Crypto Market to Crash? Here’s What Bitcoin On-Chain Data and BTC Options Signal

Highlights

- Bitcoin price slipped to $89K, with crypto market wiping out $160 billion.

- FOMC and Jerome Powell’s hawkish stance sets early signs of major crypto market crash.

- BTC options puts surpassing calls as implied volatility crashes.

- Bitcoin Bull Score Index reveals extremely bearish sentiment.

Bitcoin price slipped to $89K lows in Asia hours, dragging the broader crypto market lower. The crypto market cap tumbled from $3.22 trillion to $3.06 trillion, erasing $160 billion after the Fed cut rates by 25 bps as expected.

ETH price plunges nearly 4% to a low of $3,170. Other top altcoins such as XRP, Solana, BNB, Dogecoin, Cardano, and Zcash fell 4-8%. Will the crypto market crash in response to FOMC dissent, bearish signals in derivatives markets, and negative on-chain data?

FOMC and Powell’s Hawkish Comments Rattle Bitcoin and Crypto Market

The latest FOMC meeting reignited concerns about the Federal Reserve’s monetary policy trajectory, with some Fed officials dissenting from a 25 bps rate cut. Moreover, the Fed announced it will purchase treasury bills up to $40 billion within 30 days, starting this Friday.

Moreover, Fed Chair Jerome Powell said the Fed would pause further rate cuts heading into the January 2026 FOMC meeting. The FOMC monetary projection showed expectations of only one Fed rate cut by 25 bps in 2026, after three cuts this year. This hawkish outlook pressured risk assets, causing Bitcoin price to tumble to $89K and the crypto market to foresee a crash.

The Fed claimed the $40 billion in T-bills purchase isn’t quantitative easing (QE). However, this actually shows stress in the money market, which has driven gold prices higher. As CoinGape reported earlier, the Fed is injecting billions of dollars into the banking system to ease liquidity concerns through repo operations. Notably, this was the second-largest liquidity injection since the COVID pandemic.

The Big Short” Mike Burry said the US banks are getting weaker amid the repo market volatility, signaling another banking crisis.

So the Fed is now buying Treasuries again. $40 billion of bills a month…@FTAlphaville covers it well. And with a sense of humor – Sure John LOL. And we have a "new" acronym to learn RMPs – Reserve Management Purchases. The last line of the article is notable.

“However,… pic.twitter.com/ub7KpzkbbM

— Cassandra Unchained (@michaeljburry) December 10, 2025

Matrixport analysis revealed Bitcoin and crypto market will remain range-bound following the Fed’s decision. Implied volatility has been trending lower across the major, reflecting declining expectations for meaningful near-term price swings.

Derivatives Data Signals Crypto Market Crash

According to CoinGlass data, almost $400 million in long positions were liquidated in the last 24 hours, with total crypto liquidations valued at more than $520 million. BTC, ETH, SOL, XRP, DOGE, and ZEC witnessed the majority of liquidations.

Meanwhile, BTC options data shows traders are increasing bearish positioning. Open interest in Bitcoin options has surged, but the put/call ratio has shifted toward puts. It indicates traders are hedging or betting on further downside.

Bitcoin options of notional value $3.56 billion to expire on Friday, with a put/call ratio of 1.09. The max pain price is at $90K, with 83% odds of BTC expiring above the $90K strike price.

Experts have highlighted that options flows and funding rates are skewing negative, reinforcing the risk of continued volatility and potential further declines.

On-Chain Signals: Whales, Exchanges, and Profit-Taking

The Bitcoin Bull Score Index, a key on-chain indicator of market sentiment, signals extreme bearish sentiment. The bull score has dropped back to 0 after the Fed rate cut.

Moreover, the Bitcoin Days Bull On/Off data on CryptoQuant shows bears dominating over bulls. Also, Bitcoin rebound would face a significantly larger risk of getting liquidated, as per the Aggregated Liquidation Levels Heatmap. Notably, Bitcoin has failed to overcome the selling pressure after the October 10 crypto market crash.

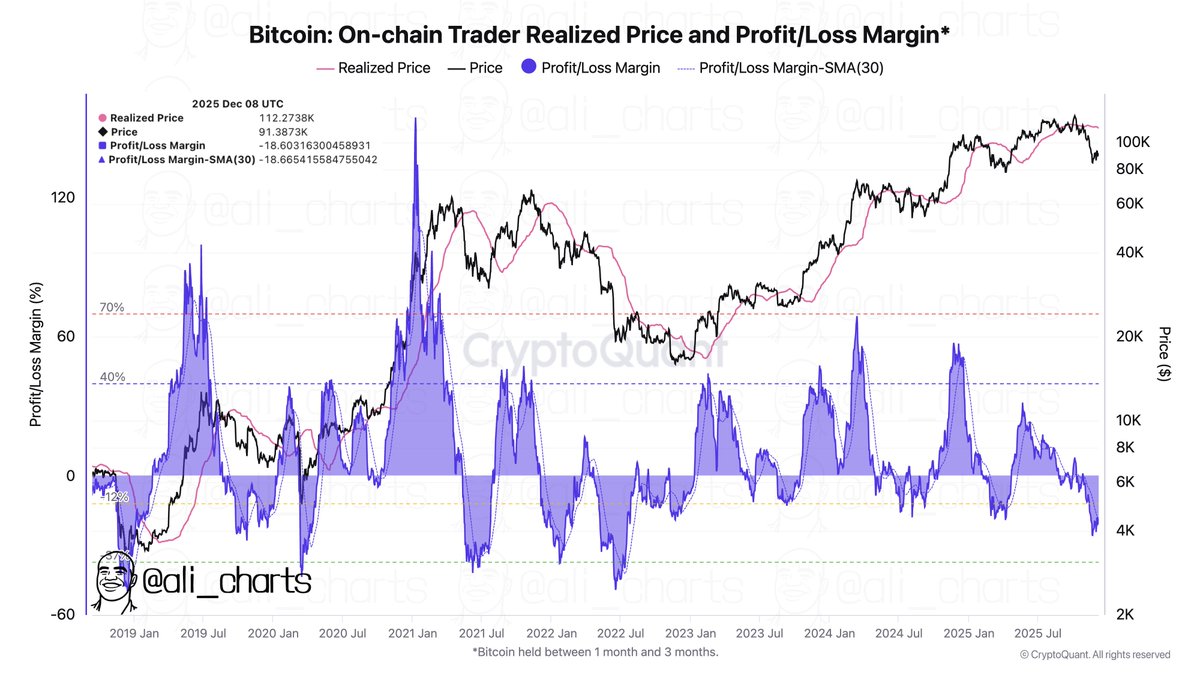

Crypto analyst Ali Martinez claimed some of the best buy-the-dip opportunities have occurred when Bitcoin on-chain trader realized loss had dropped below -37%. Currently, it is at -18% and indicates room for further crash in Bitcoin price and the broader crypto market.

Also Read: Best Crypto Futures Trading Platforms

- Fifth Spot XRP ETF Set for Launch as CBOE Approves New Fund for Trading

- Gemini Receives CFTC Nod for Prediction Market, Plans Move Into Futures and Perps

- Jerome Powell Speech: Fed Chair Signals Pause In Rate Cuts, Bitcoin Falls

- XRP News: Gemini Adds RLUSD Support on XRPL for Faster Payments

- Breaking: Fed Cuts Interest Rates by 25 Bps at FOMC Meeting, Matching Expectations

- Dogecoin Price Eyes $0.30 as Bullish Crossover Pattern Signals a Trend Shift

- Top Analyst Sees Ethereum Price Having a “Big” Breakout as Catalysts Align

- Sui Price Breaks Out of Falling Wedge: Is $2 Next Target?

- Chainlink Price Prediction: Why $20 is Next Key Target

- Solana Price Targets $200 Amid Increased Whale Accumulation

- Cardano Price Outlook: Expecting a 30-40% Bullish Wave Soon