Apple’s Latest Move Could Challenge DeFi; Launches High-Yield Savings Account

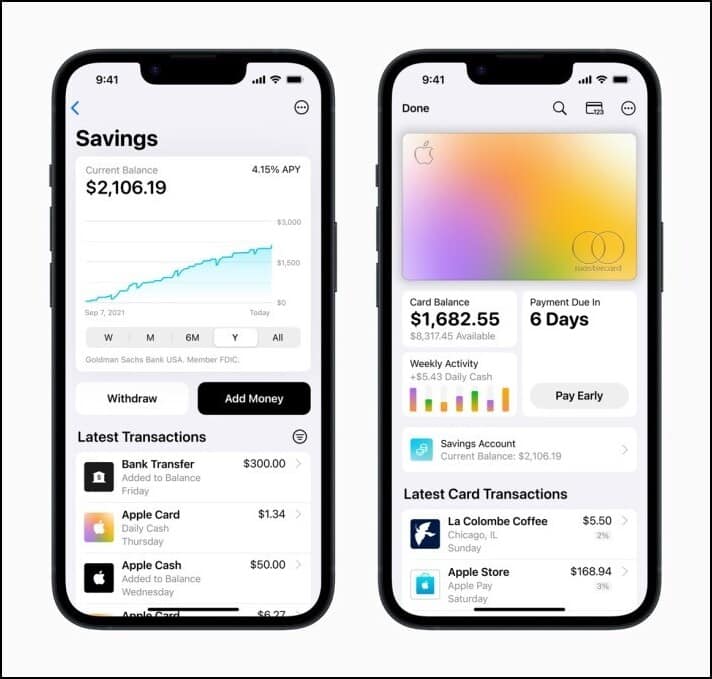

On Monday, Apple introduced its Apple Card savings account, which offers customers an annual percentage rate of 4.15%. Apple has stated that there is no requirement for a minimum deposit or balance, and customers can set up an account directly by using the Wallet software pre-installed on their iPhones. Now, whether this poses a threat to DeFi’s high-yield protocols, let’s find out.

Apple’s New Savings Feature

Apple has released this new savings alternative to the public in collaboration with Goldman Sachs. The 154-year-0ld financial institution is theoretically in charge of managing savings accounts, and therefore all balances are covered by the Federal Deposit Insurance Corporation (FDIC).

Read More: 4 Key US SEC Crypto Lawsuit Failures Every Investor Should Know

Customers who use their Apple Cards can take advantage of this newly launched high-yield savings account. Apart from that, when Apple Card users pay for their purchases, they are eligible for certain cashback on those transactions. Users earn 1% cash back on every transaction, and 2% cash back on every purchase made with Apple Pay by default. However, obtaining 3% back in rewards requires making purchases with certain retailers.

Can This Disrupt DeFi?

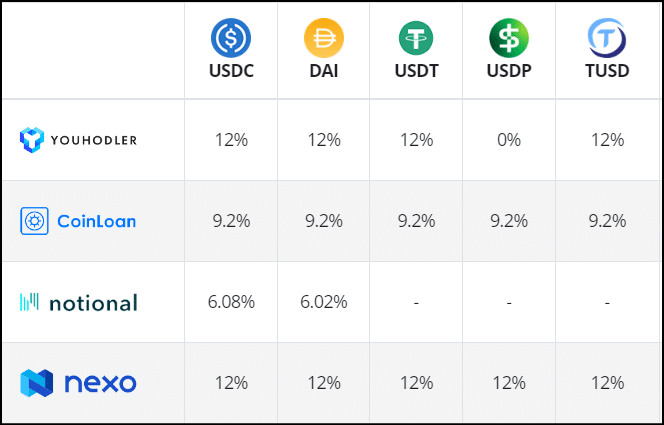

According to the FDIC, the average annual percentage yield (APY) on savings accounts across the United States is just 0.35%. Hence, Apple’s latest offering of 4.15% APY does seem high in comparison. However, competing high-yield accounts provided by prominent DeFi protocols such as Compound, Aave, Cream, Nexo and Notional continue to provide interest rates that are comparable to, if not superior to, that of Apple.

The fact that DeFi protocols provide returns on stablecoins such as USDT, TUSD, and USDC, amongst others, makes it functionally equivalent to keeping US dollars in your cryptocurrency wallet. Even if the returns created by such protocols are extremely prone to volatility, on average they have been significantly higher than the standard banking rate offered in the country.

As things stand right now, DeFi continues to give higher yields than Apple, and as a result, there is not a lot of concern over its existential crisis. Nevertheless, as traditional businesses are beginning to bridge the void in the saving account sector, DeFi may soon face intense competition in the near future.

Also Read: SEC Charges Bittrex Over Operating ‘Unregistered Securities Exchange’

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs