Crypto Stocks Circle, Coinbase Crash Before Powell’s Jackson Hole Speech

Highlights

- Circle stock has corrected 55% from June highs amid reports of insider selling, including by CEO Jeremy Allaire.

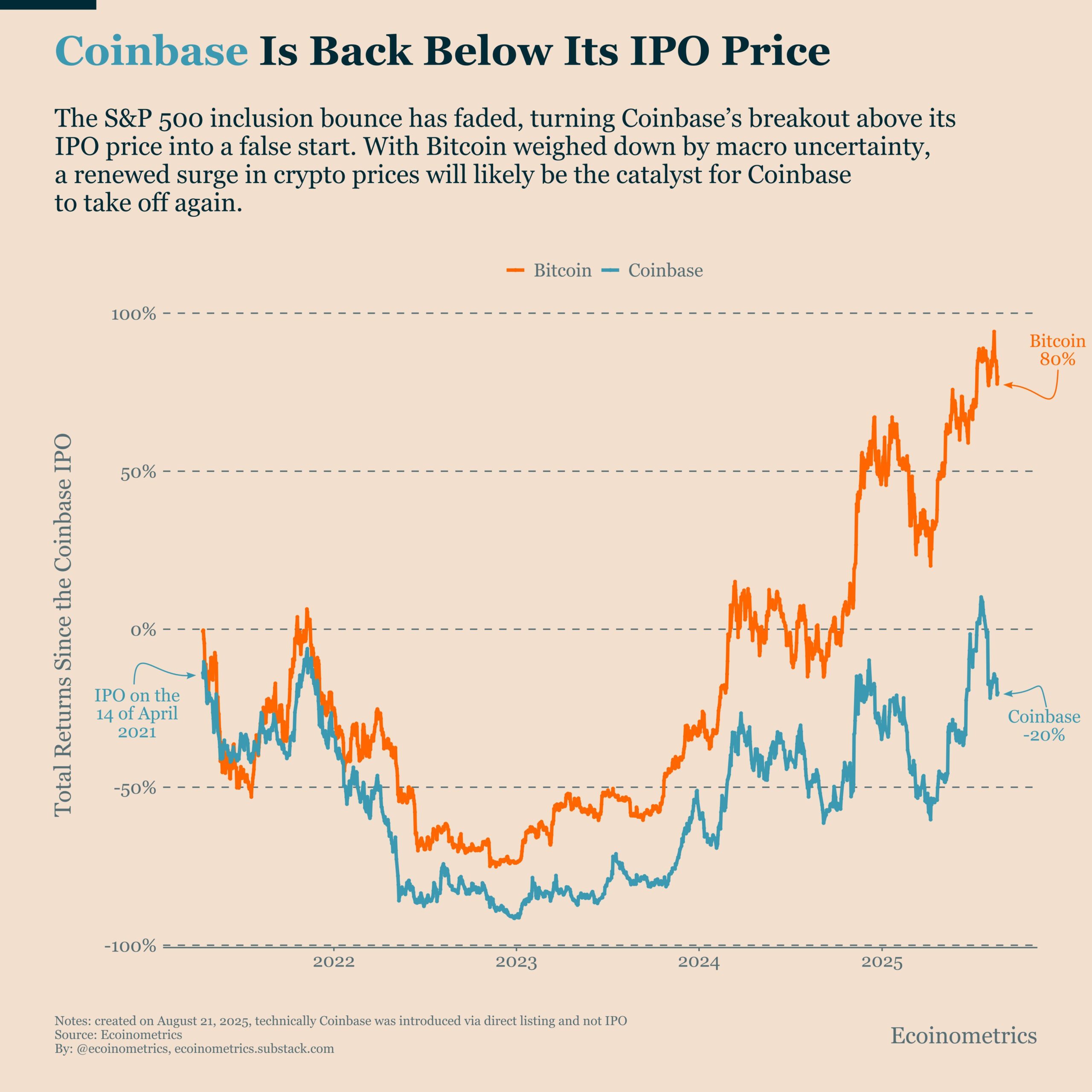

- Coinbase falls below IPO price as momentum fades in sync with Bitcoin.

- Market analysts belie Powell is unlikely to disclose any major monetary policy shift at Jackson Hole speech.

Crypto stocks like Circle (NYSE: CRCL) and Coinbase (NASDAQ: COIN) have come under strong selling pressure ahead of Jerome Powell’s Jackson Hole speech on Friday, August 22. Over the past week, both stocks are down by 7-12%, as macro uncertainty rises with waning hopes of Fed rate cuts during the September FOMC meeting. The Wall Street party for crypto firms seems to be waning recently.

Crypto Stocks Coinbase and Circle Face the Heat

The Circle (NYSE: CRCL) stock has been on a sideways move, correcting over 55% from the highs of $300 in June, as bears take control following the brief IPO party. As of Thursday’s closing, the CRCL stock was trading at $131.80, as investors ride the volatility. This comes despite the company launching a Layer-1 Arc blockchain with strong Q2 results.

Recent developments suggest that company insiders have been selling in big numbers, including CEO Jeremy Allaire. Just two months after its public debut, Circle revealed plans for a secondary offering of 10 million shares worth $1.4 billion.

Of these, eight million will be sold by existing shareholders, including CEO Jeremy Allaire. Reports suggest that Allaire alone has dumped 357,812 shares for $45.5M. This company announcement has fueled concerns over management’s confidence in the current valuation.

Popular analyst Ali Martinez shared that the CRCL stock has broken down from the support levels, which sets the next target to $100. The lower Fibonacci extension levels are around $96-100, which would represent another ~25-30% decline from current prices.

Coinbase Stock Falls Under Pre-IPO Level

Another crypto stock Coinbase (NASDAQ: COIN) has come under selling pressure, correcting by 25% over the past month. Amid the recent correction, the COIN stock has slipped back below its IPO price. The momentum that drove gains since May has faded, making last month’s breakout above the IPO price look like a false start. Despite this drop, Coinbase inked a major $2.9 billion deal in August with the acquisition of crypto derivatives platform Deribit.

Blockchain analytics platform ecoinometrics showed that the stock is trading in sync with Bitcoin, and with BTC under pressure from macro uncertainty, Coinbase has lost its upward drive.

Powell’s Jackson Hole Speech on Radar

Federal Reserve chairman Jerome Powell will be speaking at the ongoing Jackson Hole meeting on Friday, August 22. Market analysts are all eyes to whether Powell announces any monetary policy shift. However, the chances of Fed rate cuts during the September FOMC have fallen to 70%. Inflationary pressure continues to hover above the jobless data, keeping Powell in a tight spot.

- U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again?

- Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report

- XRP Community Day: Ripple CEO on XRP as the ‘North Star,’ CLARITY Act and Trillion-Dollar Crypto Company

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates