Just-In: Is This A Crypto Market Recovery? Here’s Why There’s More To It

The crypto market records a market-wide recovery chiefly due to the decline in the US dollar. A bear market rally pushed top cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) prices to rebound over $21,000 and $1700.

However, the Bitcoin rally is still weak and below the 200-WMA. Also, the Ethereum upside move is incomplete without whales and hedge funds’ participation.

Crypto Market Recovers Amid Weak Dollar

The fall in DXY index for two consecutive days led to a recovery in the crypto market. All top 20 cryptocurrencies soared over 5%, with Bitcoin (BTC) and Ethereum (ETH) rising nearly 10% and 7%. The U.S. equity markets are also up, with Dow Jones futures and Nasdaq-100 futures rising almost 1%. Meanwhile, European markets are showing the most strength, up 2%.

The Crypto Market Fear & Greed Index shows an increase in positive sentiment, with a small rise in value from 20 to 22.

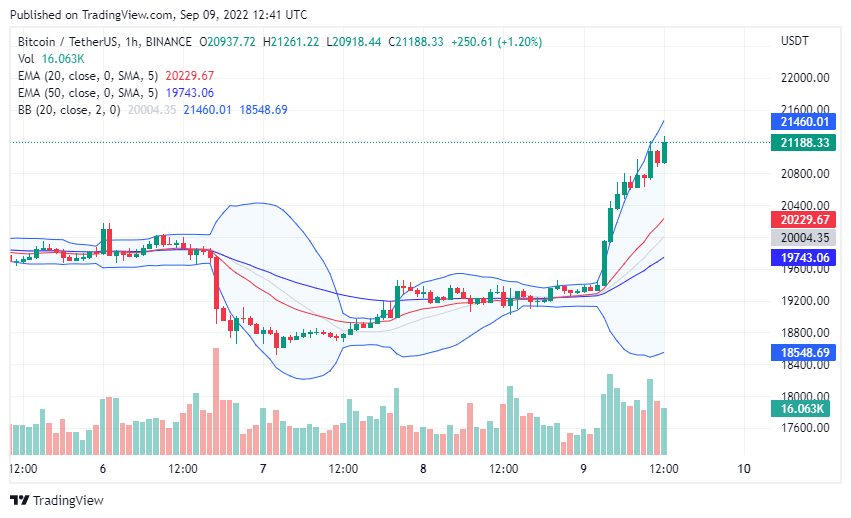

The Bitcoin (BTC) price has made a 24-hour low and high of $19,076 and $21,080, respectively. At the time of writing, the BTC price is trading over the $21,000 level. The Bitcoin rally was triggered by the upside breakout after the Bollinger bands squeeze. Along with RSI showing strength as it moves in the overbought region.

Moreover, the 20-EMA (red) has moved over 50-EMA (blue) in the daily timeframe, signaling a bullish movement.

However, the Bitcoin price is still near the key 200-WMA level at $23,000. A subsequent rally to the 200-WMA will confirm a bullish momentum and bottomed-out scenario.

Ethereum (ETH) price is trading at $1731, up 7% in the last 24 hours. The anticipation of the Merge to trigger between September 13-15, is mainly the reason behind the rally. Moreover, it is clear that the ETH price will not be deflationary immediately after the Merge.

Here’s What Other Data Indicates

SSR Shock Momentum, a variant of Stablecoin Supply Ratio is showing a clear buying signal. Stablecoin Supply Ratio is the market cap of Bitcoin relative to the market cap of all stablecoins. In the last two years, the indicator gave 11 buying signals, and 10 out of those made huge profits.

Bitcoin (BTC) Price – Stablecoin Supply Ratio. Source: CryptoQuant

The CPI data coming out next Tuesday, September 13, will confirm the market direction for the coming months. The Fed will decide 50 or 75 bps rate hike on September 21 based on the CPI and jobs data. As per the CME FedWatch Tool, the probability of a 75 bps rate hike is 86%.

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- U.S. Jobs Report: January Nonfarm Payrolls Rise To 130k, Bitcoin Falls

- Arkham Exchange Shut Down Rumors Denied as Bear Market Jitters Deepen

- XRP News: Ripple Partners UK Investment Giant Aviva to Advance Tokenization on XRP Ledger

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates