episode. He assured that it is 100% liquid and that all users could fully withdraw funds.

KuCoin CEO Releases Letter In Response To 300 M USD Movement

Earlier today, KuCoin CEO Johnny Lyu sent a letter to Crypto community and said,

“Today, the total value of the industry still stands at less than 1 trillion USD, which is 40% of the market cap of Apple. Still very few people in the world today hold crypto. On the product side, many business models have been tried and failed, and new paradigms are slowly emerging. We are still early adopters and I share the same strong belief that crypto adoption is only going to increase.”

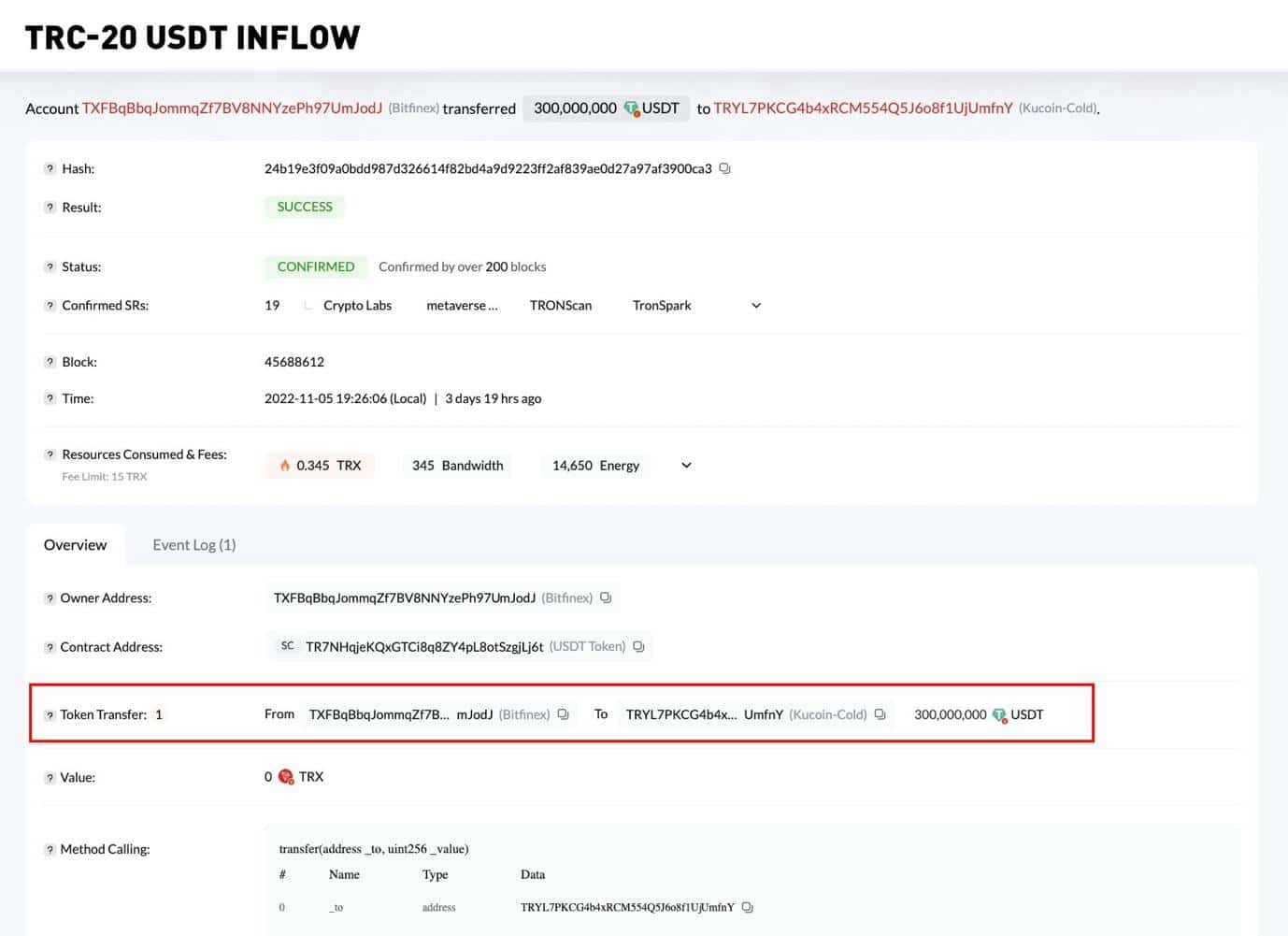

He also clarified an ongoing rumor about outflow of $300 M USD from Kucoin and said that it was merely a currency translation from ERC20 to TRC20. Image below proves his point.

While the crypto market endures the sharp drop in prices after the FTX meltdown, the US regulators appear to be watching the situation closely. SEC chair Gary Gensler said there is a need for crypto companies to work together with regulators. He also said gaining evidence on misdoings is difficult in crypto industry as transactions are interconnected between companies.

Inflation Data

Meanwhile, Solana (SOL) and FTX Token (FTT) are up by around 3% and 10% respectively. Earlier, the U.S. Bureau of Labor Statistics released the the Consumer Price Index (CPI) data. Inflation in the U.S. decreased to 7.7% on a yearly basis in October from 8% in September, the CPI report said. The October inflation was less than the expected rate of 8%. The less than expected inflation could also have had a positive effect on the improving crypto prices.

- Why is XRP Price Dropping Today?

- Breaking: FTX’s Sam Bankman-Fried (SBF) Seeks New Trial Amid Push For Trump’s Pardon

- Fed’s Hammack Says Rate Cuts May Stay on Hold Ahead of Jobs, CPI Data Release

- $800B Interactive Brokers Launches Bitcoin, Ethereum Futures via Coinbase Derivatives

- Michael Saylor Says Strategy Won’t Sell Bitcoin Despite Unrealized Loss, Will Keep Buying Every Quarter

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?