Crypto Market, S&P 500 Rally as PPI Data Fuels Rate Cut Hopes

Highlights

- The crypto market rally is led by Bitcoin, which has rallied to a 2-week high.

- The S&P 500 has reached a new high.

- There is currently a 100% chance that the Fed will cut rates at the upcoming FOMC meeting.

The crypto market and S&P 500 are in the green following the PPI data release. Traders continue to price in a Fed rate cut at the upcoming September FOMC meeting, which could be bullish for these assets.

Crypto Market and S&P 500 Rally Following PPI Data Release

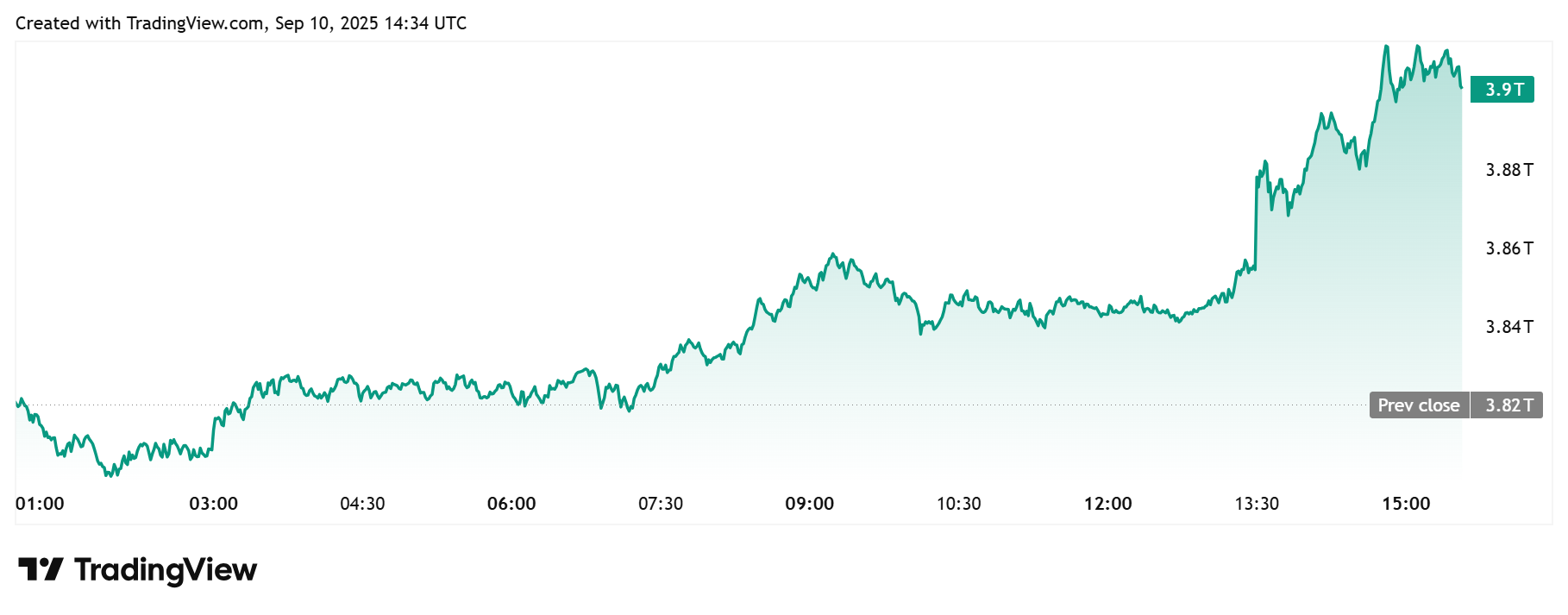

TradingView data shows that the total crypto market is up over 2% today, reaching $3.91 trillion. This market rally is led by the top coins, including Bitcoin, Ethereum, Solana, BNB, and XRP, all of which are in the green today.

BTC has climbed above the psychological $114,000 level, representing a 2-week high for the flagship crypto. The Ethereum price broke above $4,400 while BNB broke above $900, reaching a new ATH in the process.

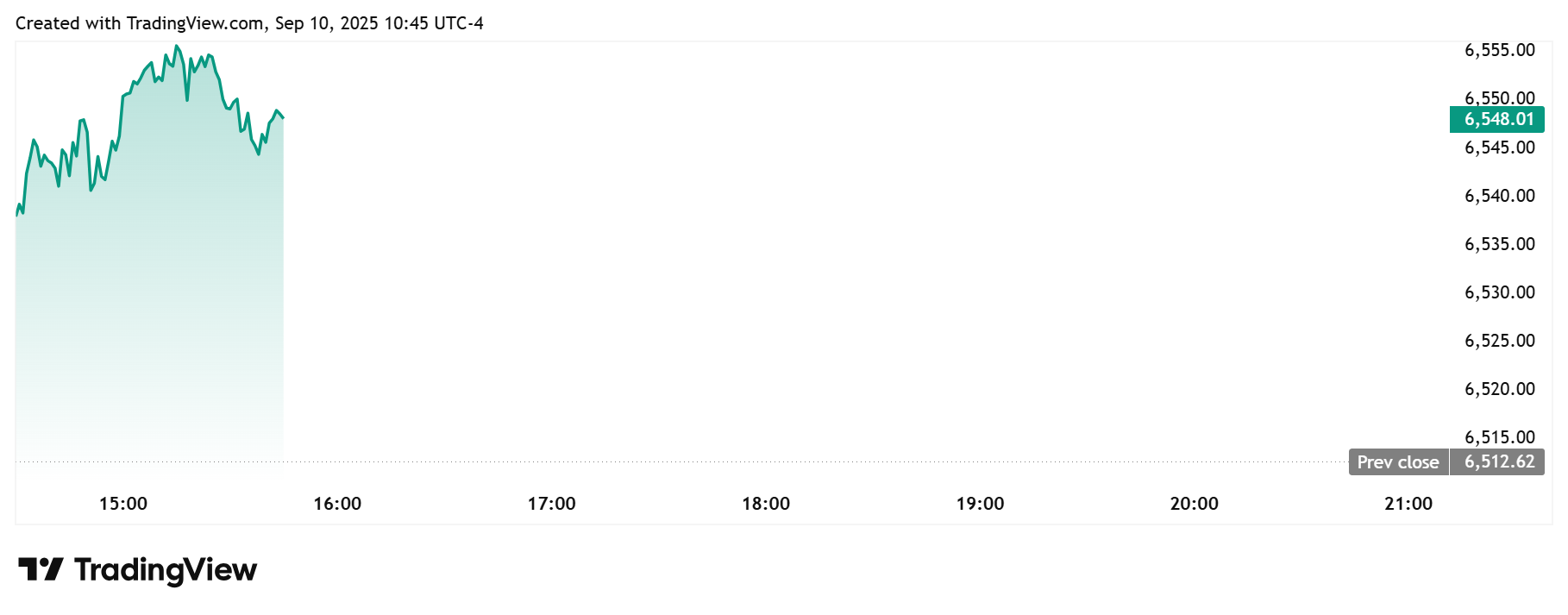

Meanwhile, the S&P 500 is also rallying today. TradingView data shows that the SPX opened at $6,550, marking a new all-time high (ATH) for the stock market index. Notably, the SPX had closed yesterday’s trading session at a then record high of $6,512.

Oracle stock (ORCL) has been one of the major gainers today in the S&P 500. The stock is up over 40% after the company raised its revenue forecast yesterday. NVIDIA’s stock is also up almost 5%, recording the highest gains among the ‘Magnificent 7’ stocks.

This broad market rally follows the PPI data release, with the inflation figures coming in lower than expectations. This has further fueled hopes that the Fed will make a rate cut at the upcoming FOMC meeting next week.

Moreover, with inflation steady while the labor market continues to weaken, there is optimism that the Fed may make a surprise 50 basis points (bps) rate cut, rather than a 25 bps cut.

Calls For a 50 BPS Rate Cut Increase

Amid the crypto market and the S&P 500 rally, and the release of economic data, market experts have continued to urge the Fed to make a 50-basis-point rate cut this month. One of these experts includes BlackRock’s Chief Investment Officer (CIO), Rick Rieder, who has been calling for a rate cut since the first half of the year.

Mohamed A. El-Erian, former CEO of PIMCO, said in a CNBC interview today that he would seriously argue for a 50 bps cut at the September meeting if he were on the Fed Board. He is advocating for a 50 bps cut because of the jobs data, which indicates that the labor market is weakening.

U.S. President Donald Trump also said that Jerome Powell must lower rates following the PPI data release. He said that the Fed Chair must make a “big” cut right now. This follows a Truth Social post yesterday in which he floated the idea of a 100 bps rate cut.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k